Marketplace Regolith

Your investment opportunities

SOXX ETF

Semiconductor & AI Infrastructure ETF

Updated on 20 Feb 2026

iShares by BlackRock

Sponsor of the Trust

Updated on 20 Feb 2026

About

SOXX (iShares Semiconductor ETF) is an exchange-traded fund that provides access to leading semiconductor companies included in the ICE Semiconductor Index through a single investment.

The fund's objective is to track the performance of companies that design, manufacture and supply semiconductors: processors, graphics chips, memory, analog components and fabrication equipment. Semiconductors are the technological foundation of AI, cloud computing, data centers, autonomous systems and the digital economy as a whole.

SOXX was launched in 2001 and is one of the oldest and most liquid thematic ETFs in the semiconductor sector.

Sponsor of the Trust: iShares by BlackRock – the world's largest ETF provider, part of BlackRock, a global investment firm with over $10 trillion in assets under management.

The fund is designed for investors who view semiconductors not as a narrow niche but as the foundation of the entire technology economy, and prefer to access this sector through a regulated, transparent and exchange-traded vehicle without the need to analyze and select individual companies.

The fund trades on NASDAQ and is available to investors as a standard ETF instrument.

What are you actually investing in?

By investing in SOXX, you invest in shares of the largest public semiconductor companies included in the ICE Semiconductor Index. The fund replicates the index structure, following its composition and weightings.

SOXX returns are generated through:

- appreciation or depreciation of the market value of the index constituents;

- dividends paid by the companies (reinvested within the fund and reflected in the price).

Your investment is directly tied to the business performance of leading chipmakers and semiconductor equipment manufacturers – companies whose products underpin AI infrastructure, cloud platforms, telecommunications and consumer electronics.

Index composition

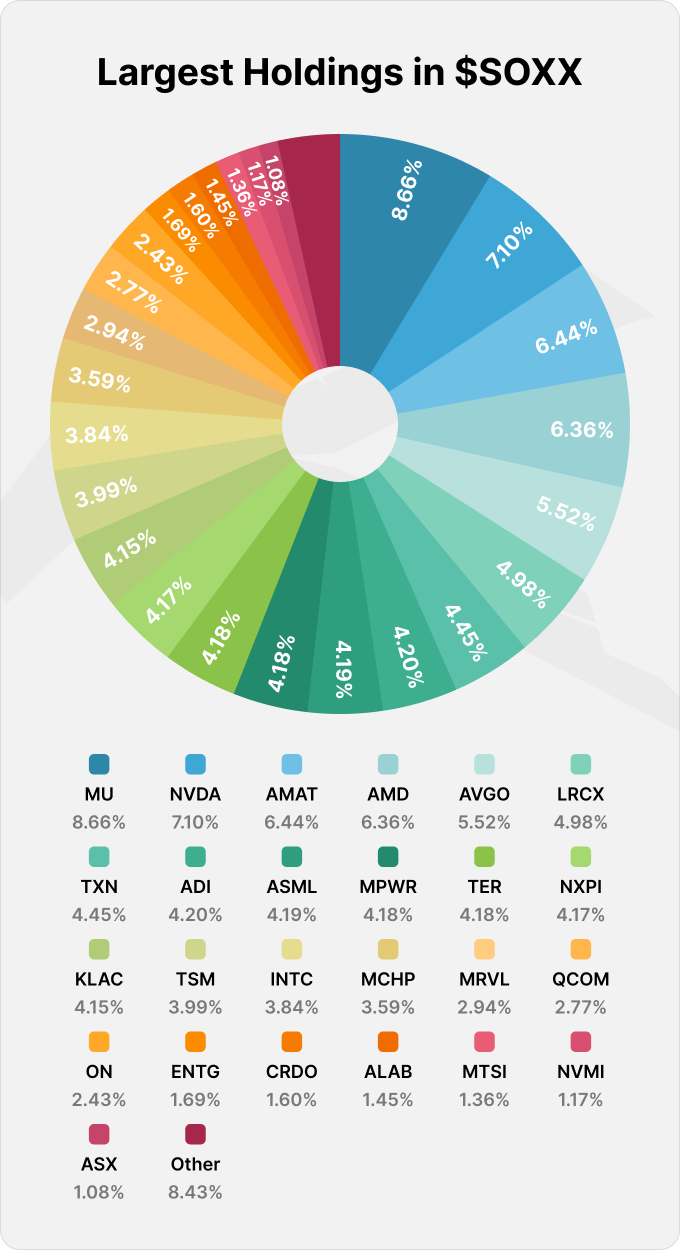

The ICE Semiconductor Index comprises 34 companies spanning all key segments of the semiconductor value chain:

- Chip Design & AI Accelerators – companies designing processors, graphics chips and accelerators for AI and data centers.

