Marketplace Regolith

Your investment opportunities

Real Estate Rental Fund

Profitable property in Dubai

Updated on 3 Mar 2026

Vadim Markov

CEO & Co-Founder

“We turn real estate into a reliable income stream.”

Updated on 3 Mar 2026

About

Real Estate Rental Fund Review

ZOOM 02.11.2023

About Basera

The company's specialisation is the leasing and efficient management of residential and commercial economy class properties in Dubai.

The company offers investors the opportunity to receive a stable income in currency from rental payments in the form of quarterly dividends.

They provide investors with the opportunity to receive a stable income in foreign currency from rental payments, thanks to our expertise and high profitability of our portfolio of properties. A team of professionals guarantees maximum management efficiency and maximisation of investment opportunities.

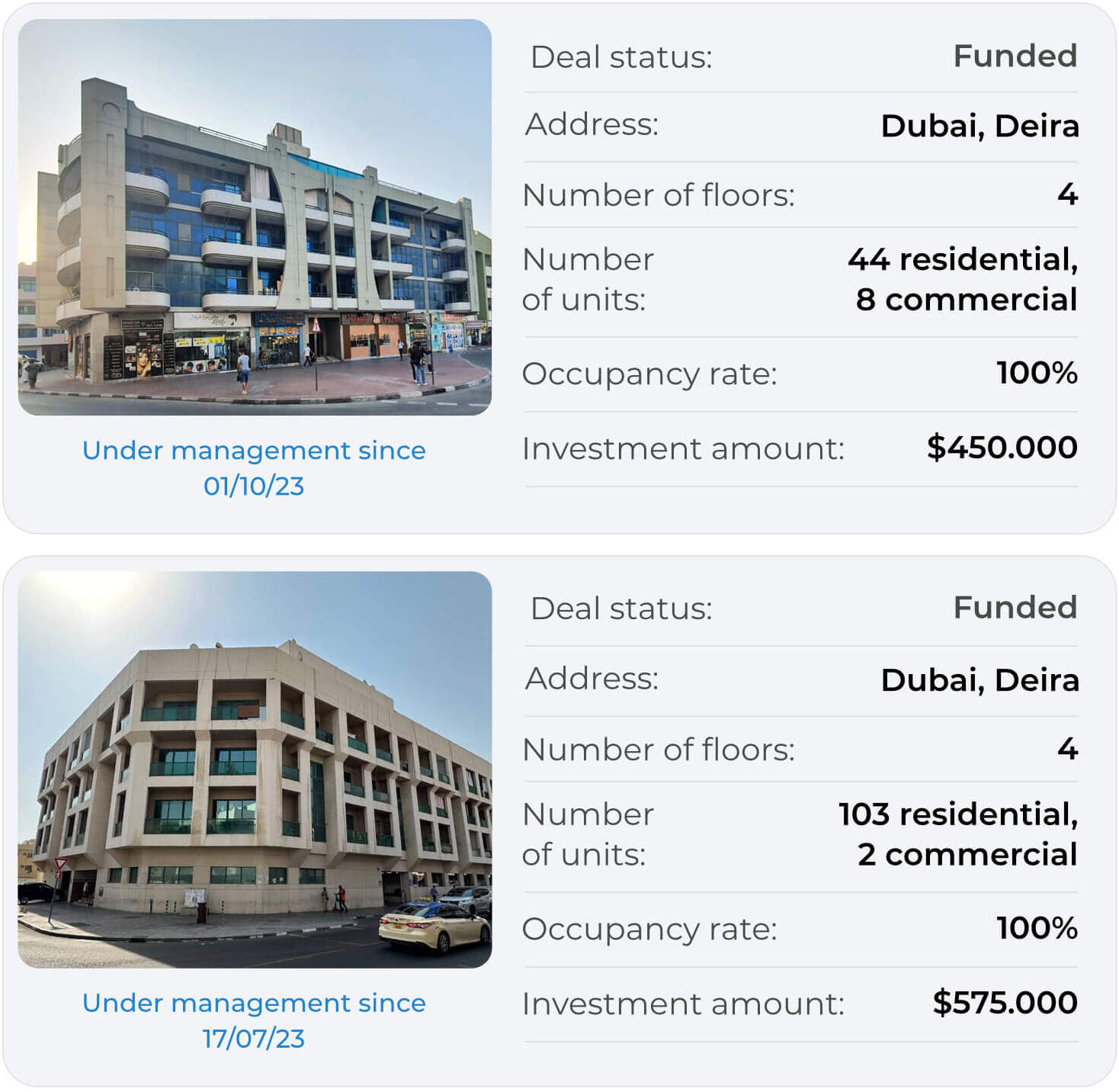

Operating Buildings Under Our Management

Business Model

.png)

The UAE law ensures protection for all involved parties.

