Marketplace Regolith

Your investment opportunities

QwilMessenger

E-sign, video & chat messenger

Updated on 5 Feb 2026

Laurent Guyot

Co-Founder & CEO

“In a world where security and trust matter most, we built a messenger that speaks the language of business.”

Updated on 5 Feb 2026

About

Communication platform

Qwil is the world's first B2B SaaS instant messaging platform for financial companies. A banking-level platform for communication between employees and clients, storing all information between them.

More than 3,000 companies, 12,000 full-time employees and 1,000,000 clients of these companies use Qwil every day - from banks, funds to crypto companies that require compliance audits. For 5 years, not a single company using Qwil has returned to communicating via E-mail.

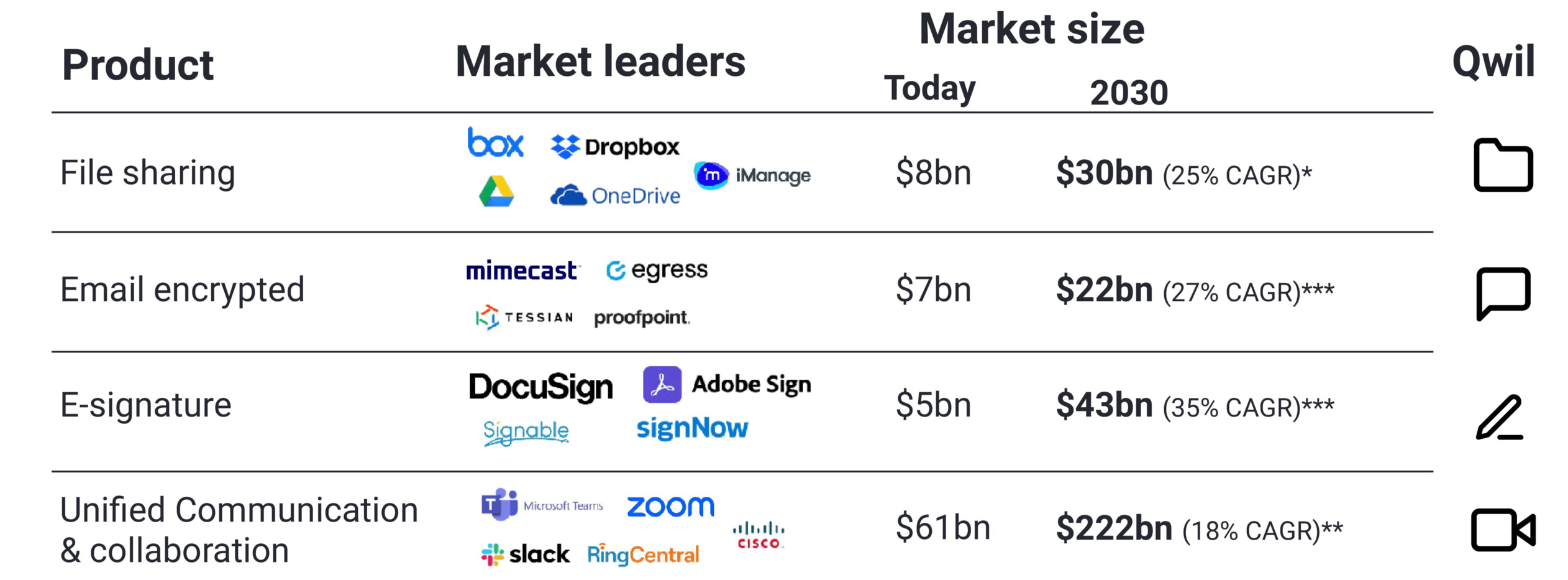

The undisputed UK leader with a global market potential of $82.36 billion. Extremely scalable and difficult to replicate proprietary SaaS platform - there are no direct competitors.

P.S. The SEC fined Bank of America, Citibank, JP Morgan and others more than $2B for using WhatsApp and violating obligations to retain all information between employees and clients. Qwil - solves this problem.

