Marketplace Regolith

Your investment opportunities

Auto Leasing

Car Leasing in UAE

Updated on 5 Feb 2026

Timur Abdrakhmanov

CEO Timauto Car Rental LLC

“Everyone should be able to own a car — not in five years, not just in dreams, but when they actually need it. We're here to make that possible.”

Updated on 5 Feb 2026

About

What We Invest In

We are raising investment into a lease-to-own used car business in the UAE.

.png)

The model targets middle and low-income customers in the UAE who need reliable transportation but face challenges accessing traditional financing options.

This model offers flexibility and affordability, with customers becoming car owners after 24 – 60 months of payments.

Investor Meetup: Auto Fund at Dubai Autodrome

Market opportunity: Filling the gap in car financing for middle and low-income individuals in the UAE market, who cannot obtain loans from banks.

Revenue model: Customers pay 20% per annum on the remaining cost of the car after a down payment of 10-50%, which will be determined based on the customer's inspection.

Average car cost: $45 000.

En.png)

En.png)

Industry Experience

Team has been operating in the UAE since 2022, under the TimAuto brand.

Long-term car rental was the first line of business established.

11.png)

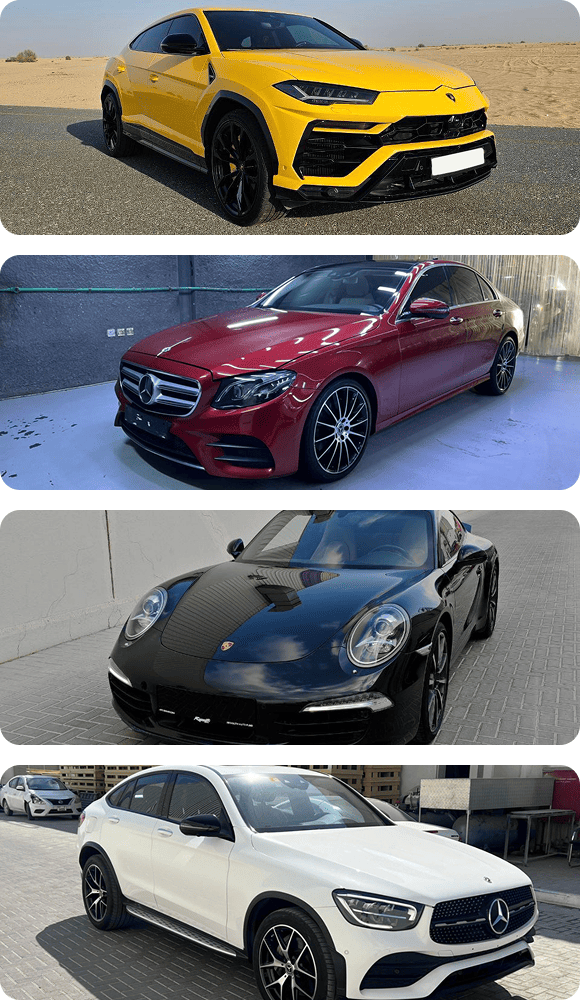

Challenges

When we began selling repaired cars in the UAE, we identified a promising market niche for further development.

- High market entry barriers for customers (strict banking requirements)

- Shortage of accessible auto financing programs for middle-class consumers

- Strong demand for reliable financial instruments for car purchases

Our solution

Establishing a proprietary leasing company offering flexible and affordable car ownership terms.

.png)

.png)

