Marketplace Regolith

Your investment opportunities

SkillBranch AI

Revolution in simultaneous interpretation

Updated on 12 Feb 2026

Dmitry Lebed

Founder & CEO

“We believe technology should unite people — removing language barriers and unlocking new ways to connect.”

Updated on 12 Feb 2026

About

Simultaneous speech translation into 70 languages using AI

We are transforming the translation market with AI, eliminating human involvement.

The multilingual translation market is on the verge of a technological revolution.

By 2032, its volume is projected to reach $30.58 billion, showing a compound annual growth rate (CAGR) of around 5.9%.

The simultaneous translation segment is expected to grow from $3.89 billion to $6.25 billion by 2033 with a CAGR of about 7%, while the AI-driven simultaneous translation market, where SkillBranch operates, is demonstrating record momentum — expanding at an average annual rate of 19.1%.

.png)

The Problem:

Traditional Translation Today

.png)

.png)

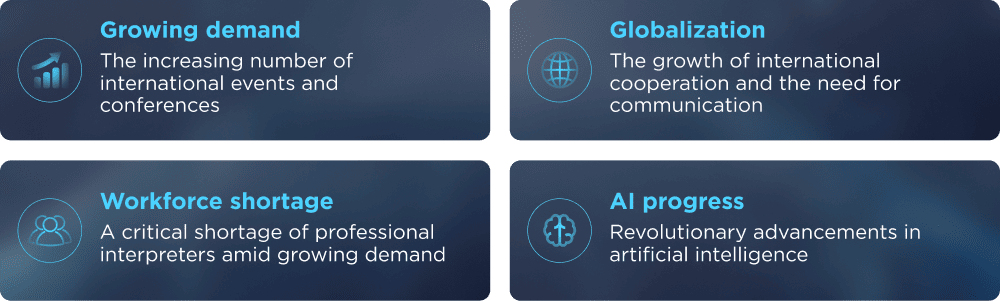

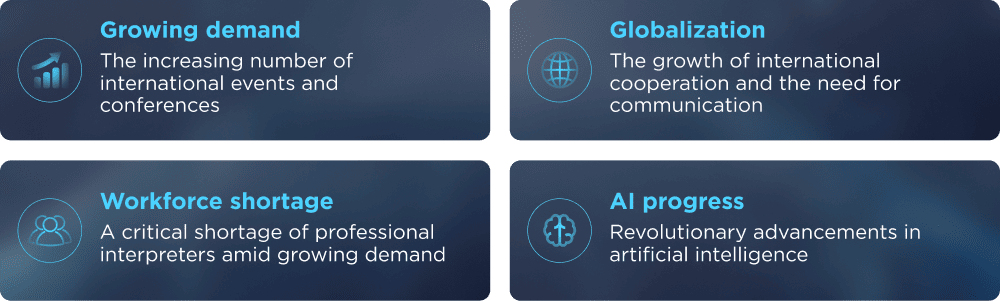

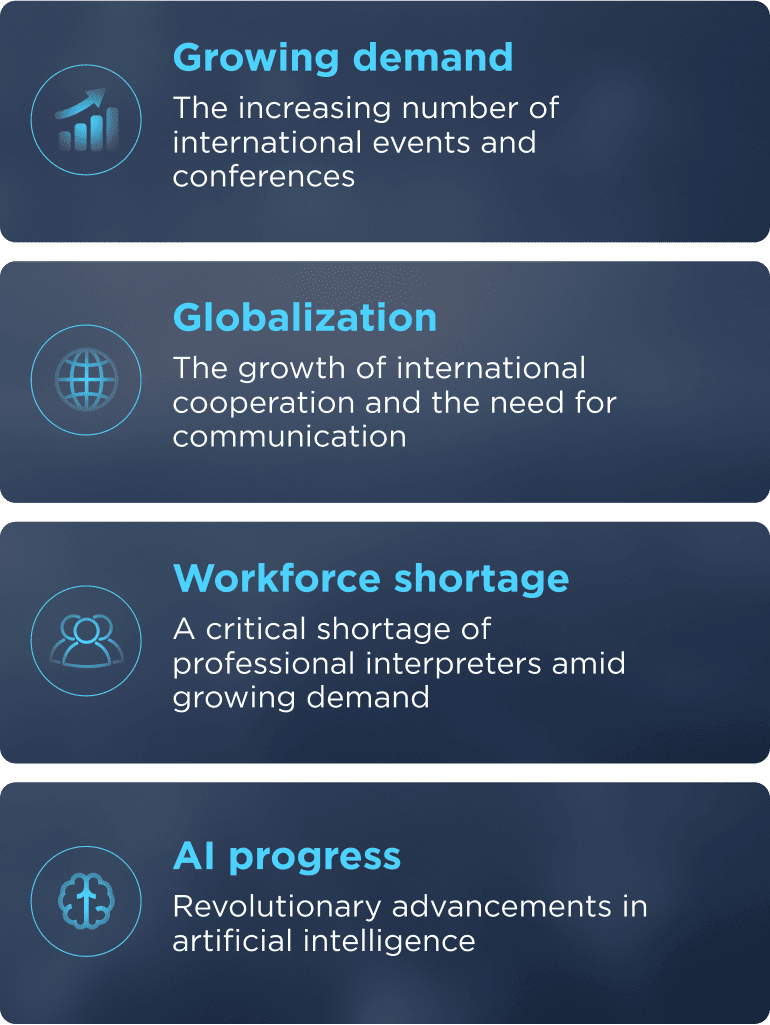

A unique window of opportunity

The acute shortage of interpreters and the development of neural networks create ideal conditions for a technological breakthrough

SkillBranch Technology

An enterprise-grade solution for large-scale events.