History of the company's creation

- Established in 2017. From secure & compliant "WhatsApp" alternative for financial institutions to the world's first B2B Saas all-in-one client communication platform for all types of professional service firms.

- As of 2023 Qwil Chat, file sharing & managing, e-signature & video meetings...replacing a lot of apps! Deployed to around 3,000 individual companies, 12,000 staff users and (eventually) up to 750,000 end client users.

- Meets the needs of all firms, all sizes and sectors. Sold over 600 licenses in 1 month on AppSumo US marketplace as a POc for indirect sales.

- Its clients include St. James' Place, Fidelity, NedBank, Global Block Digital Trading, and 100s of SMEs from

all sectors (medical, real estate, education, consulting, accounting, finance etc. - Benefits from automated deployment. It is globally scalable & hard-to-replicate proprietary SaaS platform - it has zero direct competitors. ISO 27001. HIPAA compliant. Cyber Essentials Plus. Patent granted.

- Circa $1m ARR from sticky or multiple year enterprise contracts. Huge opportunities to increase revenues and volume and capture market share in a high growth 100s billion $ "product" lead market. Raised $4.5m to date. Latest round raised £807k in January 2023 to shift to SaaS S&M model, building the inbound and outbound sales platform & automated platform.

- It has a team of 10 staff!

