Marketplace Regolith

Your investment opportunities

Kraken

Cryptocurrency exchange, bank and wallet

Updated on 5 Feb 2026

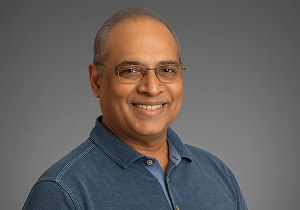

David Ripley

CEO

“Crypto is about freedom. Kraken fights for that freedom every day.”

Updated on 5 Feb 2026

About

Kraken is a globally recognised cryptocurrency exchange known for its high security, diverse range of features and long operational history.

Founded in 2011 by Jesse Powell, Kraken offers a comprehensive platform for buying, selling, trading and staking various digital assets. Navigating through Kraken's platform is straightforward, even for crypto novices. Users can effortlessly deposit, trade, and withdraw crypto with its user-friendly interface.

Kraken's commitment to global regulatory compliance sets it apart in the often murky waters of cryptocurrency. It operates in the United States (excluding New York due to the BitLicense requirement), Canada, the EU, Japan and 190 additional countries. In these jurisdictions, it is fully registered and compliant with relevant financial authorities, giving users additional peace of mind. As a worldwide platform, the exchange can also be used in several languages, including Italian, Spanish, Portuguese, and Mandarin.

Message from co-founder Jesse Powell

Powell and his company Kraken adhere to the philosophy that cryptocurrencies and blockchain can change the financial system and provide greater freedom and accessibility to financial services.

Kraken Features

The exchange offers various advanced features, including a suite of trading options such as spot, futures, and margin, making it versatile for different trading strategies. In addition to these, Kraken also offers staking services, enabling users to earn rewards on their crypto holdings. Refer to the below for a detailed overview of the products and services offered on Kraken:

- Multiple Trading Types: Buy or sell a token with spot markets or trade margin and derivatives contracts with up to 20x leverage.

- Crypto Staking: Earn up to 24% APY (Annual Percentage Yields) on 18 cryptocurrencies with both flexible and fixed terms.

- Multilingual Customer Support: Use the Kraken platform and contact the support team 24/7 via live chat in eight languages.

- OTC Desk: Institutional-level investors can access a premium service to trade cryptocurrency directly with an account manager for tighter spreads.

- NFT Marketplace: Trade thousands of NFTs with zero gas fees directly through the Kraken platform. Buy and sell popular projects like BAYC, Azuki, Moonbirds and Doodles.

- Mobile App: Buy, sell, hold and stake various cryptocurrencies through the Kraken mobile app. It can be downloaded on both iOS and Android devices.

- Kraken Pro: Trade futures and more with the Kraken Pro platform, a highly customizable exchange offering an all-in-one interface with access to spot, margin and derivatives trading.

- Proof of Reserves: Kraken publishes its proof of reserves every quarter to highlight that they hold all of their users assets 1:1 on the exchange.

Latest News

The real story of the SEC's lawsuit against Kraken, and why Kraken is moving to dismiss the case

22.02.2024

On the morning of May 10, 2023, Kraken testified about the SEC’s overreach in crypto before both the House Financial Services Committee and the House Agriculture Committee.

Kraken testified that current laws do not adequately cover the digital asset industry, and that Congress could do more to put in place a set of rules to better protect consumers and investors.

Kraken testified that in any new set of crypto exchange rules, Congress should limit the SEC’s jurisdiction in favor of other agencies. The next day, the SEC called Kraken to say it was going to sue.

Crypto innovators in the United States should not have to fear retaliation for their political speech. They should be free to earnestly advocate for better law and more efficient markets. They should be free from intimidation by a politically compromised agency.

Similarly, U.S. crypto users should enjoy a full suite of consumer protections crafted by their elected representatives in Congress. They should be the focus of carefully tailored rules that take into account both the risks and risk mitigators unique to digital asset systems. They should not be pawns in agency power struggles.

Today, we filed a motion asking the Court to dismiss the SEC’s lawsuit against Kraken. The SEC’s Complaint did not claim any fraud or consumer harm whatsoever. It made only a registration-based argument that Kraken operates as an unlicensed securities exchange, broker, dealer and clearing agency because crypto tokens are so-called “investment contracts.” Even taking all of the SEC’s allegations in the Complaint as true – and many are not – its argument is flawed as a matter of law.