The company rents the entire premises for a long period, receiving a cheap rental price, puts the facility in order and re-rents the apartments separately for a higher monthly price. The occupancy rate of such buildings is almost 100%.

Thanks to experience and some clever tactics, such as paying the first payment from investments, and the second payment with incoming rental payments, the return on the invested funds is several times higher than the market.

Current Situation. Spring 2024

- 7 properties for rent

- $610K revenue

- $138K net profit

- $6.76M net assets

- $3.26M invested by founders

- 25% return on invested capital

- 670+ units under management

- 15+ employees

- 100% occupancy

Why Does it Work?

(1).jpg)

- State protection. The real estate market is registered - for example, the tenant pays a fine if they depart early, and the landlord can evict the tenant only by notifying them 12 months in advance.

- Payment guarantee. The tenant prepays at least a month in advance and leaves a deposit that will cover 1 month of rent if they depart without notice.

- High demand. Most buildings are fully occupied at the time we rent them. We only need to maintain the premises, collect rent and renew contracts.

- Low chance of downtime. As per the contract, the tenant is required to give notice of termination of the contract 2–3 months in advance. This minimises downtime and allows you to find new tenants by the former tenant leaves the property.

- No expenses for major repairs. In the vast majority of cases, major repairs (elevators, structural repairs, ventilation and other communications) are not covered by us, but by the building owner.

- The market is not oversaturated. The market for management companies is difficult to enter. This market is mainly occupied by expats from India and Pakistan. For others, there is a high barrier to entry into this market, which leads to less competition.

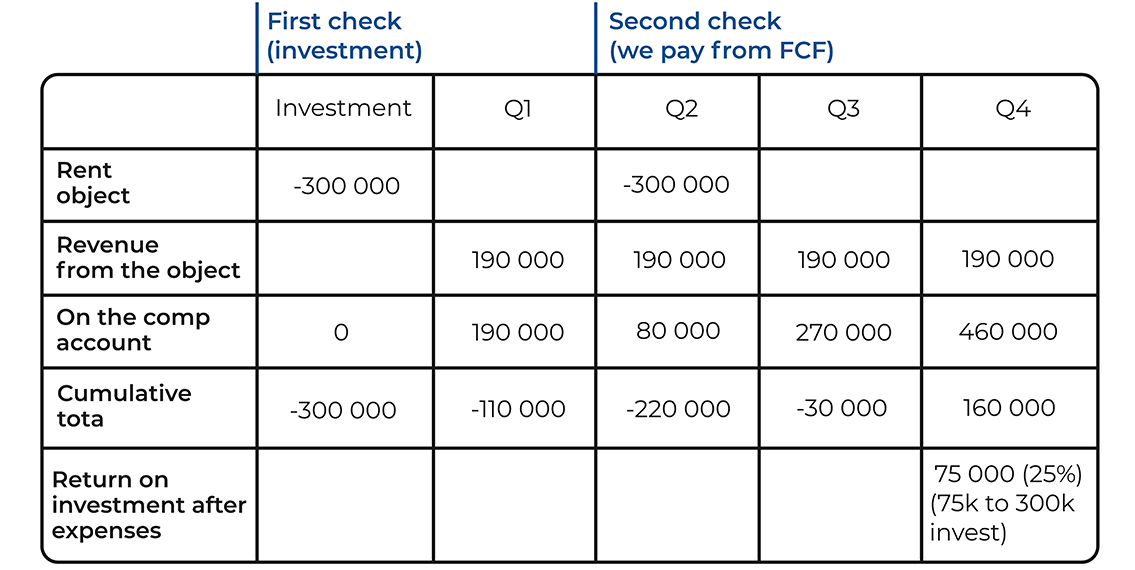

Example of Unit Economics of One Building

All amounts in the table are in US$.

In this example, the investor, having invested $300k, ultimately receives a profit of 75k, which is 25% on the invested funds.