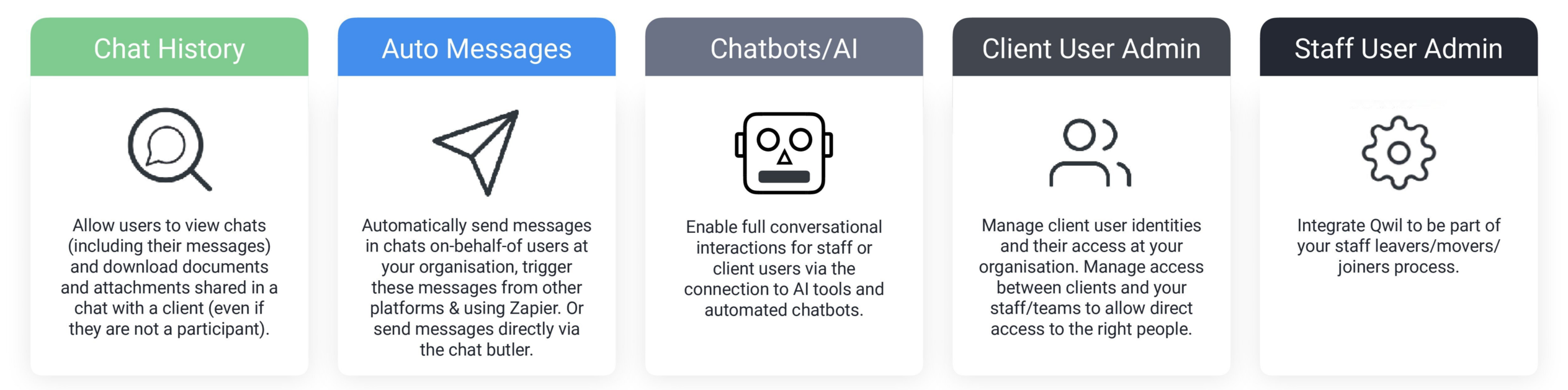

Solving professional firms greatest challenges

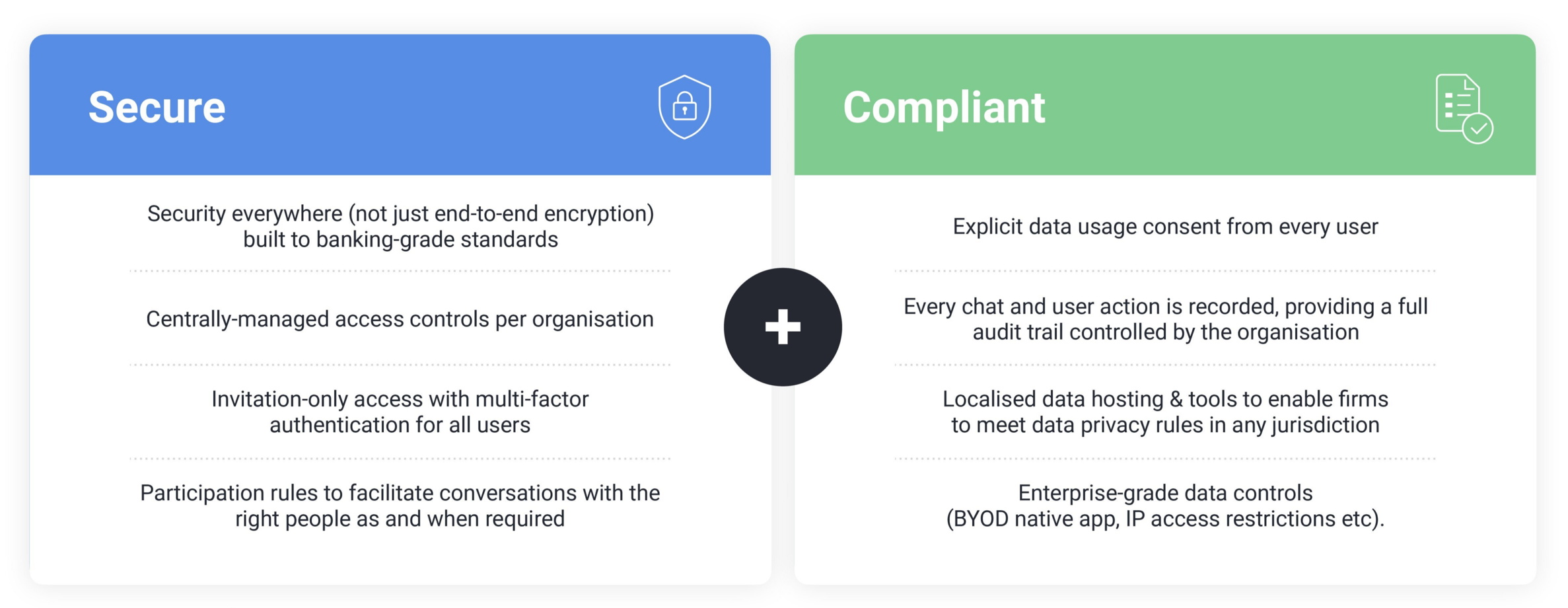

- Security & Compliance. A walled garden for verified staff and clients to communicate with a full audit trail. Control and banking security.

