Marketplace Regolith

Your investment opportunities

Abra

Trade crypto platform

Updated on 5 Feb 2026

Bill Barhydt

Founder & CEO

“Abra's mission is to democratize access to all financial services for everyone.”

(1).png?v1771626903)

Updated on 5 Feb 2026

About

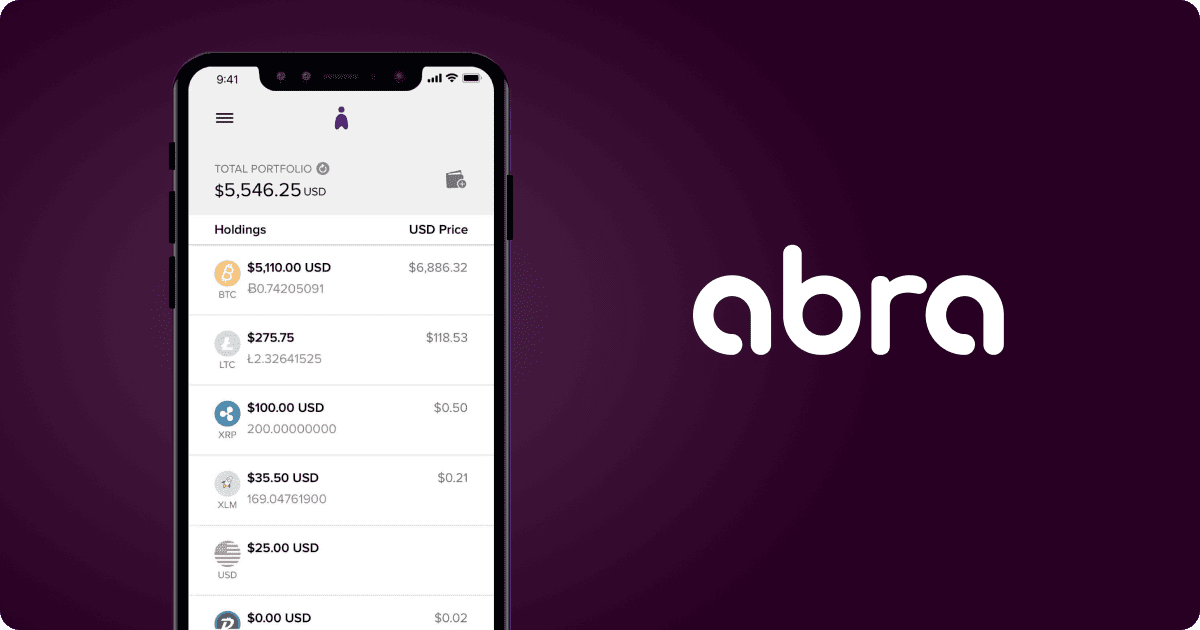

Abra is a cryptocurrency app designed to facilitate online cryptocurrency transfers and investments. Abra is a digital money network and money management platform for cryptocurrency investors. The company offers typical cryptocurrency exchange services as well as cryptocurrency lending. The company has processed more than a billion dollars in cryptocurrency loans. There has been no official IPO announcement yet but we are confident that Abra stands a good chance of becoming a global leader in cryptocurrency lending and transfers.

Abra's mission is to create a simple and fair platform that allows millions of cryptocurrency holders to maximize the potential of their crypto assets. We have a simple application that allows users to access earnings in currencies, buying, selling and trading cryptocurrencies in one place. Our vision is an open global financial system that is easily accessible to everyone.

Our values

- Provide transparency. Abra will be open, transparent and honest with our customers, partners and employees.

- Aim for impact. Abra will have a positive impact on the lives of every member of our ecosystem.

- Focus on the user. We will put the user first. Get the user experience right and wow them, and everything else will become much easier.

- Protect individuality. We believe in the human right to freely engage in all forms of commerce.

- Encourage new ideas. We believe that diversity of ideas and experiences leads to better results.

- Think long term. Abra must be a sustainable business to deliver maximum long-term benefits.

Abra's strengths

- Abra supports most of the top 100 top digital currencies (75+).

- The application integrates cryptocurrency trading and wallet functions.

- Users can earn interest on their cryptocurrencies through the Abra Boost feature.

- Buy cryptocurrency with fiat currency or sell it and receive cash in your bank account

Cons

- Abra has moved from serving non-custodial wallets to custodial wallets, which some users may consider a step backwards.

- Many popular competitors support a much wider selection of cryptocurrencies.