Cryptocurrency exchange Kraken has recently been licensed to operate in the Netherlands

8.02.2024

Obtaining the provider license is a step in Kraken’s plan to broaden its European footprint. Kraken acquired Dutch crypto broker BCM last October, and now, with a virtual asset service provider (VASP) registration from the Dutch Central Bank, it’s set to grow in the Dutch market.

"With the addition of the Dutch VASP registration, our European growth strategy continues to accelerate,” said Brian Gahan, Kraken’s Managing Director of Europe. “We see a lot of opportunity to introduce our offering to retail clients and professional traders in the Netherlands and across Europe.”

The Netherlands offers a promising market for Kraken, with about 20% of its citizens owning cryptocurrency. Kraken’s move aligns with its goal to tap into Europe’s high fintech adoption rates.

Despite facing a lawsuit from the U.S. Securities and Exchange Commission for allegedly operating without proper registration, Kraken has maintained that the lawsuit has not impacted its business operations.

Kraken & Coinbase

Kraken's valuation considering Coinbase's experience and cryptocurrency market dynamics

In the world of cryptocurrency exchanges, two major players stand out: Kraken and Coinbase. Both platforms offer a wide range of services, including spot trading, futures, and margin trading.

🐙 Founded in 2011 and offering trading of 69 cryptocurrencies, Kraken exchange is known for its security and advanced features. It serves about 6 million clients and processes over $1 billion in transactions daily.

🪙 Coinbase, which started in 2012, is known for its simple interface and ease of use, making it popular among beginners. Over 56 million users have chosen Coinbase.

The growth of the cryptocurrency market and the desire of both companies' leadership to attract additional capital and expand the business have led to plans for an IPO.

Coinbase became a public company on April 14, 2021. This step was a significant event for the cryptocurrency market, as Coinbase became the first major cryptocurrency exchange to go public in the US.

Kraken has also been considering going public since 2021. Kraken's ex-CEO, Jesse Powell, noted that the company is considering a direct listing of shares on the exchange, similar to what Coinbase did.

Let's look at the numbers:

• Kraken's trading volume in 2021 was $574 billion, while Coinbase's was $1580 billion with a P/S (price/sales) multiplier of about 9x and a market capitalization capitalisation of $52 billion.

• By 2024, the capitalization capitalisation reached $62 billion. Meanwhile, the number of shares issued by Coinbase is 242,275,175. This is comparable to Kraken's 261,000,000 shares.

The price of Kraken's shares on the Regolith platform is $19. This share price was formed at the time when the company's valuation was $5 billion. In the latest funding round, Kraken was valued by investors at $11 billion.

Assuming that Kraken's IPO valuation will be assessed with a P/S multiplier similar to Coinbase's, the company's estimated valuation could be $22.6 billion, then the calculated price per share would be $86.5. This is an approximate valuation and may vary depending on the actual market conditions and other factors at the time of the IPO.

Terms of investments

- The typical duration of an investor's engagement in a project spans approximately five years. This timeframe remains uncertain and is not definitively ascertainable.

- Investment opportunities are accessible on the Marketplace and remain available for investment until marked as Sold Out.

- Exiting a transaction is viable solely after the listing of the company's shares on the stock exchange for trading.

- Venture investments typically entail high risks, yet they also promise substantial profitability upon the successful listing of shares on the stock exchange.

Frequently Asked Questions about Kraken (FAQ)

— What is Pre-IPO?

Pre-IPO (Pre-Initial Public Offering) refers to investing in a company at a late stage of its development before its shares are listed on a public exchange. Investors gain access to the business well ahead of the IPO or an M&A transaction, typically at a valuation lower than the eventual public market price.

— How is Pre-IPO different from IPO?

At IPO, shares immediately trade on the stock exchange and become liquid. Pre-IPO is a venture-stage investment: shares are not yet publicly traded, and the holding period is usually 1–5 years until the company goes public.

— Why do companies raise capital at the Pre-IPO stage?

They seek additional funding to accelerate growth prior to a listing, strengthen their balance sheet, expand product lines, or enter new markets.