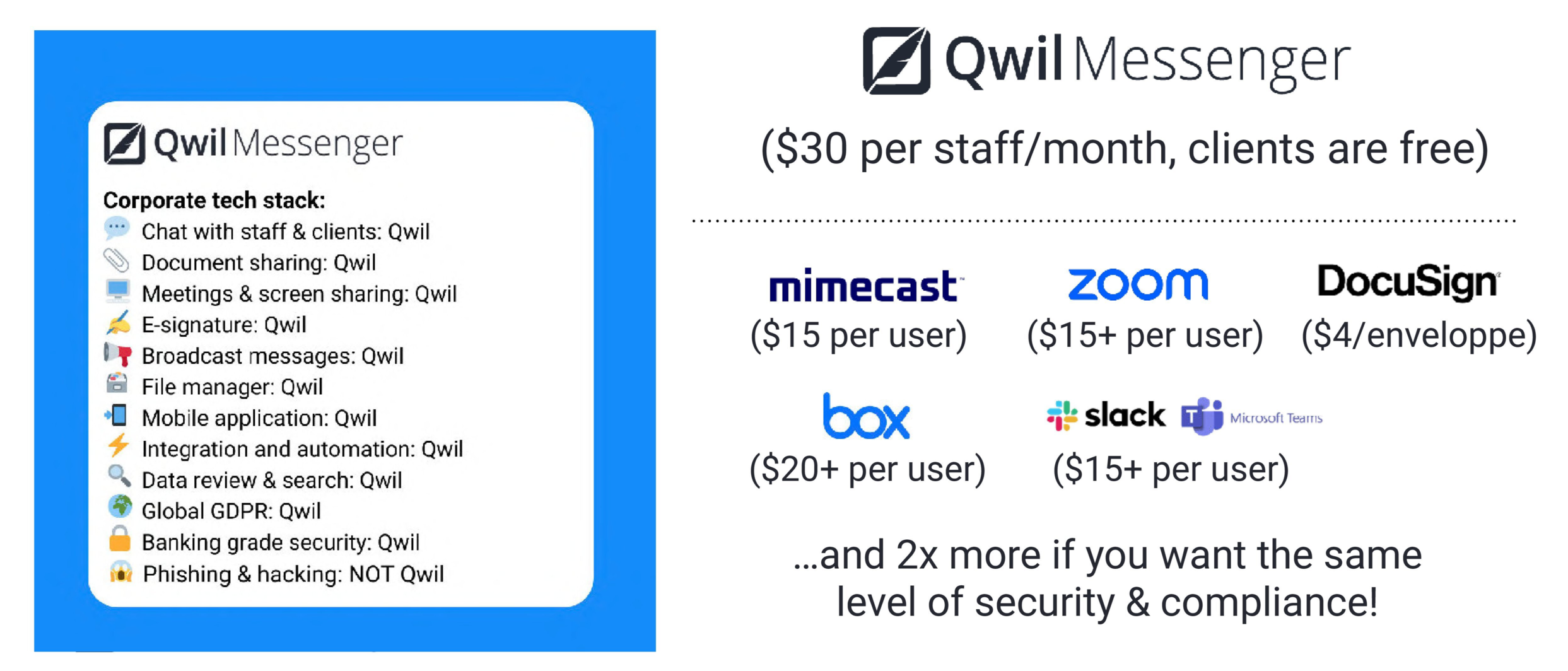

- Saving the Toggle tax. All-in one client communication platform for staff to chat, share documents, e-signatures & video calls.

- Staff & Client expectations. A professional "WhatsApp" alternative for staff & clients.

Single professional application

Our vision is a convenient application for employees, clients and landlords to create a network effect and optimize time.

WhatsApp alternative

Social / Traditional (Not Authenticated)

Out of control of the business (Shadow IT) with no audit trail. Security is not ensured despite encryption, as user identity is not verified. Increases risk of data breach and fines.

Internal / Org. to Org. (Not for Clients)

These application types are collaboration platforms designed primarily for 1 user type (staff) which can invite limited external guests (customers = staff) to channels to work on projects.

Banking level platform

- Invitation only branded platform designed for 2 user types staff & clients

- User address book defined by the firm to ensure privacy & confidentiality

- Co-ordinated multi-party chats can be created according to pre-defined rules with full audit trail

- Users can share & store files & images securely, request signatures & broadcast

Watch the demo version.

Strengths

The application is deployable in minutes, and it enables endless integrations and automations into ecosystems.

Confidentiality and reliability

Enterprise security and compliance are available to companies of all sizes. Qwil takes care of this.

Cost savings and efficiencies across the board

$30 per staff/month

Total Addressable Market

Qwil is ideally positioned to capture a % of each "single use" market.

Strategy

![]()

Qwil sales strategy: shifting from a "solution" for enterprise to a scalable SaaS product for all sectors and geographies.

Strategy in numbers

Largest UK financial adviser network - 15% of UK market including St James Place.

- Sales process (Enterprise):

- June 2019: Agreed to pilot

- Dec 2010° Intosec & risk done

- March 2020: Commercials agreed

- April 2020: Deployment 6500 staff in 3 weeks

- Dec 2020: Integration in Salestorce - Statistics June 2023:

- 2,875 tenancies (independent companies)

- 6 485/8.500 statt contract

- 2,723,831 messages sent

- Adding up to 850,000 clients

Largest marketplace for Entrepreneurs for discounted deals using Appsumo as an example.