History of the company

Abra started as an online payment service in 2014, allowing users to send money through an app. Over the course of several years, Abra has grown into a crypto investment platform providing secure custody of a cryptocurrency portfolio.

The release of the modern Abra app in 2017 provided a variety of services by combining the functions of a crypto exchange and a wallet. Abra acts as a multi-currency crypto wallet, supporting a variety of coins and tokens, making it convenient for crypto traders.

In its initial stages, Abra was a non-custodial wallet but later transitioned to a custodial solution by partnering with Bittrex as a custodian. Abra custodial custody is provided through Bittrex, which provides a high level of security, but comes with risks associated with reliance on the custodian's security measures.

In 2023, it was included in the list of “Top 20 Crypto Apps for 2023.”

Main characteristics of Abra

- Investing in cryptocurrencies on Abra is simple: select an asset, indicate the amount and choose a payment method, including Visa/MasterCard cards and virtual Google Pay or Apple Pay cards.

- Fiat to cryptocurrency conversion is supported by various payment gateways such as Banxa, Wyre, Ramp, MoonPay.

- When making cryptocurrency purchases on Abra, you are required to provide personal information and ID details.

- The ability to withdraw fiat and cash out cryptocurrency to personal bank accounts without the need to use an intermediary exchange.

- The "Grow" function allows you to earn an annual interest rate on popular cryptocurrencies, and the "Borrow" function allows you to take out cryptocurrency loans secured by Abra.

- Abra plans to issue a cryptocurrency debit card for American customers to spend cryptocurrency at retail outlets.

Comparison with competitors

Coinbase and Abra provide similar options for investing in cryptocurrencies, but there are differences. Coinbase supports over 150 cryptocurrencies, while Abra supports fewer. However, Coinbase has high trading fees of around 1%, making them expensive to trade. Abra provides more betting options and higher rewards through Abra Boost.

Regarding the trust wallet, it is a popular multi-currency solution that offers more storage options. It has a built-in dApp browser and support for thousands of coins and tokens. However, unlike Abra, Trust Wallet does not allow you to cash out crypto into fiat and does not support crypto loans.

Company's news

- Starting March 23, 2021, Abra users can use "the Borrow" feature in the mobile app worldwide and in 35 US states. This new feature, Abra Borrow, is designed to meet the growing demand from investors to use cryptocurrency as collateral to receive fiat funds. With Abra Borrow, users can easily borrow and repay funds with just a few clicks on the Abra mobile app. This service is expected to expand to other regions in the near future.

- Cryptocurrency startup Abra received $16 million from Foxconn as part of a Series B investment round. This was announced at the Money2020 conference in Las Vegas - the new capital increased the startup's total funding to $30 million. Other participants in the round include new investors Silver8 Capital and Ignia, as well as longtime backers Arbor Ventures, American Express, Jungle Ventures, Lehrer Hippeau and RRE.

- Abra and Coinify have signed an agreement allowing deposits to the Abra cryptocurrency wallet from European bank accounts through the Single Euro Payments Area (SEPA). This simplifies the deposit process for Abra customers who previously had to use US bank transfers or Mastercard, American Express or Visa bank cards. Using SEPA, you can now easily convert your cryptocurrency into a variety of tokens, including Cardano, Basic Attention Token, and Tron.

SEPA also allows you to make money transfers between EU countries, Iceland, Norway, Switzerland, Liechtenstein, Monaco and San Marino without additional complications. As such, European users can make direct bank transfers from their accounts to the Abra cryptocurrency wallet through a partnership with Coinify, which is Abra's first European partner to integrate with European banks via SEPA.

Features of venture investments

- The average duration of an investor's stay in a project is about five years. This period is unpredictable and cannot be determined by anyone.

- You can invest in a deal at any time as long as it is available on the Marketplace and is not Sold Out.

- An 'exit' from a transaction is possible only after the company's shares are listed on the stock exchange for trading.

- Venture investments are generally high-risk, but also highly profitable if the shares are successfully listed on the stock exchange.

Frequently Asked Questions about Abra (FAQ)

— What is Pre-IPO?

Pre-IPO (Pre-Initial Public Offering) refers to investing in a company at a late stage of its development before its shares are listed on a public exchange. Investors gain access to the business well ahead of the IPO or an M&A transaction, typically at a valuation lower than the eventual public market price.

— How is Pre-IPO different from IPO?