.png)

.png)

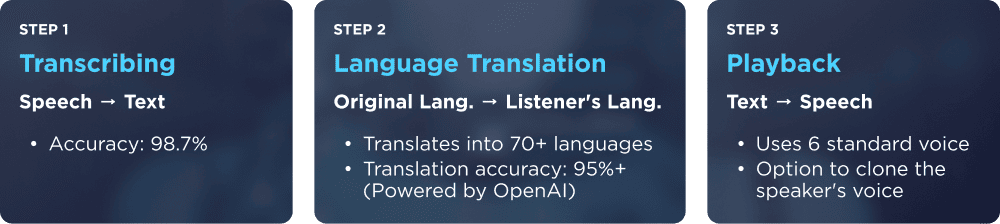

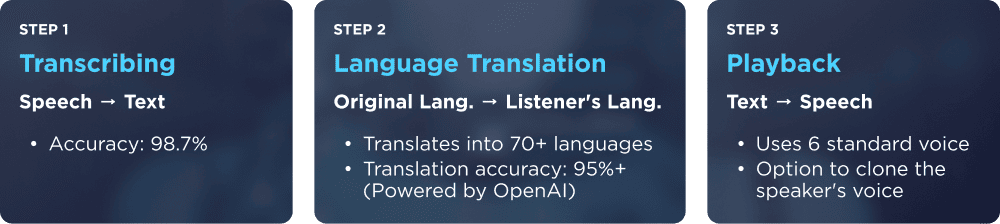

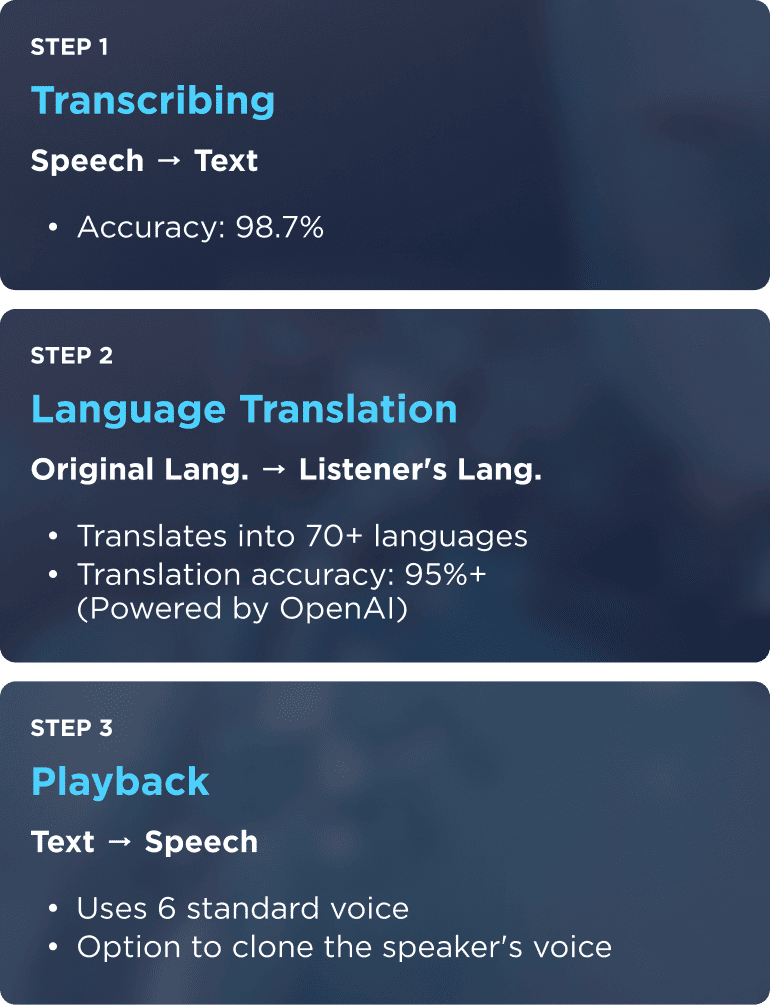

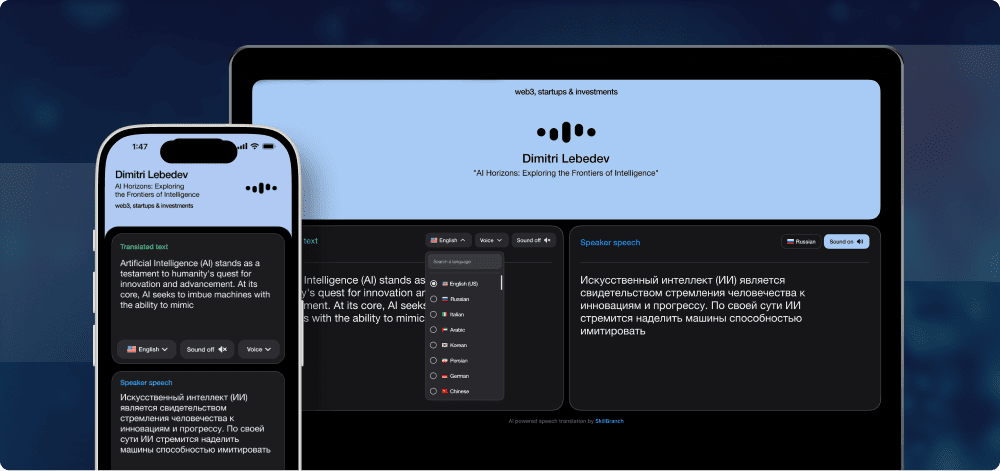

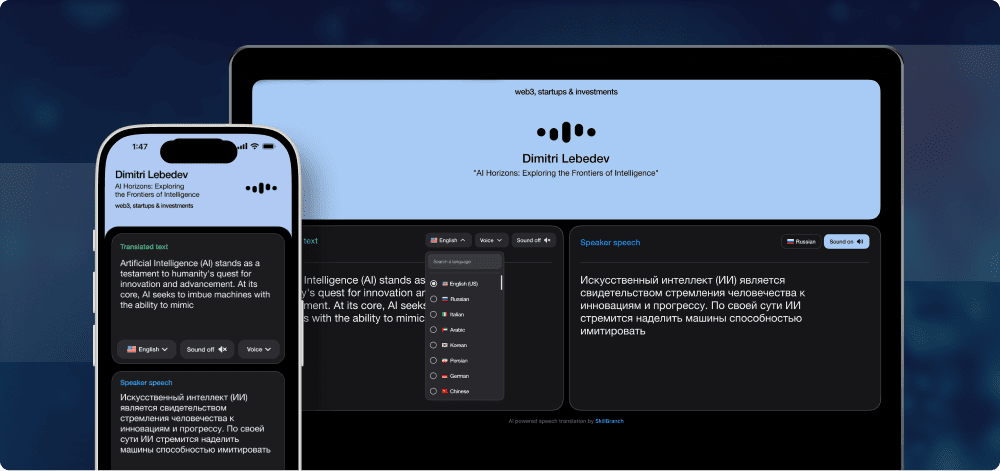

How the SkillBranch technology works

The entire process:: 3-4 seconds

Optimization target: 2 seconds

Proven in operation

Our technology has already proven its effectiveness at an international conference in Dubai

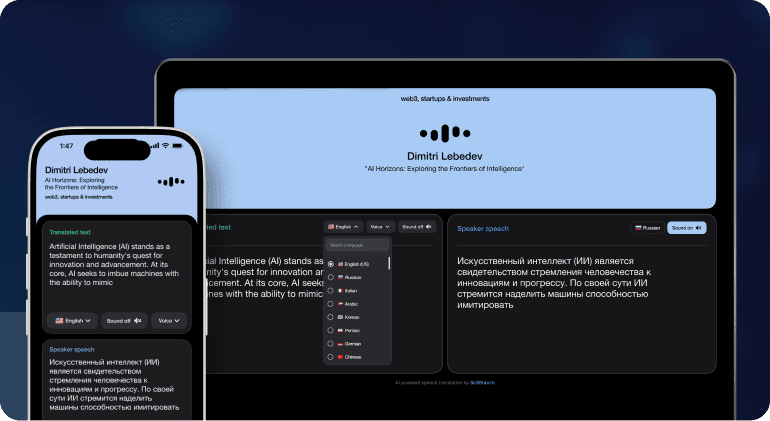

Product

Everything works directly in the user's browser — no third-party apps required.