- Sales process (Marketplace)

- March 2023: Selected by AppSumo, commercials agreed, landing page, materials and video

- April: Fully automated workflow with code checking, new APIs for deployment

- May: Launch with email campaign, self serve. - Statistics June 2023:

- Day 1: 50 licenses

- Week 1: 220 licenses

- 30 days: 450 licenses

- 6 June: 603 licences, 140+ companies from Medical, law, tax, consulting, Web, Education, Real-estate (70% US)

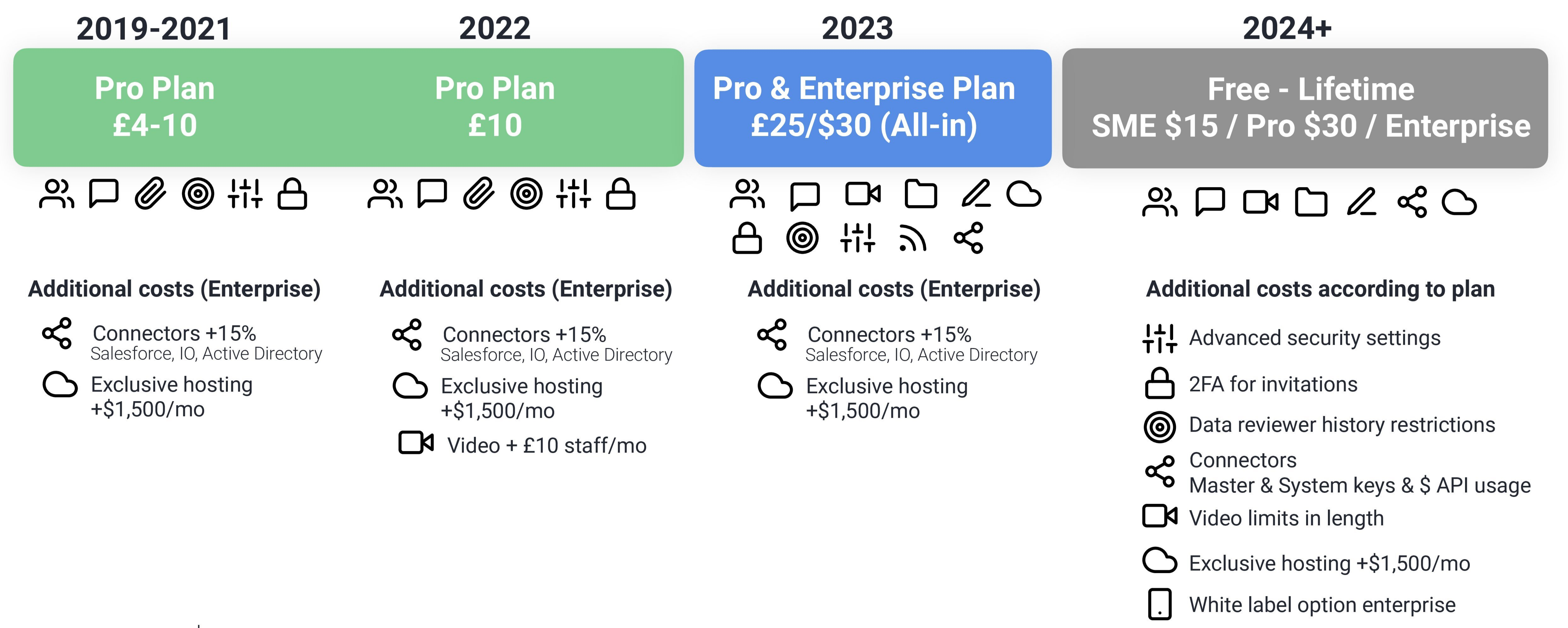

Simple SaaS Pricing increased in line with features

Ability to restrict features, self-serve & billing in Q4 & opens up plan flexibility.