NVIDIA, AMD, Broadcom, Qualcomm, Marvell Technology - Memory & Data Storage – manufacturers of memory chips and storage systems essential to data centers, cloud platforms and AI models.

Micron Technology, Intel - Semiconductor Equipment – companies producing lithographic and process equipment that enables the scaling of chip manufacturing worldwide.

Applied Materials, Lam Research, ASML, KLA Corporation, Teradyne - Analog & Specialty Components – manufacturers of analog chips, sensors and specialized solutions for automotive, industrial and telecommunications electronics.

Texas Instruments, Analog Devices, NXP Semiconductors, Monolithic Power Systems

.png)

Company weightings are determined by market capitalization with a cap on maximum allocation, ensuring balanced diversification and reducing dependence on the performance of any single company.

How the fund is structured

SOXX uses a standard ETF structure:

- company shares are held within the fund's custodial infrastructure through licensed custodians;

- the fund's structure is fully transparent and regularly disclosed;

- the fund operates under the oversight of U.S. regulators and auditors.

SOXX is one of the most liquid thematic ETFs in the semiconductor space, with over $20 billion in assets under management, allowing investors to buy and sell at prices close to market value without significant bid-ask spread losses.

Fees and distributions

Investor returns are generated through changes in the fund's market value. You acquire a share in SOXX at the current price and sell upon exit – your return is determined by the asset's price movement over the holding period.

The fund operates on a simple and transparent cost model:

- Total Expense Ratio (TER): 0.34% per year – covering fund management and administration;

- Dividends are minimal – investor returns are primarily driven by the appreciation or depreciation of semiconductor company shares within the fund.

When purchasing SOXX through the Regolith platform, a deal fee of 2% of the transaction amount is charged. Carried interest: 0%.

The role of SOXX in an investment portfolio

SOXX is typically used as a thematic instrument to strengthen the technology component of a portfolio. The fund can serve the following purposes:

- Exposure to AI infrastructure growth – semiconductors are the backbone of AI, and rising demand for computing power directly impacts the fund's performance.

- Thematic diversification – access to 34 leading semiconductor companies through a single instrument.

- Alternative to individual stocks – instead of buying NVIDIA, AMD or Micron separately, the investor gains a basket of top chipmakers.

- Boosting the tech allocation – combined with broad index ETFs (e.g. SPY), SOXX enables targeted exposure to the semiconductor sector.

- Long-term capital growth – the fund's CAGR for 2020–2025 was approximately 24.9%, significantly outperforming the broader market.

Risks

Investing in SOXX involves a number of factors inherent to the technology sector:

- Market volatility – the semiconductor sector is characterized by elevated volatility (beta ~1.4), meaning sharper swings both up and down compared to the broader market.

- Industry cyclicality – semiconductors are subject to supply-and-demand cycles: chip shortages alternate with periods of oversupply, impacting company financials and the fund's price.

- Geopolitical risks – a significant share of global chip production is concentrated in Taiwan (TSMC), and export restrictions on shipments to China may affect company revenues.

- Valuation risks – during periods of heightened AI expectations, semiconductor stocks may trade at elevated multiples, increasing the risk of a correction.

- Single-sector concentration – unlike broad index ETFs, SOXX invests exclusively in semiconductors, which eliminates cross-sector diversification.

As an equity instrument, the fund is subject to market fluctuations and does not guarantee positive returns. Investors may lose part or all of their investment.

Instrument parameters

- Ticker: SOXX

- Type: Semiconductor & AI Infrastructure ETF

- Exchange: NASDAQ

- Index: ICE Semiconductor Index

- Number of holdings: 34

- AUM: ~$20.97 billion

- Expense Ratio: 0.34%

- Morningstar Rating: ★★★★★

SOXX does not provide significant dividend distributions. Investor returns are generated through changes in the fund's market value.

Deposits and withdrawals through Regolith

SOXX purchases are processed on a rolling basis with no fixed settlement date. Trades are executed 1–3 times per week depending on market conditions and the platform's operational schedule.