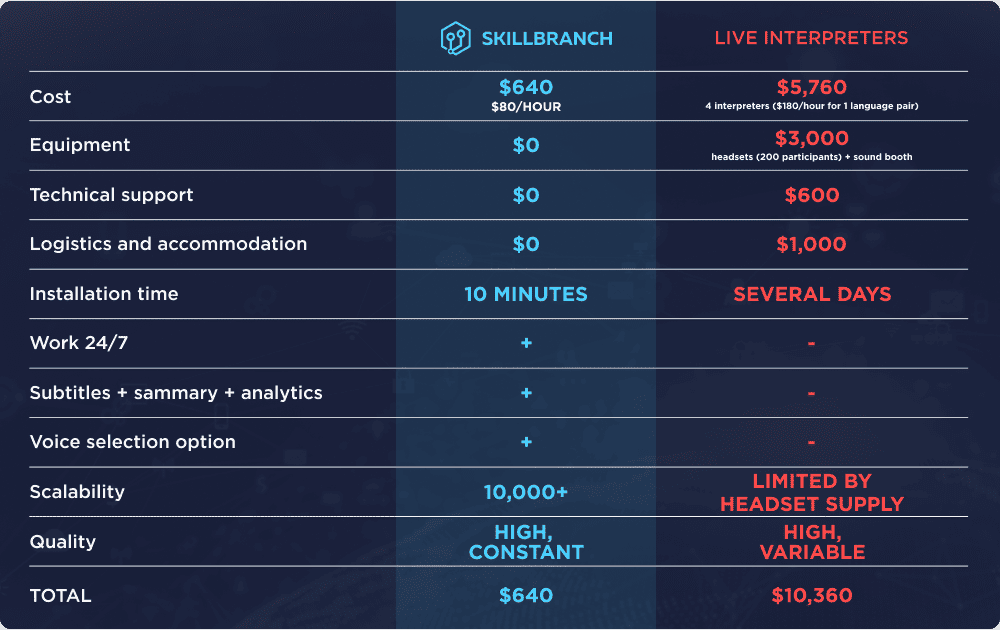

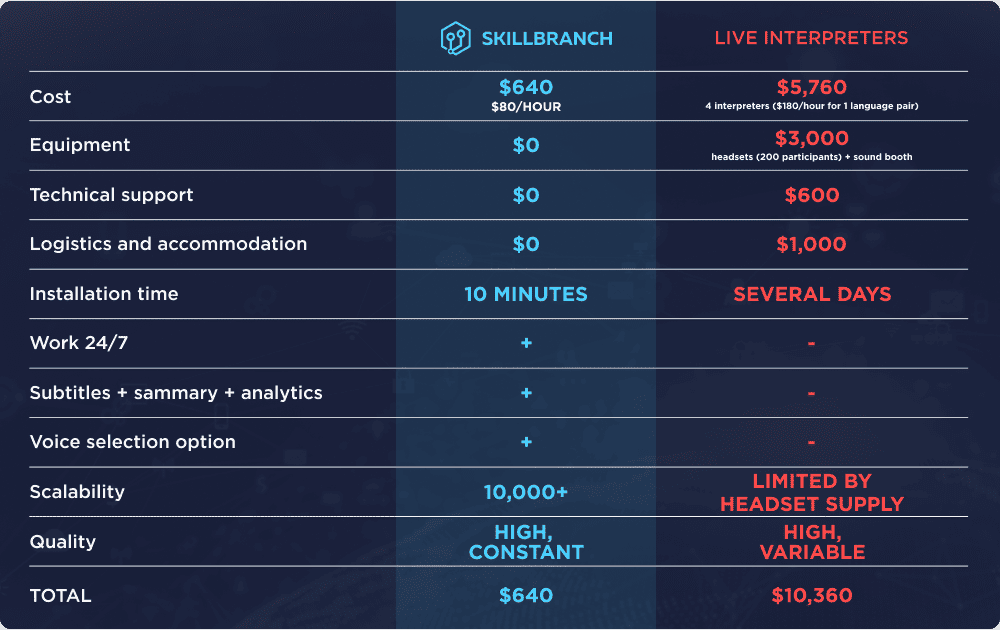

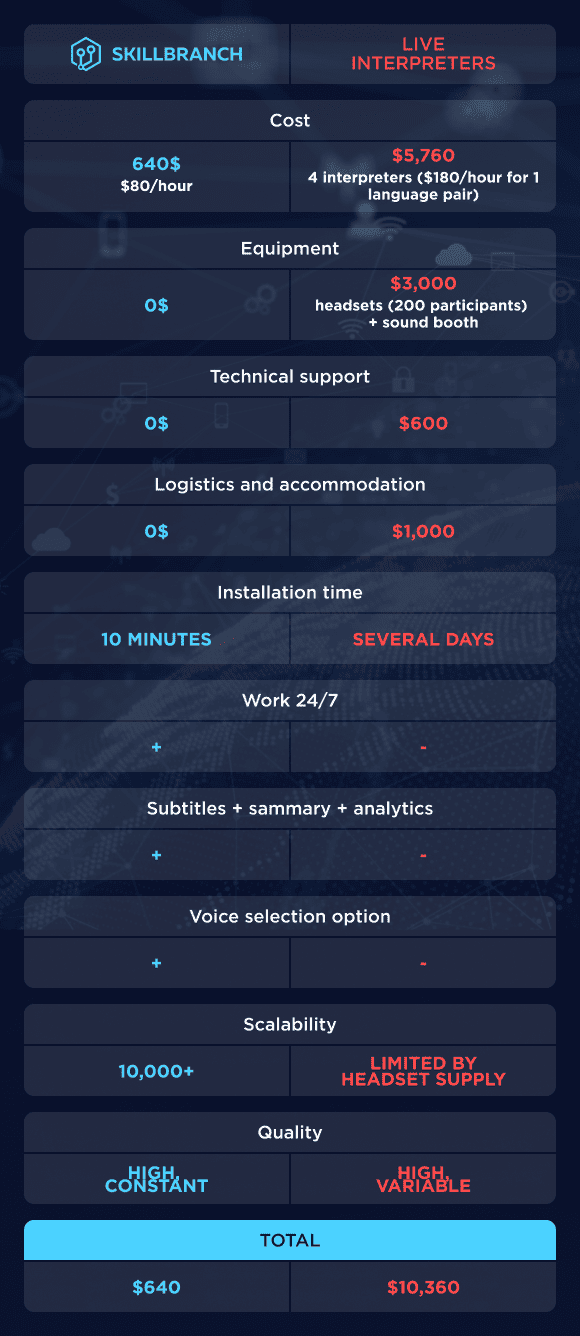

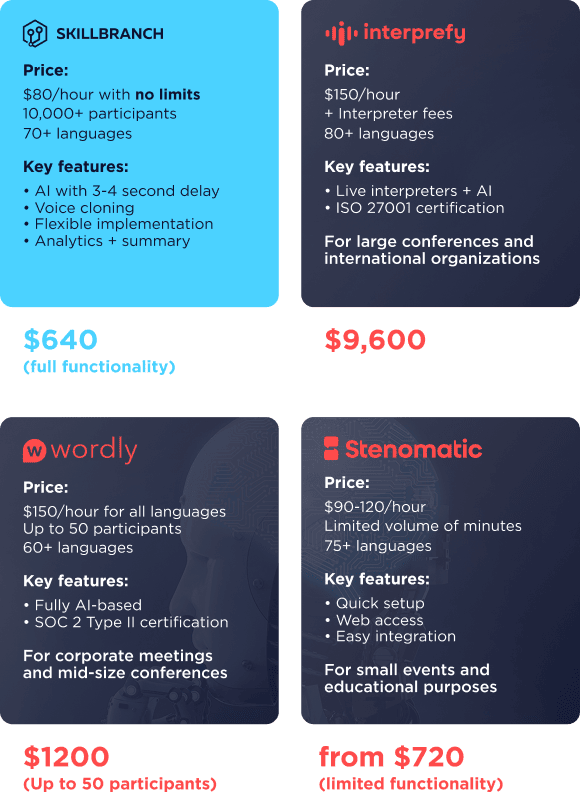

AI Translator VS Human Interpreters

Scenario: 1-day conference (8 hours) with 4 language translations