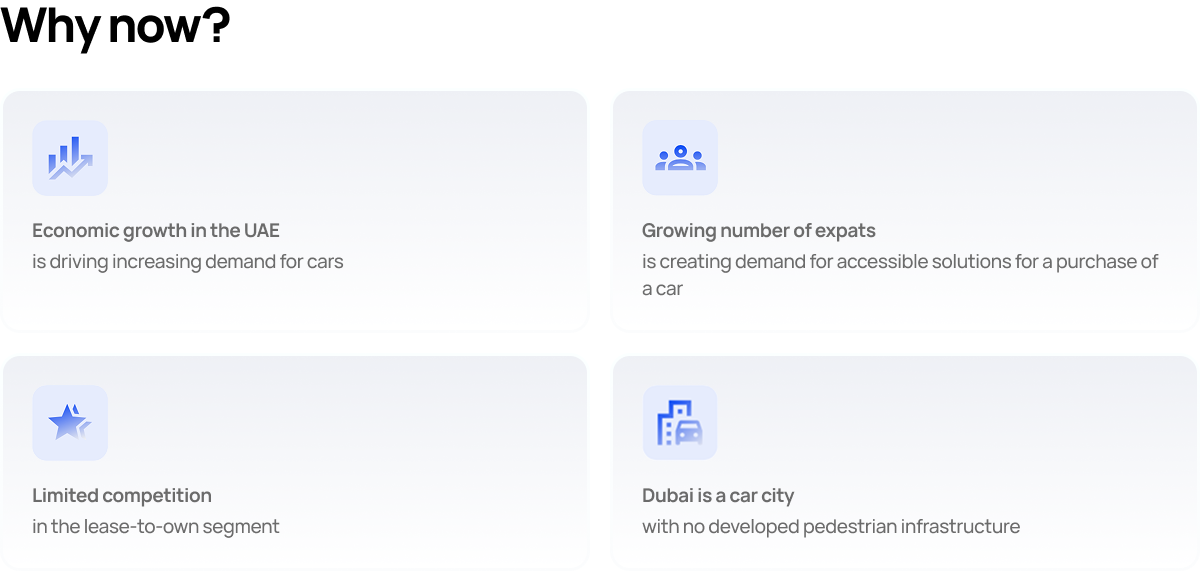

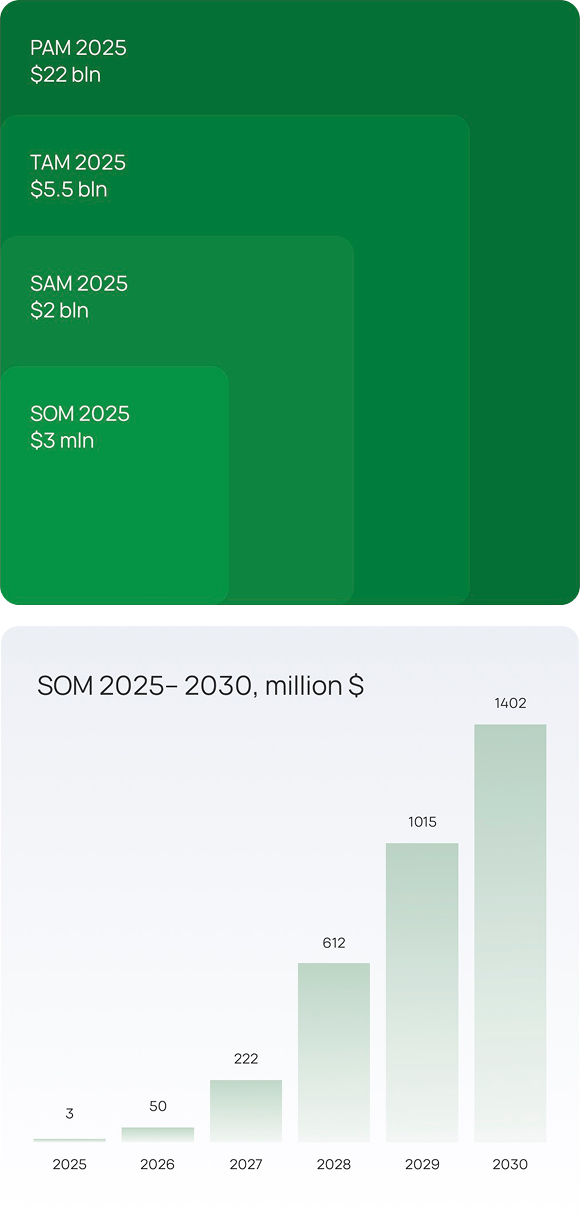

Market Size

The leasing market of cars for private usage in the MENA region reached $5 billion in 2024 and is projected to grow to $9.1 billion by 2030. The market CAGR is expected to be 10.5% from 2024 to 2030.

Taking the market CAGR into account, which equals to 10.5% from 2024 to 2030, as well as the growth rate of the market share of Regolith Leasing, the achievable market size (SOM) will be estimated at $1.4 billion.