— How is share price and valuation determined at Pre-IPO?

Pricing is based on the company’s financing rounds (Series C, Series D, etc.) and valuations set by venture capital firms and institutional investors. On a marketplace, pricing may either follow the latest round or reflect average levels from secondary market transactions.

— How can I participate in Pre-IPO via Regolith?

You select a company on the platform and submit an application. Your investment is allocated into the corresponding trust series linked to that Pre-IPO, making you a beneficiary of that series.

— How is the transaction structured legally?

The investor transfers funds and signs a set of agreements (subscription/participation agreement, trust series joinder, etc.). Shares are held by the trust, while the investor is recognized as its beneficiary.

— Where are the shares recorded if I invest through the platform?

Shares are held within the trust structure. The trust is the legal owner, and you are the beneficiary of the respective series.

— How is my participation and ownership confirmed?

Your personal account provides access to key documents: the series participation agreement, trust declaration, and asset specification. These confirm your beneficiary status.

— Can I verify that Regolith actually participates in the deal?

Yes. Your account contains supporting documents for each trust series, detailing the deal structure and ownership arrangements.

— What is the minimum investment amount?

The minimum is shown on each deal page. On average, it ranges from $150 to $850 depending on the company.

— What is the typical investment horizon?

Generally 12–36 months, until IPO or M&A. The exact timing cannot be predetermined.

— When and how can I exit the investment?

Exit is only possible at a liquidity event — IPO or strategic sale (M&A). At that point, shares are sold and proceeds distributed to investors.

— What fees apply?

• Entry fee: 5% at the time of purchase

• Exit fee: 20% of profit (success fee)

• No management or exit-only fees apply

— Do I receive dividends before IPO?

No. Most Pre-IPO companies reinvest profits into growth. Investor returns are realized solely through capital appreciation at IPO or sale.

— What risks are involved in Pre-IPO investments?

Pre-IPO is a venture-stage asset class. Key risks include:

• IPO delay or cancellation

• Downward revision of valuation

• Low liquidity on the secondary market

• Market-wide or macroeconomic downturns

— Can I know in advance how much I will earn?

No. Returns depend on valuation at IPO/M&A and market conditions. Potential upside can be 2–5x, but there is also risk of capital loss.

— What if the IPO is postponed or cancelled?

You remain a shareholder. In case of cancellation, exit may still occur via strategic sale (M&A) or by holding shares until a future listing.

— What if the valuation declines?

Returns may be significantly below expectations, or the investment may result in a loss.

— What if the company goes bankrupt?

Pre-IPO is a high-risk venture investment. In the event of bankruptcy, capital may be lost entirely as shares become worthless.

— How likely is a successful IPO?

Venture statistics show that on average, only 1 in 10 companies reaches IPO or strategic sale. Many remain private or cease operations. This dynamic explains both the potential for outsized returns and the elevated risk profile.

— Examples of Pre-IPO value growth

SpaceX

In 2022–2023, SpaceX shares on the private market were available around $60 each. By 2025, secondary market prices reached $237 — a ~4x increase (+295%). Importantly, SpaceX has not yet conducted an IPO, leaving further potential upside.Circle (USDC issuer)

In Dec 2024, Circle shares traded at $24. By June 2025, its IPO priced at $31, and shares surged to $123 on day one, later peaking at $290. As of Sep 2025, they trade near $131. From $24 to $131, that’s +446% (over 5x).Example with Regolith fees

An investor placing $100,000 at $24 per share would have received ~4,166 shares. Selling at $123 yields ~$512,000 (+412% gross). After 5% entry fee ($5,000) and 20% success fee ($82,484), net proceeds would be ~$425,000 (+325%).

These examples illustrate how Pre-IPO works: while growth can be exponential, actual results depend on company fundamentals, entry timing, and market conditions.

Significant investors

Team

David Ripley

CEO

“Crypto is about freedom. Kraken fights for that freedom every day.”

Details

Foundation date

2011Employees

2300+Attracted investments

~$1.4BCompany valuation

$20BExpected IPO date

2026Terms

Deal fee

5%Carried interest

20%Dividends

NoneRisk potentinal

HighOther

Active users

over 13 mWebsite

Kraken.com

Русский

Русский