• Minimum investment period: 1 week

• Minimum amount: $50

• Deal fee: 2%

• Carried interest: 0%

Withdrawals are processed through the platform's standard procedure upon completion of the minimum investment period.

Frequently Asked Questions about SOXX ETF (FAQ)

1. What is SOXX?

SOXX is an exchange-traded fund (ETF) that allows you to invest in 34 leading semiconductor companies included in the ICE Semiconductor Index through a single purchase. The fund tracks the performance of a sector that serves as the technological backbone of AI, cloud computing and the digital economy.

2. Who manages the fund?

The fund is issued and administered by iShares, part of BlackRock – the world's largest investment firm with over $10 trillion in assets under management.

3. What exactly am I investing in when I buy SOXX?

By purchasing SOXX, you invest in shares of 34 major semiconductor companies: designers of processors and AI accelerators, memory manufacturers, chip fabrication equipment makers and specialty component producers. This is not a bet on a single company – it's participation in the collective performance of the entire semiconductor sector.

4. Is this an actively managed fund?

No. SOXX is a passively managed index fund. It does not attempt to outperform the market or pick individual stocks – it simply replicates the structure of the ICE Semiconductor Index.

5. Which companies are included in the fund?

The fund holds companies across all key segments of the semiconductor industry:

– Chip design & AI accelerators: NVIDIA, AMD, Broadcom, Qualcomm

– Memory & data storage: Micron Technology, Intel

– Fabrication equipment: Applied Materials, Lam Research, ASML

– Analog components: Texas Instruments, Analog Devices, NXP Semiconductors

6. Does the fund's composition change?

Yes. The ICE Semiconductor Index is reviewed on a regular basis. Companies may be added or removed depending on their size, liquidity and index eligibility criteria. SOXX automatically reflects these changes.

7. Does SOXX pay dividends?

Dividends are minimal. Semiconductor companies typically reinvest profits into growth and R&D rather than shareholder payouts. Investor returns are primarily driven by the fund's price appreciation.

8. What are the fees?

When purchasing SOXX through the Regolith platform:

– Deal fee: 2%

– Carried interest: 0%

9. What role does SOXX play in an investment portfolio?

SOXX serves as a thematic tool to strengthen the technology allocation within a portfolio. The fund provides targeted exposure to the semiconductor sector – the foundation of the AI economy – and allows investors to replace individual chipmaker stock picks with a single trade.

10. Why are semiconductors considered a long-term trend?

Demand for computing power is growing exponentially: AI models, data centers, cloud platforms, autonomous vehicles, IoT – all require chips. No major technology of the future can function without semiconductors, making the sector a structural beneficiary of the ongoing digital transformation.

11. What are the risks of investing in SOXX?

SOXX performance depends on the state of the semiconductor sector and the broader tech market. The fund exhibits elevated volatility (beta ~1.4), is subject to industry cyclicality and carries geopolitical risks (reliance on TSMC and Taiwan, export restrictions). Significant short-term fluctuations are possible.

12. How does SOXX differ from broad index ETFs?

Broad ETFs such as SPY cover the entire market and include semiconductor companies only as a fraction of the portfolio. SOXX provides concentrated exposure specifically to the semiconductor sector, amplifying both the growth potential and the level of risk.

13. Where does SOXX trade?

The fund trades on the NASDAQ exchange and is one of the most liquid thematic ETFs in the semiconductor space, with over $20 billion in assets under management.

14. How does the SOXX purchase process work through Regolith?

SOXX purchases through the Regolith platform are processed on a rolling basis with no fixed settlement date. Trades are executed 1–3 times per week depending on market conditions and the platform's operational schedule. Once a request is submitted, funds are reserved and the purchase is completed in the nearest available trading window at the actual transaction price.

15. What is the minimum investment period?

The minimum investment period is 1 week. After that, the investor can either hold the position or exit the instrument with no additional platform fees.

16. What is the minimum entry amount?

The minimum transaction amount when purchasing SOXX through Regolith is $50.

iShares by BlackRock

Sponsor of the Trust

Performance

Return for 2020

+52.73%Return for 2021

+44.09%Return for 2022

-35.09%Return for 2023

+67.13%Return for 2024

+12.92%Return for 2025

+40.73%Terms

Deal Fee

2%Carried Interest

0%Minimum investment period

1 weekRisk potential

Low

Русский

Русский