Market Analysis of AI Translators

Comparative analysis and our advantages over other AI solutions.

Product Ecosystem

Unit economics with 97% margin and and multiple revenue streams for rapid growth to $20M ARR.

.png)

.png)

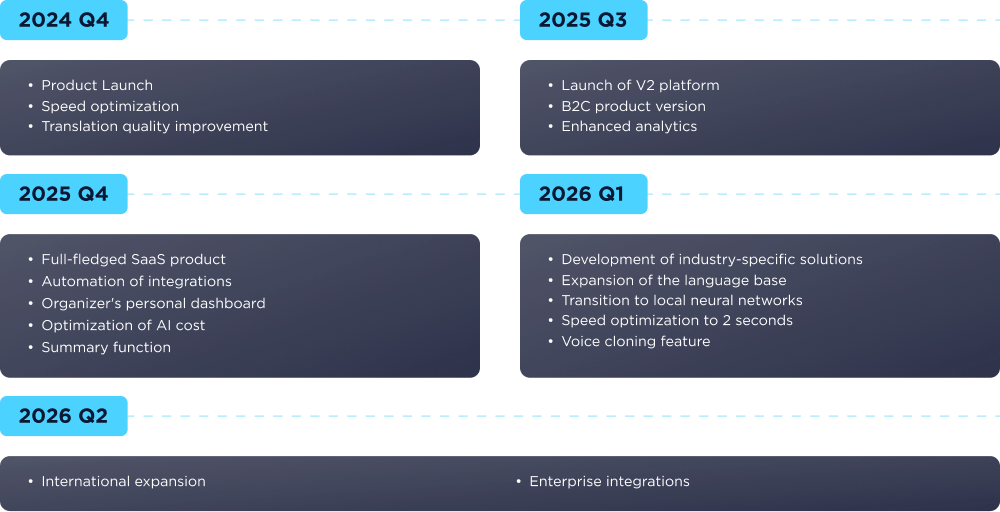

Roadmap

12.png)