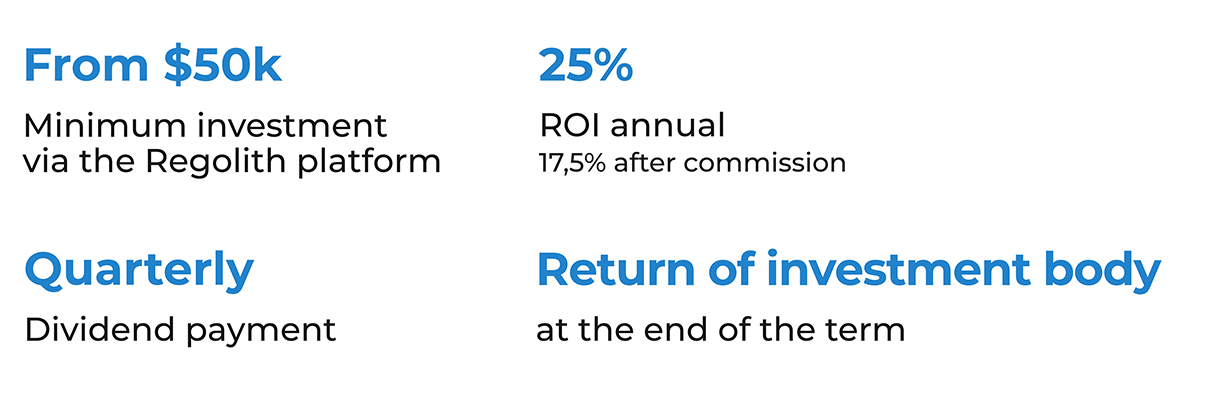

Current Investment Opportunities

- $2.466.000 - total investment required in 3 buildings

- Annual return rate: 25%

- Dividend payout frequency: Once per quarter

- Minimum investment duration: 1 year

Hurry up before all the investment spots are sold out! 🚀

Area of Responsibility

- Registration of all necessary contracts with the Dubai Land Department (DLD);

- Collection of rent payments from tenants;

- Renewal of contracts with current tenants;

- Search for new tenants;

- Minor repairs;

- Cleaning of common areas;

- Provision of water, electricity, and air conditioning in common areas;

- Management of other issues related to building maintenance.

Market Projections from 2023→2040

- 3 million migrants → 7 million migrants

- $10 billion economic rental market → $25 billion economic rental market

- 14,000 targeted buildings → 25,000 targeted buildings

Investment for 12 months, With the Possibility of Extension

Features of Investments

- Regolith platform commission is 30% of the profit received. 17.5% after commission

- The decision to extend or return the body of the debt 3 months before the end of the term.

FAQ

How Does the Fund Work?

The fund leases budget residential buildings in Dubai for 12 to 36 months, renovates them, and subleases individual rooms at higher rates. Thanks to high occupancy (up to 100%) and upfront payments from tenants, the fund generates stable cash flow and pays monthly dividends to investors.

Why Focus on Staff Accommodation?

The affordable housing segment in Dubai is growing steadily, driven by an influx of migrant workers. Most tenants are companies providing housing for their employees. This demand, combined with legal protections for landlords, ensures predictable and stable returns.

What Returns Do Investors Receive?

The fund offers a fixed annual dividend yield of 25%, with payouts made monthly. After Regolith’s performance fee (30% of profits), investors receive a net yield of 17.5% per annum.

How Are Investor Interests Protected?

All lease agreements are registered with the Dubai Land Department (DLD). Tenants pay security deposits and are required to give 2–3 months’ notice before vacating, which minimizes vacancy risk. The fund is not responsible for capital expenditures — these are covered by the building owners.

Who Manages the Properties?

Operations are handled by a licensed property management company in the UAE, staffed by a team of over 15 professionals experienced in residential rentals. They oversee tenant acquisition, rent collection, maintenance, repairs, and cleaning — ensuring high occupancy rates and consistent income for investors.

What Are the Fund’s Expenses?

The fund only covers operational costs such as cleaning, utilities, and minor repairs. Capital expenditures (e.g. elevators, HVAC systems) are the responsibility of the building owners, significantly improving the fund’s net profitability.

Where Are the Buildings Located?

The properties are located in high-demand worker housing areas such as Al Quoz and Dubai Investments Park (DIP). Investors may schedule a visit to inspect the properties in person.

What Are the Investment Terms?

Minimum investment: $50,000

Term: 12 months

Investors may choose to renew or exit the investment three months prior to maturity.

How Promising Is This Market?

Dubai’s affordable housing market is projected to grow from $10 billion in 2023 to $25 billion by 2040. The migrant population is expected to rise from 3 to 7 million. This demographic trend supports the fund’s long-term strategy and reduces exposure to market volatility.

How Does This Compare to Buying an Apartment?

By investing in entire buildings, the fund secures wholesale pricing, accelerates return on investment, and minimizes vacancy risk — unlike individual apartments, which are more prone to downtime and tenant turnover.

Vadim Markov

CEO & Co-Founder

“We turn real estate into a reliable income stream.”

Dividends

Average monthly DY

1.42%Fixed Dividend Yield

17%Terms

Deal Fee

0%Exit fee

0%Carried interest

30%Carried interest on $1M+ vol.

25%Carried interest on $5M+ vol.

20%Management fee

0%Minimum investment period

2 yearsDividends

Every monthRisk potential

LowDetails

Formation date

May 2022Asset valuation

$6 761 191Number of houses

7

Русский

Русский