Competitive Analysis

.png)

.png)

Business Model

In the "lease-to-own" model, the company's risk is minimized:

- Cars are registered under the company until fully paid by the customer

- The company reclaims the car one 30 days after a payment default

- All cars are equipped with GPS trackers with a car lock function

- All cars have full insurance coverage

11.png)

Required Investments

Investment amount: $10 000 000

Min. investment amount: $25 000

Minimum period: 2 years

Annual return: 12%

After two years, the investor can withdraw their initial investment within three months of submitting a request. There is also an option to reinvest dividends or increase capital as the company grows.

.png)

.png)

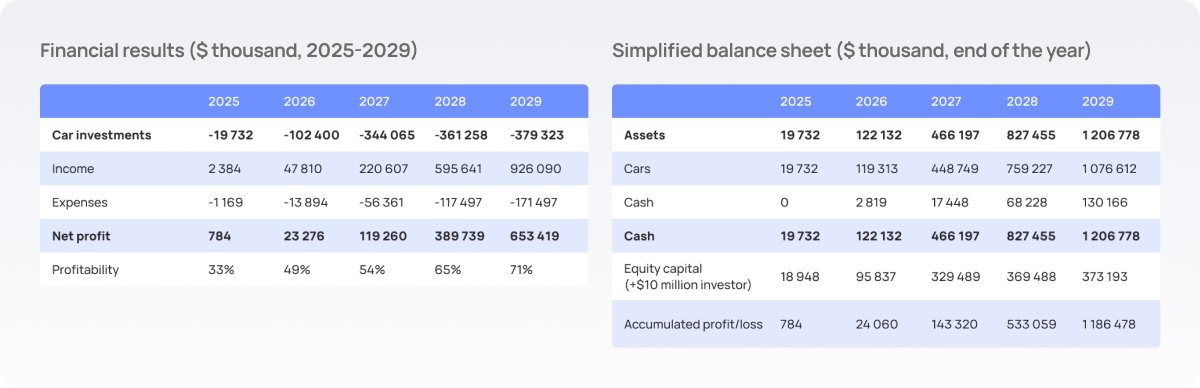

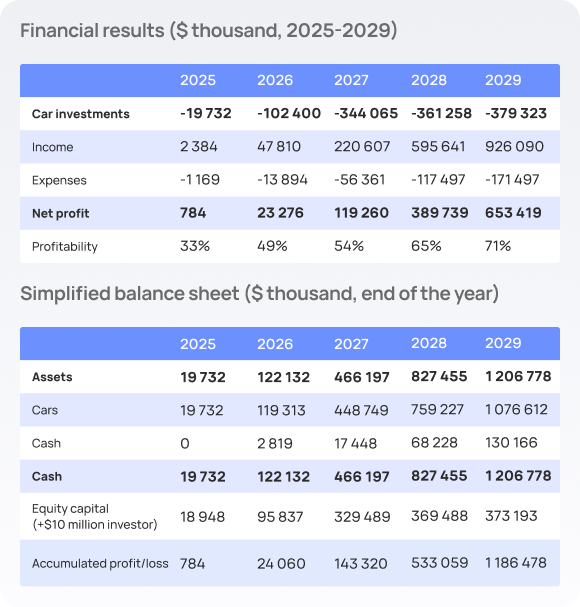

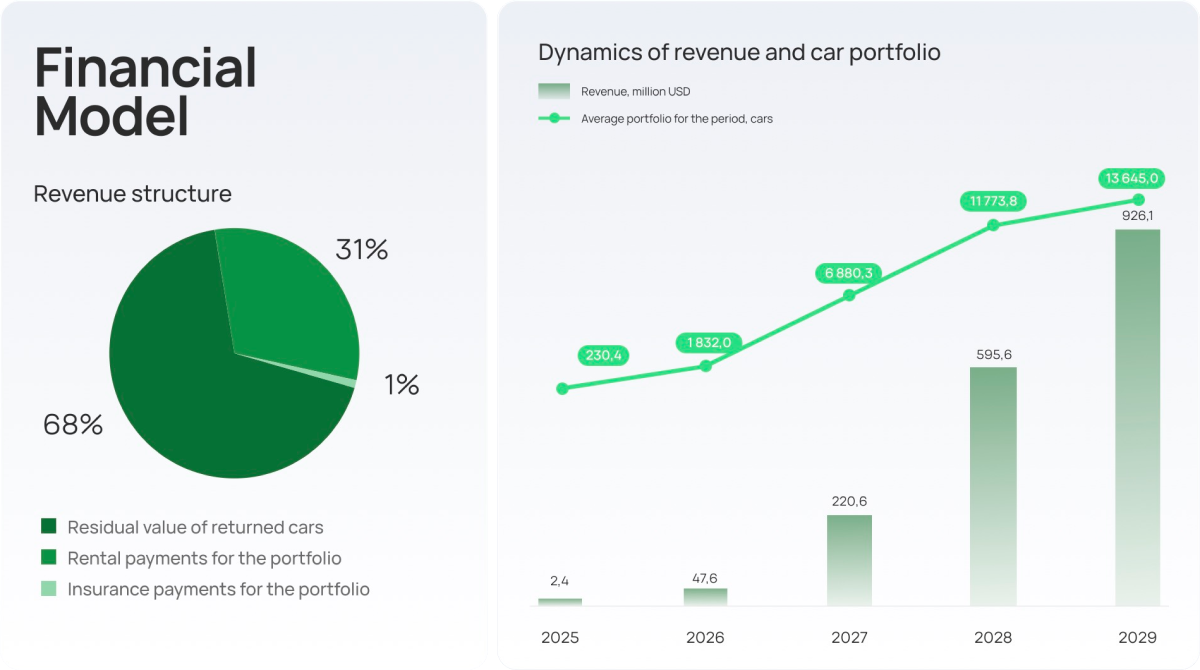

Financial Model

Fleet: 580 vehicles in 2025-2026, scaling to 11 150 by 2029

Average vehicle cost: $45 000

Theft and losses 1%

Funding: $10M investor capital in 2025

Investments = Assets: $19.7M (2025) – $379.3M (2029) are capitalized as cars on the balance sheet

Vehicles yield $81 000 (100% margin vs $40 500 net cost)

Total assets $1 206M by 2029

11.png)

About Us

We are a team of professionals with over 5 years of experience in the car market in Dubai. Our mission is to make buying or selling a car as simple and profitable as possible for you. We offer a full range of services: from selection and registration to credit and leasing. Trust us, and you’ ll get the car of your dreams without any hassle.

FAQ

What return can I expect if I invest in the Auto Leasing Fund?

The fund offers a fixed annual return of 12% in USD. Payouts are made quarterly to your account in the Regolith app.

What is the minimum investment term?

The minimum term is 2 years. After that, you can request a return of your principal or choose to reinvest.

Can I invest for a longer term — 3 or 5 years?

The base term is 2 years. At the end of the period, you can:

• withdraw your principal

