Marketplace Regolith

Your investment opportunities

ARKG ETF

Genomics and Biotechnology ETF

Updated on 20 Feb 2026

ARK Invest

Sponsor of the Trust

Updated on 20 Feb 2026

About

ARKG (ARK Genomic Revolution ETF) is an actively managed exchange-traded fund that provides access to companies operating at the intersection of genomics, biotechnology, and artificial intelligence within a single investment.

The fund's objective is to invest in companies developing and implementing breakthrough technologies in gene editing, molecular diagnostics, gene therapy, bioinformatics, and synthetic biology. Genomics is one of the key sectors in the future of medicine and science, with the potential to transform the treatment of diseases that were until recently considered incurable.

ARKG was launched in 2014 and is one of the most recognized thematic ETFs in the genomics and biotechnology space.

Sponsor of the Trust: ARK Invest is an investment firm founded by Cathie Wood in 2014, specializing in disruptive technologies. ARK Invest manages a suite of actively managed ETFs focused on innovative sectors: artificial intelligence, robotics, fintech, space, and genomics.

Unlike most ETFs, ARKG does not track an index. The ARK Invest team independently selects and revises the fund's holdings based on proprietary research. This allows the fund to respond swiftly to scientific breakthroughs, FDA approvals, and shifts in the competitive landscape.

The fund is listed on the BATS exchange and is available to investors as a standard ETF instrument.

Frequently Asked Questions about ARKG ETF (FAQ)

1. What is ARKG?

ARKG is an actively managed exchange-traded fund (ETF) that provides access to 35 companies operating at the intersection of genomics, biotechnology, and artificial intelligence within a single investment. The fund targets a sector that is transforming the approach to disease treatment, diagnostics, and drug development.

2. Who manages the fund?

The fund is managed by ARK Invest, an investment firm founded by Cathie Wood in 2014. ARK Invest specializes in disruptive technologies and manages a suite of actively managed ETFs focused on innovative sectors.

3. What exactly am I investing in when I buy ARKG?

By purchasing ARKG, you invest in shares of 35 companies across different areas of genomics: gene editing, molecular diagnostics, AI in medicine, synthetic biology, and genomic infrastructure. This is not an investment in a single company, but rather participation in the collective performance of the entire genomics sector.

4. Is this a passive index fund?

No. ARKG is an actively managed fund. The ARK Invest team independently selects and revises the portfolio based on proprietary research, rather than tracking an index. This allows the fund to respond swiftly to scientific breakthroughs, FDA approvals, and shifts in the competitive landscape.

