Marketplace Regolith

Your investment opportunities

Tron Staking Fund

TRX staking and selling energy

Updated on 6 Mar 2026

Justin Sun

Founder TRON (TRX)

“Decentralize the web.”

Updated on 6 Mar 2026

About

Tron Staking Fund is an investment fund based on staking TRX cryptocurrency on the TRON network. The fund freezes tokens to support blockchain operations and generates income from two sources: network rewards for transaction validation and energy sales to crypto exchanges, P2P platforms and DeFi services. Dividends are paid monthly in USDT.

Tablet (2).png)

Tablet (2).png)

Mobile (3).png)

Beyond dividend returns, investors gain exposure to TRX price appreciation. When exiting the fund, tokens are sold at the prevailing market rate – meaning any increase in TRX value over the holding period translates into additional profit. There is no performance fee on TRX price gains.

Desktop 2 (3).png)

Desktop 2 (3).png)

Mobile 2 (3).png)

What is TRON (TRX) cryptocurrency?

TRON is a decentralized blockchain platform founded by Justin Sun in 2017. It enables fast, low-cost transactions and supports smart contracts and decentralized applications (DApps). The network can process up to 2,000 transactions per second, with transfer fees costing just fractions of a cent.

TRX is the native cryptocurrency of the network, used for payments, transaction fees, and governance.

In 2019, TRON became one of the first networks to support USDT (Tether) in the TRC-20 format. In 2021, TRON surpassed Ethereum in circulating USDT volume, becoming the largest network for stablecoins.

The majority of USDT, USDC, and other stablecoins are now issued and transacted on TRON. Crypto exchanges prefer this network for transfers due to its high processing speed for large volumes of transactions and low failure rates compared to other networks. By 2024, the number of users exceeded 295 million, with over 9.8 billion transactions processed. It continues to evolve as a leading blockchain infrastructure for fast and accessible financial operations.

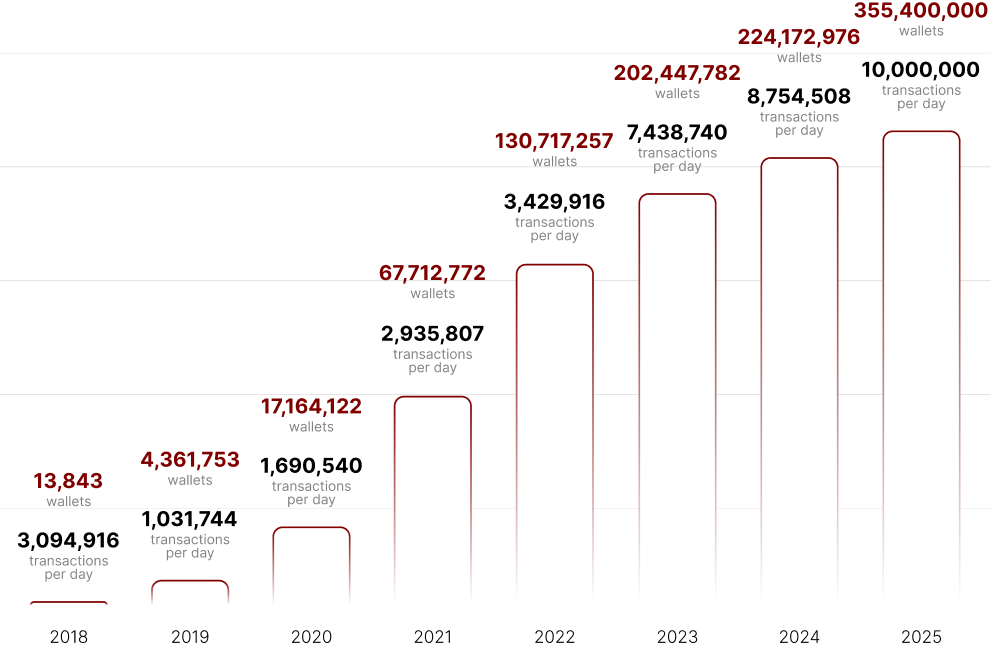

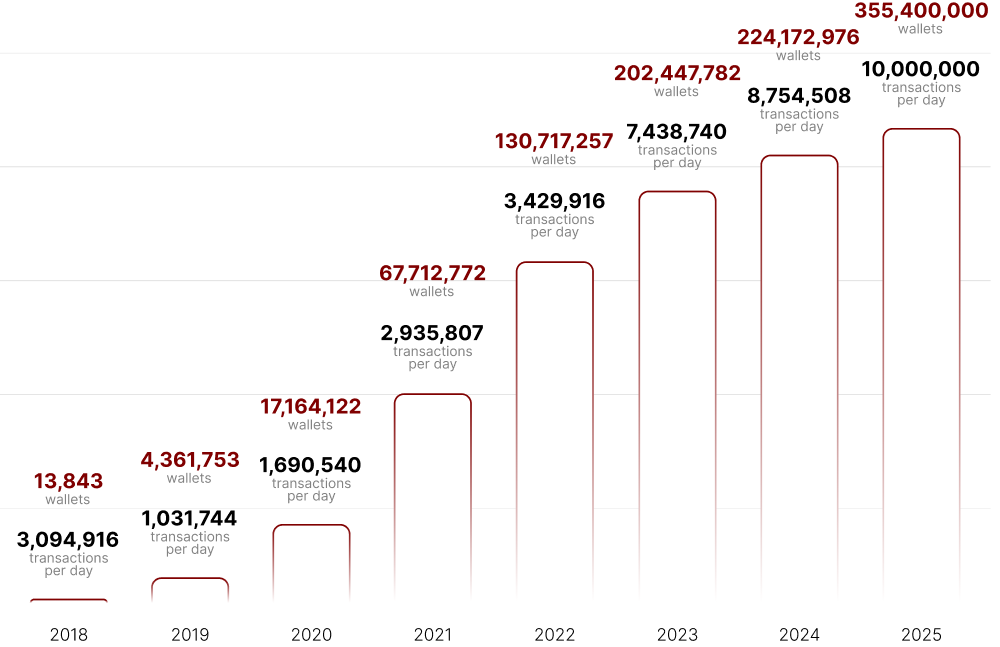

User adoption is accelerating, with a rapid increase in daily transaction volume.

