Marketplace Regolith

Your investment opportunities

AIQ ETF

ETF focused on artificial intelligence and technology

Updated on 19 Feb 2026

Global X ETFs

Sponsor of the Trust

“You invest in artificial intelligence and the technological infrastructure that forms the foundation of the modern economy.”

Updated on 19 Feb 2026

About

AIQ (Global X AI & Technology ETF) is an exchange-traded fund that provides exposure to the artificial intelligence, big data, and technology infrastructure sector through a single investment.

The fund’s objective is to track the performance of companies that develop, implement, and monetize AI technologies, net of fund expenses.

AIQ is managed by Global X, a U.S.-based thematic ETF provider, and tracks the Indxx Artificial Intelligence & Big Data Index – a specialized index of companies involved in the development of artificial intelligence and data analytics technologies.

AIQ is designed for investors who view artificial intelligence as a long-term structural trend and prefer to access it in a public, regulated, and diversified ETF format, without the need to select individual stocks.

The fund is listed on the NASDAQ and is available to investors as a standard ETF instrument.

What are you actually investing in?

By investing in AIQ, you gain exposure to equities of companies that:

- develop AI algorithms and software,

- build computing and cloud infrastructure,

- manufacture semiconductors and data-processing equipment,

- apply AI across business processes, finance, industry, and services.

The fund’s performance is driven by changes in the market value of the underlying equities included in the index.

AIQ does not invest directly in startups and is not a venture fund. The core of the portfolio consists of large, publicly traded technology companies.