• reinvest for the next cycle

• increase your allocation (if new slots are available)

Can I exit earlier?

The fund is structured as a fixed-term investment. After 2 years, you may submit a request to withdraw your capital — funds are returned within 3 months. Early exit is not available.

What happens if a client stops paying?

In case of default:

• The vehicle is repossessed

• It’s resold through our existing channels

• The proceeds return to the fund — your return remains unaffected

Why is this model considered reliable?

• All vehicles are insured and registered to the company

• Each car is tracked via our internal CRM system

• The model has proven its effectiveness through the existing AutoFund

How does the fund generate income?

Clients lease cars with the option to buy. They pay an upfront deposit and then monthly installments at 20% annualized. These payments form the fund’s revenue.

What are the risks for investors?

Risk is minimized through operational control:

• Cars remain under the company’s ownership until fully paid

• In case of default, the car is repossessed within 30 days

• All vehicles have GPS trackers with remote lock and comprehensive insurance

Where are the cars located?

All vehicles are based in Dubai, UAE. We’ve been operating in this region for over three years, with full licensing and established resale channels.

Who manages the fund and the project?

The fund is managed by Regolith’s team, the creators of AutoFund. We've been running automotive projects in Dubai since 2022 with a dedicated local team, technical support, and a logistics department in the UAE.

Team

Timur Abdrakhmanov

CEO Timauto Car Rental LLC

“Everyone should be able to own a car — not in five years, not just in dreams, but when they actually need it. We're here to make that possible.”

Dividends

Fixed Monthly DY

1%Fixed Dividend Yield

12%Terms

Deal Fee

0%Carried Interest

0%Minimum investment period

2 yearsDividends

Once a monthRisk potential

Low

Русский

Русский