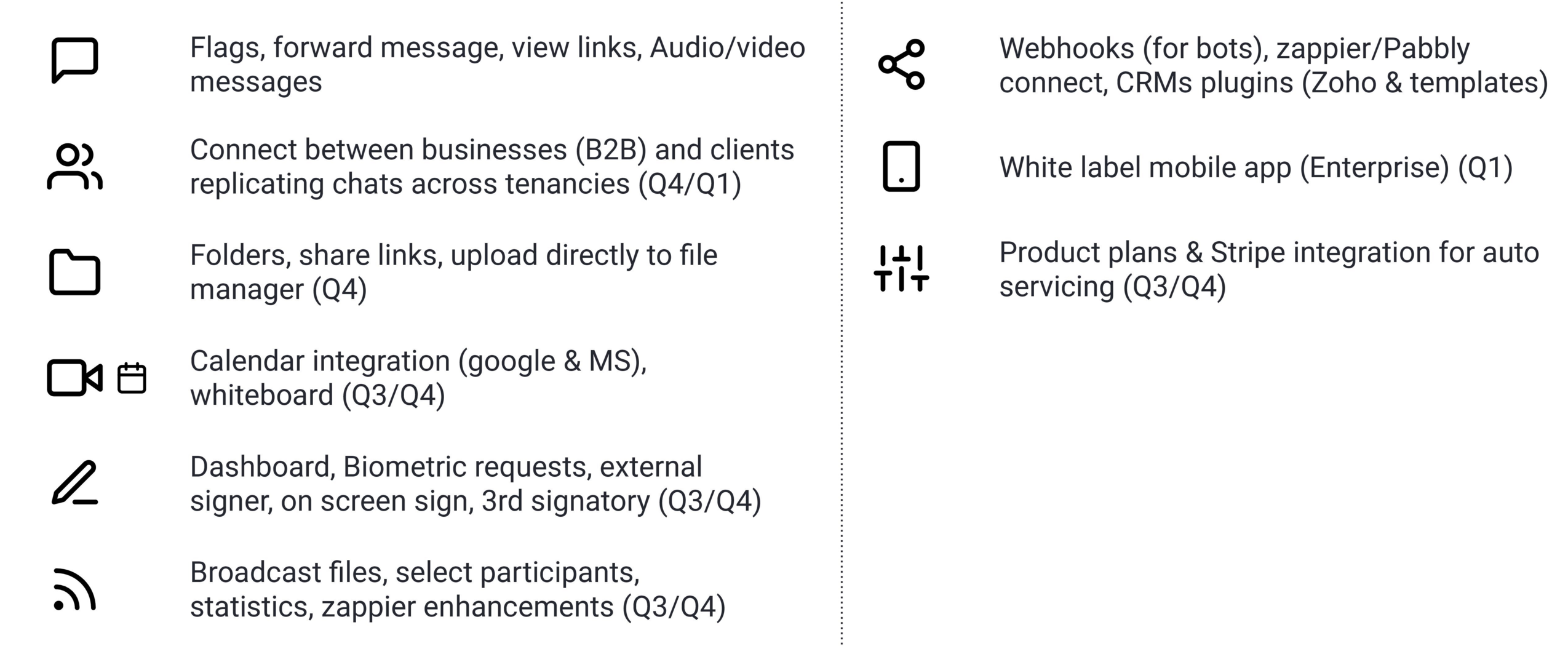

Roadmap

Completing features & self serve management.

Frequently Asked Questions about QwilMessenger (FAQ)

— What is Pre-IPO?

Pre-IPO (Pre-Initial Public Offering) refers to investing in a company at a late stage of its development before its shares are listed on a public exchange. Investors gain access to the business well ahead of the IPO or an M&A transaction, typically at a valuation lower than the eventual public market price.

— How is Pre-IPO different from IPO?

At IPO, shares immediately trade on the stock exchange and become liquid. Pre-IPO is a venture-stage investment: shares are not yet publicly traded, and the holding period is usually 1–5 years until the company goes public.

— Why do companies raise capital at the Pre-IPO stage?

They seek additional funding to accelerate growth prior to a listing, strengthen their balance sheet, expand product lines, or enter new markets.

— How is share price and valuation determined at Pre-IPO?

Pricing is based on the company’s financing rounds (Series C, Series D, etc.) and valuations set by venture capital firms and institutional investors. On a marketplace, pricing may either follow the latest round or reflect average levels from secondary market transactions.