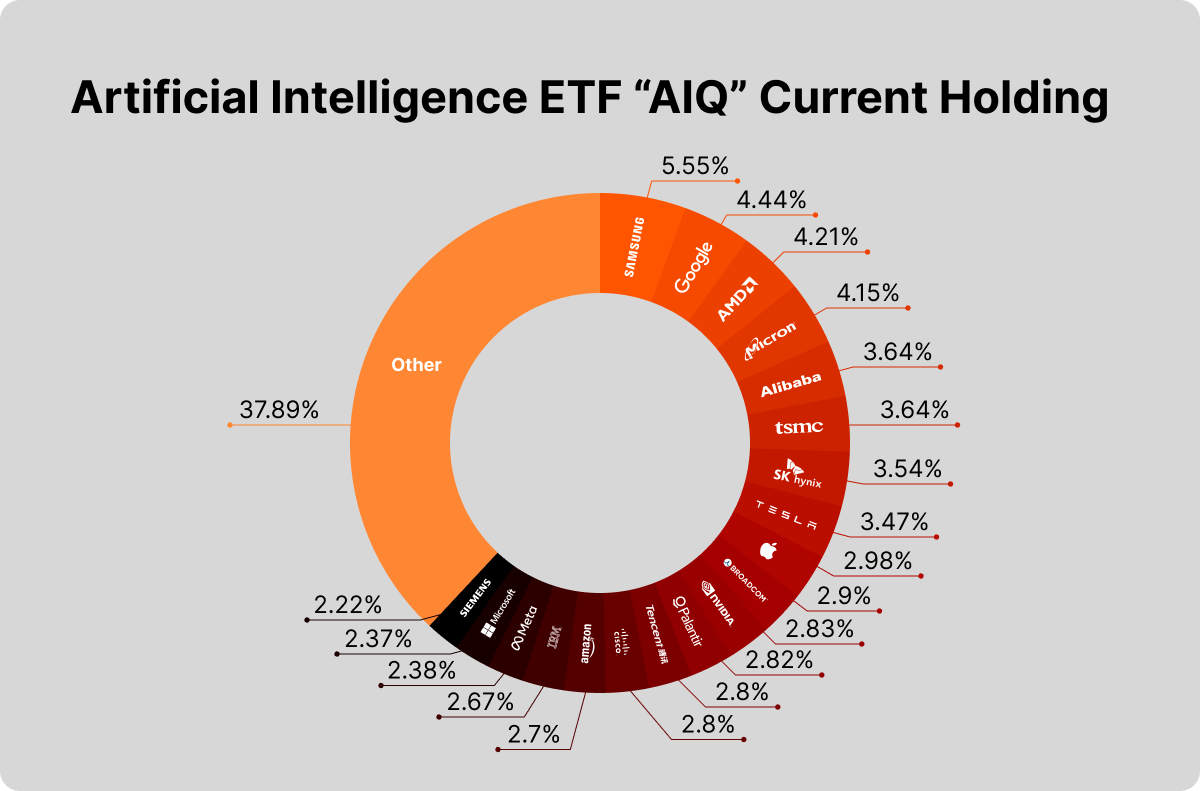

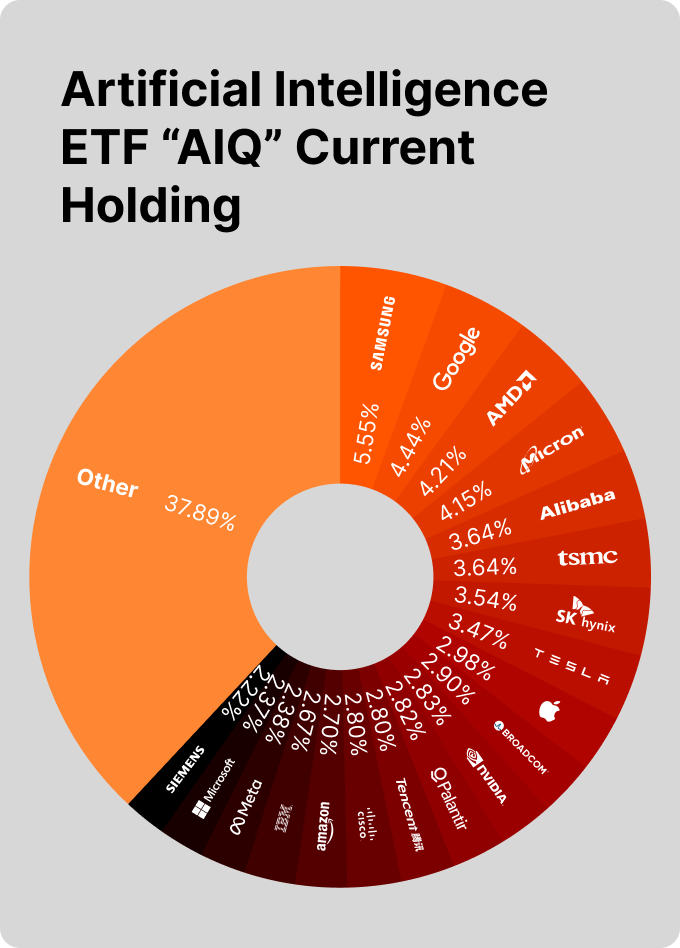

Portfolio composition and diversification logic

AIQ includes approximately 80–90 companies from developed markets. The portfolio is diversified:

- across companies,

- across regions,

- across key segments of the AI ecosystem (software, computing infrastructure, cloud solutions, and real-world AI applications).

The fund holds large, publicly listed technology companies, including Alphabet, Microsoft, Amazon, NVIDIA, Advanced Micro Devices, Taiwan Semiconductor Manufacturing Company, Samsung Electronics, Micron Technology, IBM, and Meta Platforms.

Top holdings typically represent 2–5% each, reducing reliance on the performance of any single stock.

The fund is primarily focused on large-cap companies, resulting in lower volatility compared to narrowly focused or highly concentrated AI funds.

Core portfolio sectors

- Technology Services – cloud services, software, and AI platforms (Alphabet, Microsoft, Amazon, IBM)

- Electronic Technology – semiconductors and computing hardware (NVIDIA, AMD, TSMC, Samsung Electronics, Micron Technology)

- Consumer & Industrial Technology – AI adoption in the real economy (Meta Platforms, Amazon, Tesla)

This structure reflects the real AI market value chain: data → computing → practical application.

Fees and distributions

• Expense Ratio: 0.68% per year, covering fund management and administration

• Dividends: typically minimal or none

→ investor returns are primarily driven by ETF price appreciation

When purchasing AIQ via the Regolith platform:

• entry fee – 2%

• сarried Interest – 0%

Role of AIQ in an investment portfolio

AIQ is typically used as a long-term thematic allocation and may serve the following purposes:

- Participation in the AI trend – investing in technologies already embedded in business and the economy

- Dedicated AI and technology allocation within the equity portion of a portfolio, rather than blending AI exposure into broad market funds

- A diversified basket of AI companies instead of single-stock selection, reducing issuer-specific risk

- Used alongside index ETFs to increase exposure to AI and technology relative to the broad market

Risks

Investments in AIQ involve several risk factors:

- Market volatility — the technology sector is subject to growth cycles and corrections

- Valuation risk — multiples may compress during periods of changing market expectations

- Regulatory and technological risk — evolving regulation and competitive dynamics

As an equity-based instrument, the fund is subject to market fluctuations and does not guarantee positive returns.