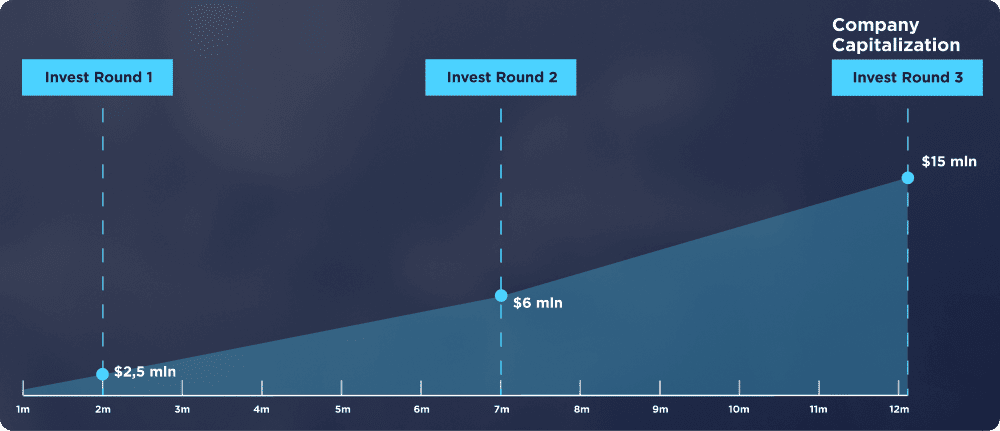

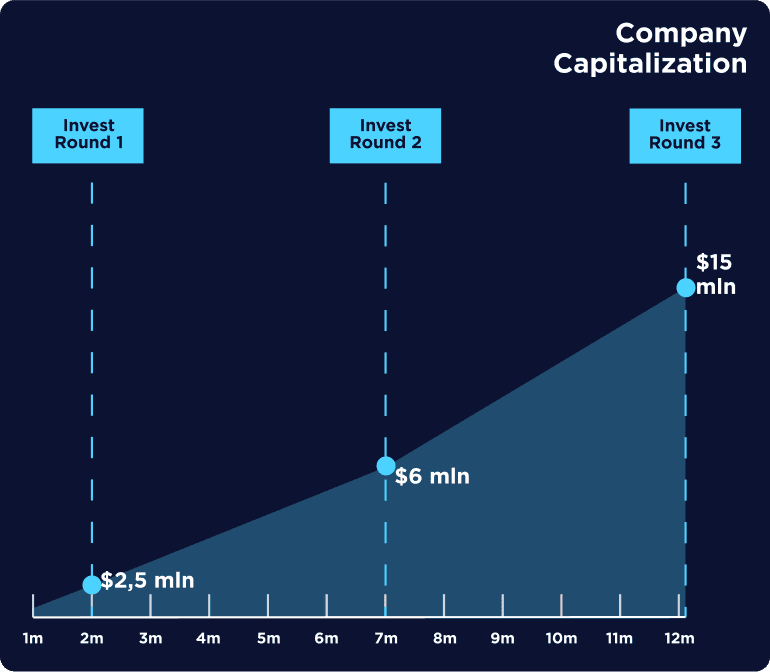

Our Plan for Capitalization Growth

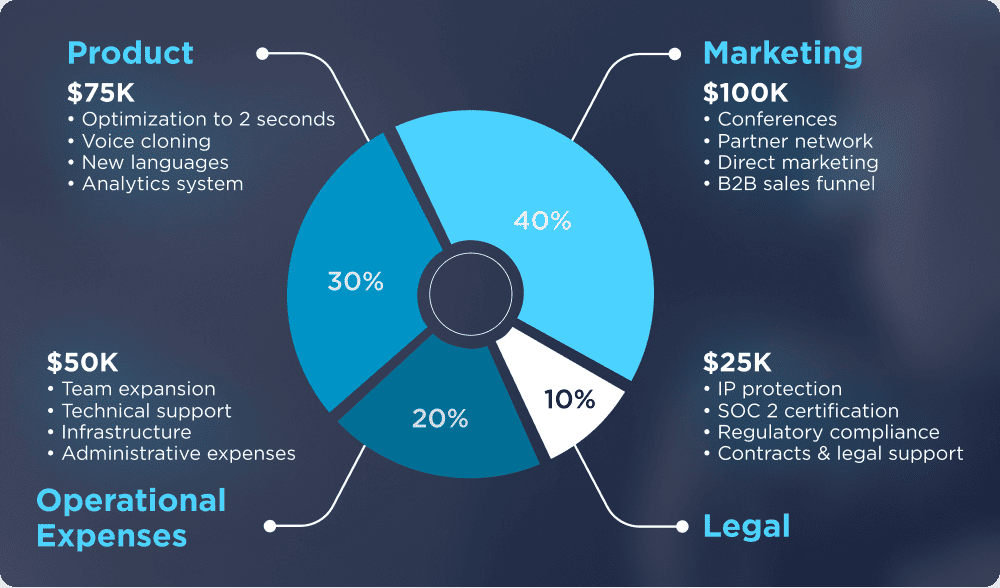

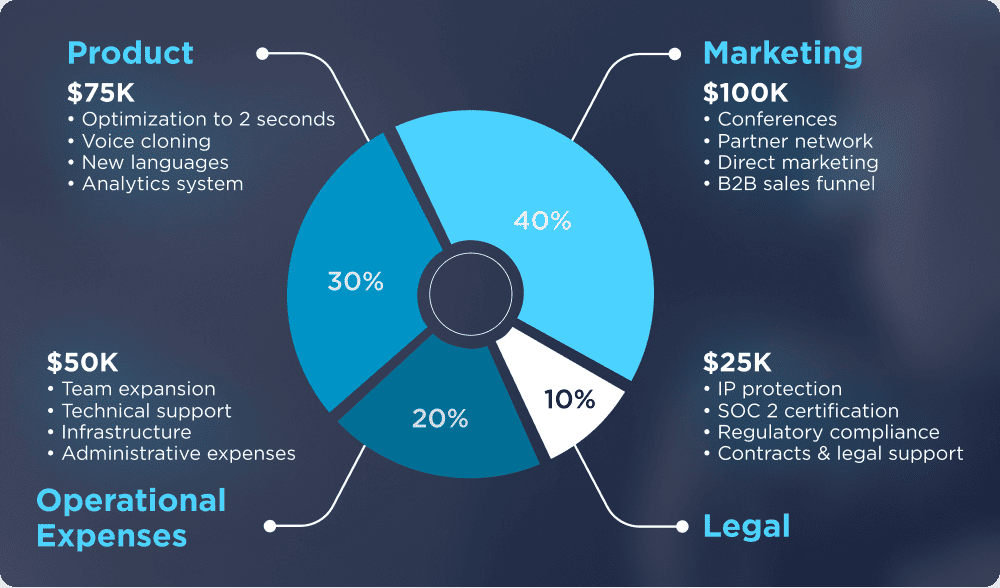

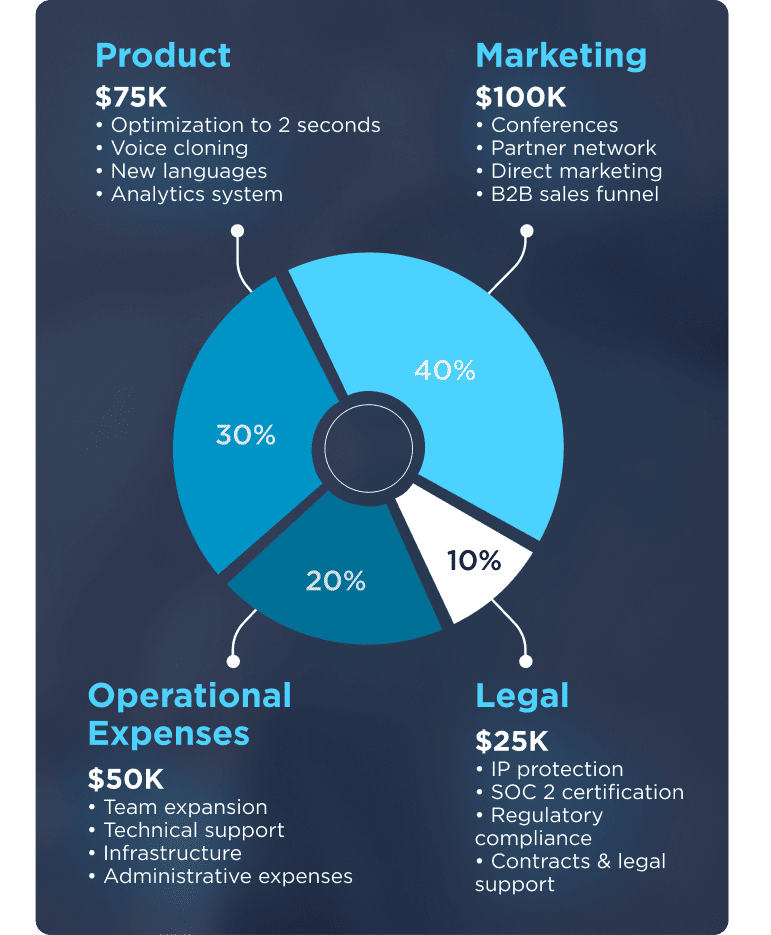

Investments

Pre-Seed Round to Capture the Rapidly Growing Market

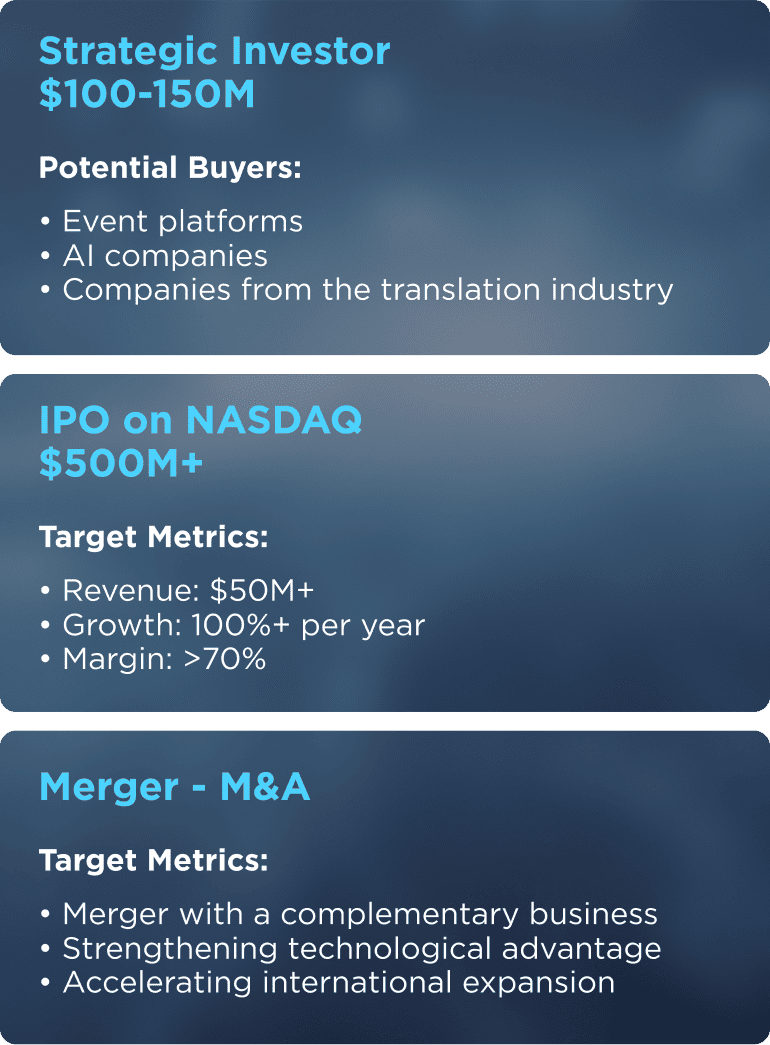

Exit Strategy for Investors

Three potential scenarios within a 3-5 year horizon

Time to Act

Important information for investors

Venture investments offer high growth potential but also carry an increased risk of partial or complete loss of capital. Startups may face market, operational, and technological risks that can affect their performance.