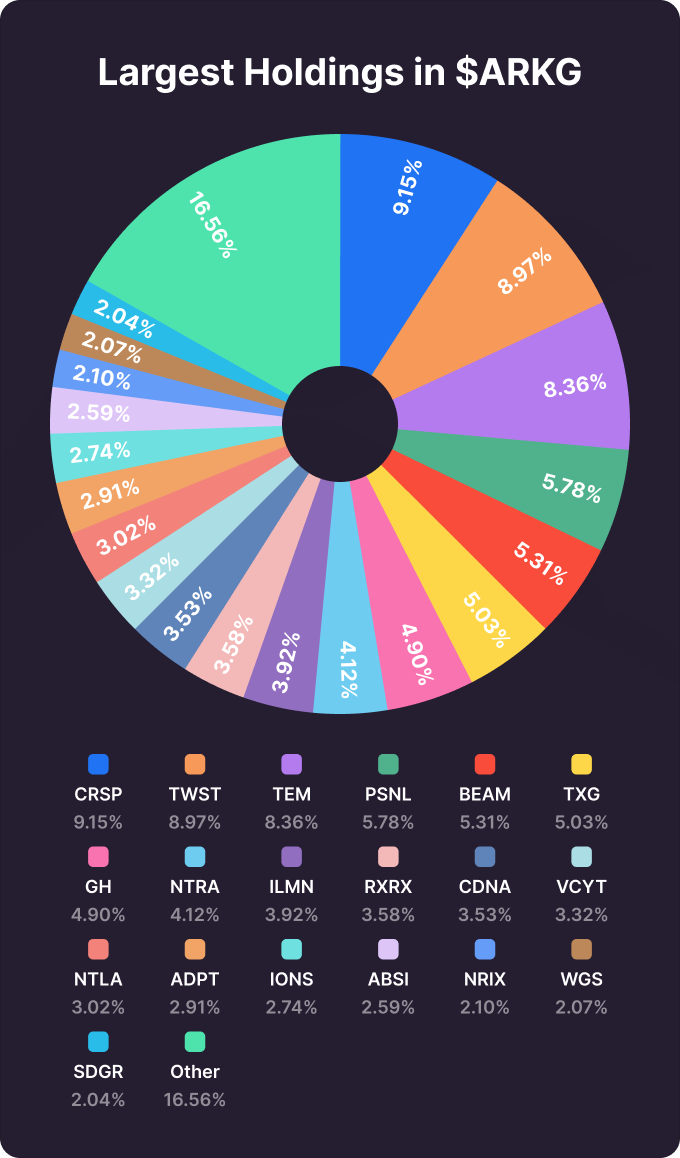

5. Which companies are included in the fund?

The fund includes companies across all key areas of the genomic revolution:

• Gene editing: CRISPR Therapeutics, Beam Therapeutics, Intellia Therapeutics

• AI in medicine: Tempus AI, Recursion Pharmaceuticals, Schrodinger

• Molecular diagnostics: Guardant Health, Natera, Veracyte

• Synthetic biology and genomic infrastructure: Twist Bioscience, Illumina, 10x Genomics

• Gene therapy: Adaptive Biotechnologies, Ionis Pharmaceuticals

6. Does the fund's composition change?

Yes, and more frequently than passive ETFs. The ARK Invest team regularly reviews the portfolio, adding companies with the greatest potential and reducing positions that have lost their appeal. The current composition is published daily on the ARK Invest website.

7. Does ARKG pay dividends?

Dividends are minimal. Most companies in the portfolio are in an active growth phase and direct their resources toward research and development rather than shareholder distributions. Investor returns are primarily driven by changes in the fund's market value.

8. What are the fund's fees?

When purchasing ARKG through the Regolith platform:

• Entry fee: 2%

• Performance fee: 0%

The fund's Expense Ratio (TER) is 0.75% per year — higher than passive ETFs, reflecting the fund's active management approach.

9. What role does ARKG play in an investment portfolio?

ARKG serves as a thematic instrument for participating in the growth of genomic and biotechnology technologies. The fund provides targeted exposure to a sector at an early stage of commercialization and replaces a bet on a single biotech company with a diversified basket of 35 players.

10. Why is genomics considered a long-term trend?

Gene editing technologies (CRISPR), AI diagnostics, and synthetic biology are transitioning from laboratories to clinical practice. The first CRISPR therapies have already received regulatory approval. The cost of genome sequencing has dropped from $3 billion to under $200 over the past 20 years. ARK Invest projects that genomics sector revenue will grow several-fold over the next decade.

11. What are the risks of investing in ARKG?

ARKG is characterized by high volatility (beta of approximately 1.69), meaning fluctuations are significantly greater than the broader market. Most portfolio companies are in the growth and R&D phase. Success depends on clinical trial outcomes, FDA approvals, and intellectual property protection. Active management decisions by the ARK Invest team also carry risk. Significant short-term fluctuations are possible.

12. How does ARKG differ from broad index ETFs?

Broad ETFs (such as SPY) cover the entire market and include biotech companies only partially. ARKG provides concentrated exposure specifically to the genomics sector, amplifying both growth potential and risk. Additionally, ARKG is an actively managed fund, not a passive one.

13. Where is ARKG traded?

The fund is listed on the US-based BATS (Cboe BZX) exchange. The fund's AUM is approximately $1.25 billion.

14. How does the ARKG purchase process work through Regolith?

ARKG purchases through the Regolith platform are executed on a rolling basis and are not tied to a fixed date. Transactions are processed 1–3 times per week depending on market conditions and the platform's operational schedule. Once a request is submitted, funds are reserved, and the purchase is executed at the next available trading window at the actual transaction price.

15. What is the minimum investment period?

The minimum investment period is 1 week. After that, the investor may hold the position or exit the instrument without any platform-side fees.

16. What is the minimum entry threshold?

The minimum transaction amount when purchasing ARKG through Regolith is $50.

ARK Invest

Sponsor of the Trust

Performance

Return for 2020

+180.56%Return for 2021

−33.92%Return for 2022

−53.90%Return for 2023

+16.22%Return for 2024

−28.24%Return for 2025

+23.04%Terms

Deal Fee

2%Carried Interest

0%Minimum investment period

1 weekRisk potential

Low

Русский

Русский