Instrument details

• Ticker: AIQ

• Type: Artificial intelligence and technology ETF

• Exchange: NASDAQ

AIQ does not provide regular dividend payments.

Investor returns are driven by changes in the market value of the ETF, reflecting the performance of AI-sector companies.

Subscriptions and redemptions via Regolith

AIQ purchases are executed on a rolling basis, without a fixed investment date. Transactions are processed 1–3 times per week, depending on operational scheduling.

• Minimum investment period – 1 week

• Minimum investment amount – $50

• Entry fee – 2%

• Сarried Interest – 0%

Redemptions follow the platform’s standard procedure after the minimum holding period has been completed.

Frequently Asked Questions about AIQ ETF (FAQ)

1. What is AIQ?

AIQ is an exchange-traded fund (ETF) that allows investors to gain exposure to the artificial intelligence and technology sector through a single investment. The fund combines shares of companies involved in AI, big data, and technology infrastructure.

2. Who manages the fund?

The fund is managed by Global X, a U.S.-based thematic ETF provider that is part of the international investment group Mirae Asset.

3. What am I actually investing in when I buy AIQ?

By purchasing AIQ, you invest in shares of publicly traded technology companies that develop, implement, and use artificial intelligence, data analytics, cloud, and computing solutions.

4. Are these venture startups?

No. AIQ invests in established public companies, primarily large- and mid-cap firms. The fund does not invest directly in startups and is not a venture capital product.

5. Which companies are included in the fund?

AIQ invests in public technology companies operating in artificial intelligence and related fields. The portfolio includes companies from different segments of the AI market, such as:

- AI platforms and software: Alphabet (Google), Microsoft

- Semiconductors and computing infrastructure: NVIDIA, AMD, TSMC

- Cloud and enterprise technology solutions: Amazon (AWS), IBM

- Memory and hardware solutions: Samsung Electronics, Micron Technology

This approach provides diversified exposure to the AI sector and reduces dependence on the performance of individual companies.

6. How many companies are in the AIQ portfolio?

The portfolio typically includes around 80–90 companies, providing diversification and reducing reliance on the performance of individual stocks.

7. How are investments allocated within the fund?

The fund is diversified:

- across companies (top holdings usually represent 2–5% each),

- across sectors,

- across regions.

The core of the portfolio consists of large technology companies.

8. Does the fund pay dividends?

Dividends are typically minimal or absent. Investor returns are driven by changes in the ETF’s market price, reflecting increases or decreases in the share prices of the underlying companies.

9. What fees apply to the fund?

When purchasing AIQ via the Regolith platform:

- Entry fee: 2%

- Performance fee: 0%

10. Why do investors add AIQ to their portfolio?

AIQ is commonly used:

- to participate in the long-term growth of AI and technology,

- to allocate a dedicated technology-focused segment within a portfolio,

- as a complement to index ETFs in order to increase exposure to AI and technology.

11. How is AIQ different from broad index ETFs?

AIQ provides a targeted focus on AI and technology, while broad index ETFs track the overall market and include AI companies only as part of a wider allocation.

12. What risks are associated with investing in AIQ?

- Market volatility in the technology sector,

- Potential corrections following periods of rapid growth,

- Regulatory and competitive risks.

- As an equity-based fund, returns are not guaranteed.

13. Where is AIQ traded?

AIQ is listed on the U.S. NASDAQ exchange under the ticker AIQ.

14. How does the purchase process work via Regolith?

Purchases are executed on a rolling basis and are not tied to a fixed date.

Transactions are processed 1–3 times per week, depending on market conditions and the platform’s operational schedule.

15. What is the minimum investment period?

The minimum investment period is 1 week. After that, investors may continue holding the position or exit the investment.

16. What is the minimum investment amount?

The minimum investment amount when purchasing AIQ through Regolith is $50.

Global X ETFs

Sponsor of the Trust

“You invest in artificial intelligence and the technological infrastructure that forms the foundation of the modern economy.”

Performance

Return for 2020

+52.88%Return for 2021

+17.09%Return for 2022

−36.45%Return for 2023

+55.39%Return for 2024

+24.11%Return for 2025

+31.89%Terms

Deal Fee

2%Carried Interest

0%Minimum investment period

1 weekRisk potential

Low

Русский

Русский