Before investing, assess your risk profile and carefully review the project materials. All investment decisions are made at your own discretion.

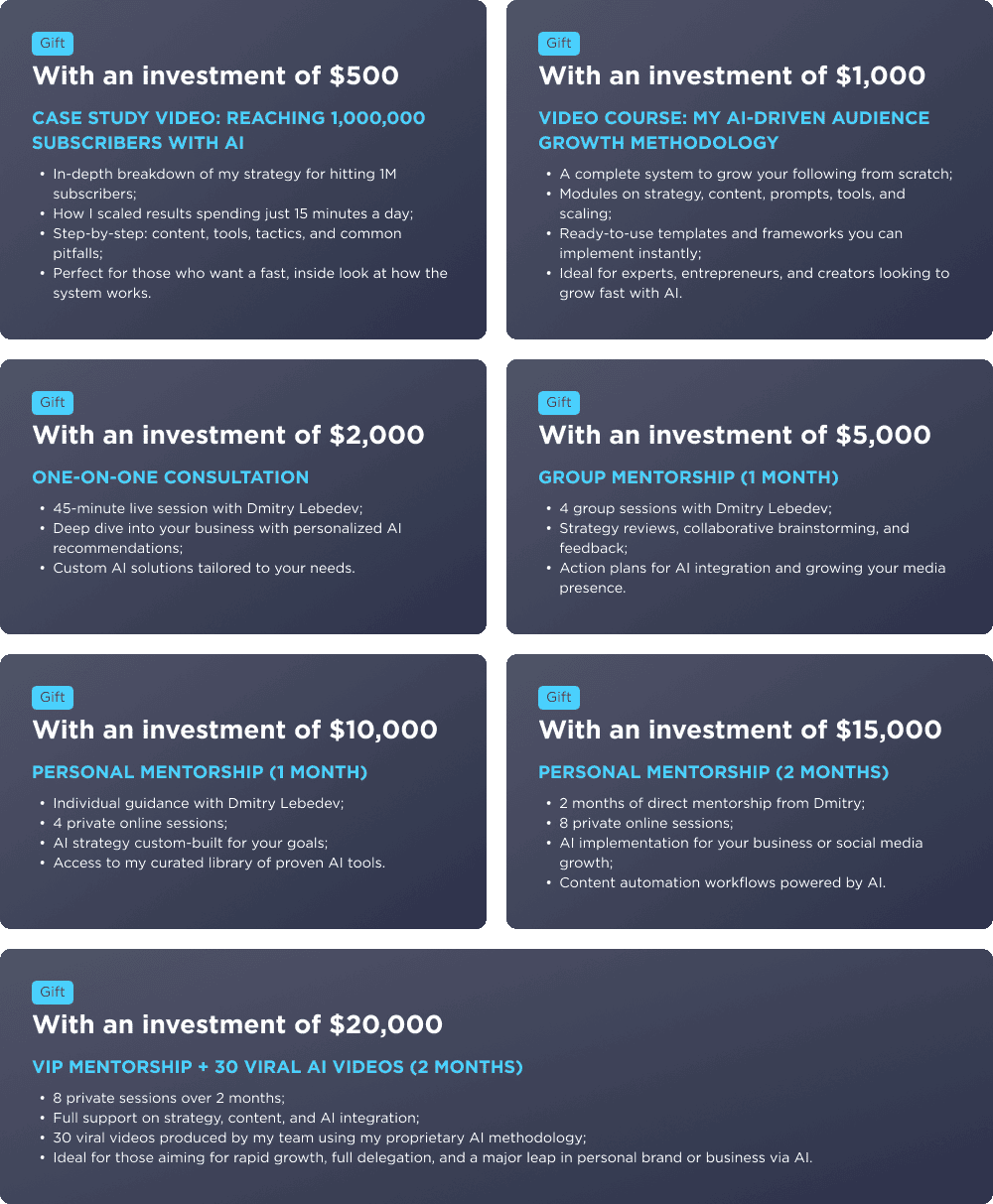

Bonuses Based on Investment Amount 🎁

Get consulting from Dmitry Lebed — founder of SkillBranch and author of one of the Top 3 AI-avatar blogs in the CIS (1,000,000+ followers).

.png)

.png)

Dmitry will share his proprietary methodology for creating viral content with AI, growing an audience, and running high-performing social media accounts.

He’ll also provide practical solutions for integrating AI into your business to automate processes and boost efficiency.

⚡️ This is your chance not just to invest — but to gain valuable insights and implement AI for maximum impact!

Frequently Asked Questions about SkillBranch AI (FAQ)

Investment & Strategic Questions

1. How will investors make money from this project? What are the return scenarios?

The project offers two core return models:

- Equity growth — As revenue, user base, and global reach expand, the company’s valuation is expected to grow significantly. This provides investors with an opportunity to profit from equity sales during strategic rounds.

- Dividend model — Our unit economics generate positive cash flow. We plan to start paying dividends once we reach operational profitability.

2. What is the investor’s exit strategy (strategic sale, M&A, IPO, buyback)?

We are currently exploring three realistic exit scenarios:

- Secondary sale to a strategic investor during major rounds (Series A/B) at $50M–$100M+ valuation

- M&A transaction with a major player (e.g., Zoom, Hopin, Microsoft, OpenAI, Speechmatics)

- IPO within 4–6 years with a target valuation of $500M+ following global scaling

We’re also open to buybacks of early investor shares once we reach sustainable profitability and strong financial performance.