How does TRX staking work?

TRX staking is a way to support the TRON network while earning rewards. Your coins remain secure, as they are not transferred to third parties or exposed to hacking risks. Staking is considered one of the most reliable investment methods.

How does the staking process work?

1. TRX is purchased and frozen — this means that the coins remain stored on the most secure hardware wallet and are temporarily unavailable for transfers.

2. Your tokens start working: they are used to confirm transactions in the TRON network and help maintain its stability. In addition, your TRX generate Energy for transfers in the TRON network. We sell this Energy to crypto exchanges, P2P exchanges, DeFi platforms and other financial services, helping them save on fees.

3. You receive a reward: our system credits your earnings to your account in USDT every month.

4. You can unfreeze TRX — the minimum investment term is 1 month. After submitting a withdrawal request, a 15-day unfreezing period begins (set by TRON algorithms). Upon completion, TRX is sold on the exchange at the current market rate, and funds are credited to your account.

.png)

.png)

.png)

Commission Terms

• For TRX price growth, the carried interest is 0%.

• For dividend yield, the carried interest is 30%.

Risks of Investing in TRON (TRX) Staking

1. Price volatility – If TRX price declines, staking rewards may not be enough to cover potential losses. However, as you can see from the TRX price growth chart above, this cryptocurrency demonstrates steady growth over the long term, with relatively low volatility for the crypto market.

2. Changing rewards – Staking yields depend on network conditions and validator decisions, meaning they can decrease over time.

3. Regulatory uncertainty – Some countries may impose restrictions on staking or introduce taxation on staking rewards.

Withdrawal Process

The minimum investment term is 1 month.

The withdrawal process is carried out as follows:

• Upon the investor’s request, the Company initiates the unstaking process, triggering a 15-day unfreezing period, during which TRX is unlocked within the blockchain network.

• After the 15-day unfreezing period, the Company sells the TRX on the exchange at the current market rate.

• The proceeds from the sale are then credited to the investor’s account on the next Dividend Payout Day. The Company is not responsible for market fluctuations or changes in TRX value during the withdrawal process.

Frequently Asked Questions about Tron Staking Fund (FAQ)

1. What is TRX Staking?

TRX staking is the process of freezing your cryptocurrency to support the TRON network, in exchange for passive income. Unlike traditional bank deposits, your assets remain in your wallet and are not transferred to any third parties.

2. How Does Staking Work?

The staking process involves four steps:

• Freezing your tokens

• Delegating your votes to a validator

• Earning rewards + generating Energy

• Unfreezing your tokens (takes 15 days)

3. Why TRX and Not Other Coins?

TRON offers higher reliability and returns compared to coins like ETH, Cardano, Polkadot, or Solana. Its network is stable, fees are low, and there are no slashing risks. Over 50% of all USDT transfers are conducted on the TRON network.

4. Where Does the Up to 20% Yield Come From?

The base yield from validators is around 4.5%. Additional income is generated from selling Energy to other network participants (exchanges, payment services, etc.). We share this extra revenue with our investors.

5. How Safe Is It?

Investor funds are never transferred to third parties and are stored in cold wallets. We use only TRON’s official blockchain logic, without smart contracts. The fund can manage Energy but does not have access to your assets.

6. How Do I Get Started?

Sign up on the Regolith platform, complete KYC, and fund your account. Then choose the TRX Staking Fund and invest. Dividends are paid out monthly.

7. How Is Staking Different from Mining?

Mining requires expensive hardware and energy to generate new coins. Staking, on the other hand, uses existing coins to support the network and earn rewards.

8. Can I Withdraw My Funds?

Yes, the minimum investment term is 1 month. Following the request, the asset undergoes a 15-day unfreezing period, after which TRX is sold at market rate and funds are credited to the investor's account.

9. Where Are My Assets During Staking?

Your assets remain in the wallet used for staking — you don’t transfer them to anyone. For investments of $100,000 or more, we offer custom wallet solutions — available upon request via your manager.

10. What’s the Minimum Investment?

Starting from just $100. Even small investments generate rewards. The larger the investment, the higher the total return.

11. Are There Risks on the TRON Network Side?

Like any blockchain, theoretical risks exist. But TRON is one of the most stable and decentralized ecosystems. Governance is handled by validators and the community through a voting process.

12. What If the TRX Price Drops?

Like all crypto, TRX is volatile. However, TRON has real-world use, high USDT volume, and solid fundamentals. In 2025, Canary Capital filed for the first U.S. staking ETF based on TRX — a strong sign of institutional confidence.

Justin Sun

Founder TRON (TRX)

“Decentralize the web.”

Dividends

Average monthly DY

1.41%Dividend performance over 11 months

15.48%Performance

Dividend Yield 2023

22%Dividend Yield 2024

21%Dividend Yield 2025

17.5%TRX Value Growth

In 2023: $0.053 → $0.1077

+103%In 2024: $0.1077 → $0.2542

+136%In 2025: $0.2542 → $0.2843

+11.8%Terms

Carried Interest

30%Carried interest on $500k+ vol.

25%Carried interest on $1M+ vol.

20%Performance fee on TRX growth

0%Minimum investment period

1 monthDividends

Once every monthRisk potential

High

Русский

Русский