— How can I participate in Pre-IPO via Regolith?

You select a company on the platform and submit an application. Your investment is allocated into the corresponding trust series linked to that Pre-IPO, making you a beneficiary of that series.

— How is the transaction structured legally?

The investor transfers funds and signs a set of agreements (subscription/participation agreement, trust series joinder, etc.). Shares are held by the trust, while the investor is recognized as its beneficiary.

— Where are the shares recorded if I invest through the platform?

Shares are held within the trust structure. The trust is the legal owner, and you are the beneficiary of the respective series.

— How is my participation and ownership confirmed?

Your personal account provides access to key documents: the series participation agreement, trust declaration, and asset specification. These confirm your beneficiary status.

— Can I verify that Regolith actually participates in the deal?

Yes. Your account contains supporting documents for each trust series, detailing the deal structure and ownership arrangements.

— What is the minimum investment amount?

The minimum is shown on each deal page. On average, it ranges from $150 to $850 depending on the company.

— What is the typical investment horizon?

Generally 12–36 months, until IPO or M&A. The exact timing cannot be predetermined.

— When and how can I exit the investment?

Exit is only possible at a liquidity event — IPO or strategic sale (M&A). At that point, shares are sold and proceeds distributed to investors.

— What fees apply?

• Entry fee: 5% at the time of purchase

• Exit fee: 20% of profit (success fee)

• No management or exit-only fees apply

— Do I receive dividends before IPO?

No. Most Pre-IPO companies reinvest profits into growth. Investor returns are realized solely through capital appreciation at IPO or sale.

— What risks are involved in Pre-IPO investments?

Pre-IPO is a venture-stage asset class. Key risks include:

• IPO delay or cancellation

• Downward revision of valuation

• Low liquidity on the secondary market

• Market-wide or macroeconomic downturns

— Can I know in advance how much I will earn?

No. Returns depend on valuation at IPO/M&A and market conditions. Potential upside can be 2–5x, but there is also risk of capital loss.

— What if the IPO is postponed or cancelled?

You remain a shareholder. In case of cancellation, exit may still occur via strategic sale (M&A) or by holding shares until a future listing.

— What if the valuation declines?

Returns may be significantly below expectations, or the investment may result in a loss.

— What if the company goes bankrupt?

Pre-IPO is a high-risk venture investment. In the event of bankruptcy, capital may be lost entirely as shares become worthless.

— How likely is a successful IPO?

Venture statistics show that on average, only 1 in 10 companies reaches IPO or strategic sale. Many remain private or cease operations. This dynamic explains both the potential for outsized returns and the elevated risk profile.

— Examples of Pre-IPO value growth

SpaceX

In 2022–2023, SpaceX shares on the private market were available around $60 each. By 2025, secondary market prices reached $237 — a ~4x increase (+295%). Importantly, SpaceX has not yet conducted an IPO, leaving further potential upside.Circle (USDC issuer)

In Dec 2024, Circle shares traded at $24. By June 2025, its IPO priced at $31, and shares surged to $123 on day one, later peaking at $290. As of Sep 2025, they trade near $131. From $24 to $131, that’s +446% (over 5x).Example with Regolith fees

An investor placing $100,000 at $24 per share would have received ~4,166 shares. Selling at $123 yields ~$512,000 (+412% gross). After 5% entry fee ($5,000) and 20% success fee ($82,484), net proceeds would be ~$425,000 (+325%).

These examples illustrate how Pre-IPO works: while growth can be exponential, actual results depend on company fundamentals, entry timing, and market conditions.

More than 2,800 clients

Company certificates and licenses

Laurent Guyot

Co-Founder & CEO

“In a world where security and trust matter most, we built a messenger that speaks the language of business.”

Details

Foundation date

2017Employees

10Attracted investments

$4.5 mCompany valuation

$72 mWebsite

Qwil.ioTerms

Deal fee

5%Carried interest

20%Dividends

NoneRisk potentinal

Very high

Русский

Русский