3. When do you expect investor exits, and what is your valuation target by then?

Our target exit horizon is 2–3 years, contingent on reaching key revenue and scaling milestones. At that point, we project a valuation of $100M, creating a potential 40x return for early investors. Our goal is fast capitalization via aggressive growth and global pilots with large enterprise clients within the next 12 months.

4. What do investors receive in exchange for their investment? Equity, SAFE, convertible note, royalties?

We issue investments via a SAFE (Simple Agreement for Future Equity) — a widely accepted, flexible, and transparent instrument that converts into equity upon a priced round.

5. Will the company pay dividends? If so, when and under what conditions?

Yes, our long-term strategy includes a dividend component. Once operational profitability is achieved, we plan to initiate regular dividend distributions. Our objective is not only high-growth equity upside, but also sustainable financial performance that returns capital via dividends.

Product & Technology

6. How does your real-time translation technology work? Do you use proprietary models or third-party APIs?

We build on OpenAI’s Whisper — one of the most accurate and scalable speech-to-text models in the world. We integrate it via our own API orchestration layer, which coordinates multiple neural networks:

- Speech recognition (transcription)

- Text translation

- Text-to-speech and subtitles

This enables a modular platform where we can switch models or customize them for specific use cases — from conferences to corporate meetings.

7. How do you ensure real-time translation accuracy?

We use OpenAI Whisper, trained on millions of hours of multilingual content. It handles complex sentence structures, accents, slang, and technical language — even in noisy or unpredictable environments.

8. Is there latency? If so, how much?

Current delays:

- Subtitles: ~2.5–3 seconds

- Voice translation: ~4–5 seconds

We are testing optimizations to reduce latency to under 2 seconds, approaching the experience of live human interpretation. For most B2B clients and platforms, this level of delay is already acceptable given the multilingual coverage and quality.

9. How scalable is your system? Can it handle 1,000+ concurrent sessions?

Yes. Our infrastructure is built for horizontal scaling with dynamic load balancing in the cloud.

- At 300 active streams, server load is <20%

- As demand increases, the system auto-scales in real time by adding GPU instances

- Our API supports 1,000+ simultaneous streams with no degradation in quality

We are already stress-testing for large-scale events like global summits.

10. What is your current stage (MVP, alpha, beta, scaling)?

We are in commercial MVP stage:

- Product is already used by early clients

- First integrations completed

- Paying users confirm market fit

We are now expanding language coverage, optimizing algorithms, and preparing for scale and B2B partnerships. Our next milestone: MRR growth and entry into global enterprise markets.

Market & Competition

11. What is the size and growth rate of the global translation market?

According to industry reports, the global simultaneous interpreting market is expected to grow from $3.89 billion to $6.25 billion by 2033 with a CAGR of around 7%, while the AI-powered simultaneous interpreting segment shows record momentum, expanding at an average rate of 19.1% per year.

Growth drivers:

- Digitization of education and business communication

- Globalization of hybrid and online events

- Demand for multilingual content accessibility

12. Which market segments show the most potential?

Key verticals:

1. Events and conferences — Organizers seek multilingual broadcast capabilities

2. EdTech and universities — Especially for international course delivery

3. Corporate meetings — Global teams need real-time multilingual communication

4. Government and intergovernmental orgs — UN sessions, summits, diplomacy

13. What is your go-to-market strategy for international expansion

Our B2B strategy includes:

• Direct outreach to event organizers via LinkedIn, intros, and public databases

• Building case studies in priority regions (U.S., UAE, Germany)

• Speaking and exhibiting at niche events

• Publishing niche SEO and content in local languages

14. Who are your direct and indirect competitors?

Key players:

• Interprefy — hybrid translation for governments

• Wordly — automated translation for business events

• Stenomatic — AI-based live subtitles

⚡ Our edge: speed of integration, flexibility, and free access for end-users.

We also offer a comparison table with features, pricing, and customization. On most fronts, we outperform current solutions.

15. What if a major player (Google, Zoom, Microsoft) launches a similar product for free?

We focus on a specific B2B niche — events, where the organizer pays, not the end-user. This segment requires:

• Event-branded customization

• Format-specific localization (e.g., panels, festivals, hybrid summits)

• Reliability, support, white-label integration

Large platforms don’t offer that depth. We don’t compete on scale — we compete on specialization.

Also, we’re open to:

• White-label integration or partnerships

• Acquisition as part of their localization strategy (a viable investor exit path)

Product, Clients & Monetization

16. What languages do you support, and how fast can you add new ones?

We support 50+ languages — including English, Spanish, Chinese, Arabic, Hindi, Russian, Japanese, and more.

We regularly expand via:

• Whisper model updates

• Additional model integration

• Language tuning for industries like media, finance, healthcare

17. Who is your core target audience?

Our focus:

1. Event organizers — Conferences, summits, online events needing live multilingual translation

2. International corporations — For internal comms, training, and cross-border meetings

3. EdTech platforms — Especially those expanding globally

18. Do you have paying clients or pilots?

Yes. Early traction includes:

• Blockchain Life Dubai — 10,000+ attendees, 70 languages supported, excellent organizer feedback

• Ongoing negotiations with event agencies and corporate clients for integration into live streams and internal comms

This validates demand, product quality, and ability to scale.

19. What is your monetization model?

We use a multi-tier model:

1. Pay-as-you-go — Hour-based translation packages (~$80/hr)

2. Enterprise licensing — On-premises deployment (~$20,000/year)

3. White-label — Embedded or rebranded versions for partner platforms

4. Subscription (future) — For small teams, educators, or recurring users

Partners and clients

Investors

1 (1).jpg)

Team

Dmitry Lebed

Founder & CEO

“We believe technology should unite people — removing language barriers and unlocking new ways to connect.”

Details

Foundation date

October 2024Employees

5Company valuation

$2.5 millionAvailable allocation

$150,000Terms

Deal Fee

0%Carried Interest

20%Risk potential

High

Русский

Русский

.png)

.png)