At IPO, shares immediately trade on the stock exchange and become liquid. Pre-IPO is a venture-stage investment: shares are not yet publicly traded, and the holding period is usually 1–5 years until the company goes public.

— Why do companies raise capital at the Pre-IPO stage?

They seek additional funding to accelerate growth prior to a listing, strengthen their balance sheet, expand product lines, or enter new markets.

— How is share price and valuation determined at Pre-IPO?

Pricing is based on the company’s financing rounds (Series C, Series D, etc.) and valuations set by venture capital firms and institutional investors. On a marketplace, pricing may either follow the latest round or reflect average levels from secondary market transactions.

— How can I participate in Pre-IPO via Regolith?

You select a company on the platform and submit an application. Your investment is allocated into the corresponding trust series linked to that Pre-IPO, making you a beneficiary of that series.

— How is the transaction structured legally?

The investor transfers funds and signs a set of agreements (subscription/participation agreement, trust series joinder, etc.). Shares are held by the trust, while the investor is recognized as its beneficiary.

— Where are the shares recorded if I invest through the platform?

Shares are held within the trust structure. The trust is the legal owner, and you are the beneficiary of the respective series.

— How is my participation and ownership confirmed?

Your personal account provides access to key documents: the series participation agreement, trust declaration, and asset specification. These confirm your beneficiary status.

— Can I verify that Regolith actually participates in the deal?

Yes. Your account contains supporting documents for each trust series, detailing the deal structure and ownership arrangements.

— What is the minimum investment amount?

The minimum is shown on each deal page. On average, it ranges from $150 to $850 depending on the company.

— What is the typical investment horizon?

Generally 12–36 months, until IPO or M&A. The exact timing cannot be predetermined.

— When and how can I exit the investment?

Exit is only possible at a liquidity event — IPO or strategic sale (M&A). At that point, shares are sold and proceeds distributed to investors.

— What fees apply?

• Entry fee: 5% at the time of purchase

• Exit fee: 20% of profit (success fee)

• No management or exit-only fees apply

— Do I receive dividends before IPO?

No. Most Pre-IPO companies reinvest profits into growth. Investor returns are realized solely through capital appreciation at IPO or sale.

— What risks are involved in Pre-IPO investments?

Pre-IPO is a venture-stage asset class. Key risks include:

• IPO delay or cancellation

• Downward revision of valuation

• Low liquidity on the secondary market

• Market-wide or macroeconomic downturns

— Can I know in advance how much I will earn?

No. Returns depend on valuation at IPO/M&A and market conditions. Potential upside can be 2–5x, but there is also risk of capital loss.

— What if the IPO is postponed or cancelled?

You remain a shareholder. In case of cancellation, exit may still occur via strategic sale (M&A) or by holding shares until a future listing.

— What if the valuation declines?

Returns may be significantly below expectations, or the investment may result in a loss.

— What if the company goes bankrupt?

Pre-IPO is a high-risk venture investment. In the event of bankruptcy, capital may be lost entirely as shares become worthless.

— How likely is a successful IPO?

Venture statistics show that on average, only 1 in 10 companies reaches IPO or strategic sale. Many remain private or cease operations. This dynamic explains both the potential for outsized returns and the elevated risk profile.

— Examples of Pre-IPO value growth

SpaceX

In 2022–2023, SpaceX shares on the private market were available around $60 each. By 2025, secondary market prices reached $237 — a ~4x increase (+295%). Importantly, SpaceX has not yet conducted an IPO, leaving further potential upside.Circle (USDC issuer)

In Dec 2024, Circle shares traded at $24. By June 2025, its IPO priced at $31, and shares surged to $123 on day one, later peaking at $290. As of Sep 2025, they trade near $131. From $24 to $131, that’s +446% (over 5x).Example with Regolith fees

An investor placing $100,000 at $24 per share would have received ~4,166 shares. Selling at $123 yields ~$512,000 (+412% gross). After 5% entry fee ($5,000) and 20% success fee ($82,484), net proceeds would be ~$425,000 (+325%).

These examples illustrate how Pre-IPO works: while growth can be exponential, actual results depend on company fundamentals, entry timing, and market conditions.

Well-known clients and partners

Significant investors

Bill Barhydt

Founder & CEO

“Abra's mission is to democratize access to all financial services for everyone.”

Details

Foundation date

2014Employees

97+Attracted investments

$96MCompany valuation

$340MExpected IPO date

2026Website

Abra.comTerms

Deal fee

5%Carried interest

20%Dividends

NoneRisk potentinal

High

Русский

Русский