Platform of Investment and Financial Instruments

Private investments are highly risky, illiquid and may result in total loss of capital.

00000

Users Users

00

Countries

00000

Purchases Purchases

$ 00 M +

Value Value

Investment opportunities

Dataminr

Social Data Analysis

.jpg?v1772918362)

Tron Staking Fund

TRX staking and selling energy

SLAT Fund

Short & Long Active Trading Fund

Mining Fund

Multi-crypto mining fund

.jpg?v1772918362)

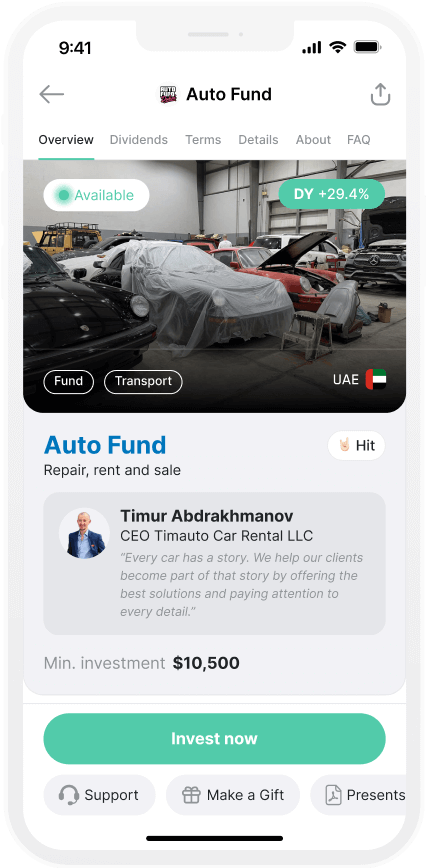

Auto Fund

Repair, rent and sale

.png?v1772918362)

GLTR ETF

Physical Precious Metals Basket

AIQ ETF

ETF focused on artificial intelligence and technology

.png?v1772918362)

BOTZ ETF

ETF focused on robotics, automation, and AI

ARKG ETF

Genomics and Biotechnology ETF

SOXX ETF

Semiconductor & AI Infrastructure ETF

-2.png?v1772918362)

SPY ETF

500 Largest Public Companies Index

OpenSea

Platform for trading tokens

Real Estate Rental Fund

Profitable property in Dubai

MetaMask

Cryptocurrency wallet

BitPay

Crypto payment service provider

Discord

Video, voice & text multichat

Kraken

Cryptocurrency exchange, bank and wallet

SkillBranch AI

Revolution in simultaneous interpretation

Grayscale

Largest digital asset manager

Abra

Trade crypto platform

QwilMessenger

E-sign, video & chat messenger

Auto Leasing

Car Leasing in UAE

How it works?

Sign Up with Apple or Google

Use your Apple or Google account to speed up registration — just a few steps and you're in.

Verify Your Identity

For your safety, we use Veriff — a trusted, fast, and secure verification provider.

Deposit with Any Option

Fund your account via SWIFT (USD/EUR), USDT, Bank cards, Apple/Google Pay, or ACH.

Choose Your Investment

Explore unique venture investment opportunities & funds with regular dividends.

Invest From $100

Invest with just 2 clicks in what you like, starting from as little as $100.

Track Your Portfolio

Track your deals, monitor transactions, and generate detailed statements effortlessly.

Why Choose Us?

Accessible from any device (Web, iOS, Android)

Verification in just 5 minutes

Purchase an asset in just 2 clicks

Exclusive deals from $100 to $500,000

Legal documents and analytical reports

Metrics and charts for each transaction

Personal manager for clients from $100,000

Support service 7 days a week

about us

Diversification and investments in alternative markets are crucial aspects of building long-term wealth. However, such tools are often inaccessible or restricted for private investors. Purchasing shares in private companies and PreIPO deals, meeting high initial requirements for real estate investments, and executing profitable transactions typically involve extensive legal work, substantial time, and networking.

In 2021, we established the private investment structure, Regolith, allowing direct trading on U.S. financial markets. Legally and without intermediaries, you can invest in financial opportunities and derivatives on the American market, engaging in various types of transactions such as Pre-IPO, IPO, Stock Market, and more alongside Regolith. Additionally, we've secured participation in financial deals and operations in collaboration with major banking institutions and underwriters.

We are here to assist you

Investing in startups and various private market ventures, commodities, and cryptocurrencies comes with inherent risks. We want to help you determine if private market investing is the right fit for you.

Submit your request for a consultation with our investor relations team. They'll make time to educate you and address your questions without any sales pressure. Rest assured, we are here to assist you.

start investing from $100 now

One of the main advantages of the marketplace is the ability to purchase a volume of a trade starting from as low as $100 or even one share. This allows every user to invest in exclusive offers with just a few clicks.

F.A.Q.

What financial investments does Regolith support?

How do we select companies for Pre-IPO?

How do we choose companies for investment?

How quickly are funds withdrawn?

From which countries do you accept direct investments?

How to invest on the platform?

Are the funds in Regolith insured?

ready to get started?

Join over 18647 investors who are already building a portfolio of unique deals with us. Don't wait, join now!