Marketplace Regolith

Your investment opportunities

GLTR ETF

Physical Precious Metals Basket

Updated on 19 Feb 2026

Aberdeen Standard Investments

Sponsor of the Trust

“You invest in physical gold, silver, platinum, and palladium. These assets are often used as a hedge against inflation and the devaluation of fiat currencies: metals cannot be ‘printed,’ and their supply is limited.”

Updated on 19 Feb 2026

About

GLTR (abrdn Physical Precious Metals Basket Shares ETF) is an exchange-traded fund that provides exposure to physical precious metals through a single investment. The fund’s objective is to reflect the price performance of gold, silver, platinum, and palladium in the proportions held by the trust, net of expenses.

GLTR (as a fund/trust) was originally launched under the sponsorship of ETF Securities USA LLC (part of the ETF Securities group). Subsequently, the sponsor was renamed/changed to Aberdeen Standard Investments ETFs Sponsor LLC (currently operating under the abrdn brand).

The fund was designed for investors who view precious metals as a distinct asset class and prefer to gain exposure through a regulated, exchange-traded, and transparent structure, without the need to directly purchase, store, insure, or manage the logistics of physical metals.

GLTR is listed on the NYSE and is available to investors as a standard ETF instrument.

What are you actually investing in?

By investing in GLTR, you are investing in physical precious metals held by the trust. The fund owns metals in the form of allocated bullion bars and allocated metal positions, rather than shares of mining companies or derivative instruments.

The return profile of GLTR is driven by changes in market prices of gold, silver, platinum, and palladium. The investment is not linked to corporate operations, profitability, or management decisions, but instead reflects the price dynamics of precious metals as an asset class.

According to the fund’s disclosures, a daily bar list is published, enhancing transparency. In addition, an independent inspector conducts semi-annual audits of the vaults, confirming the physical existence of the metals held by the trust.

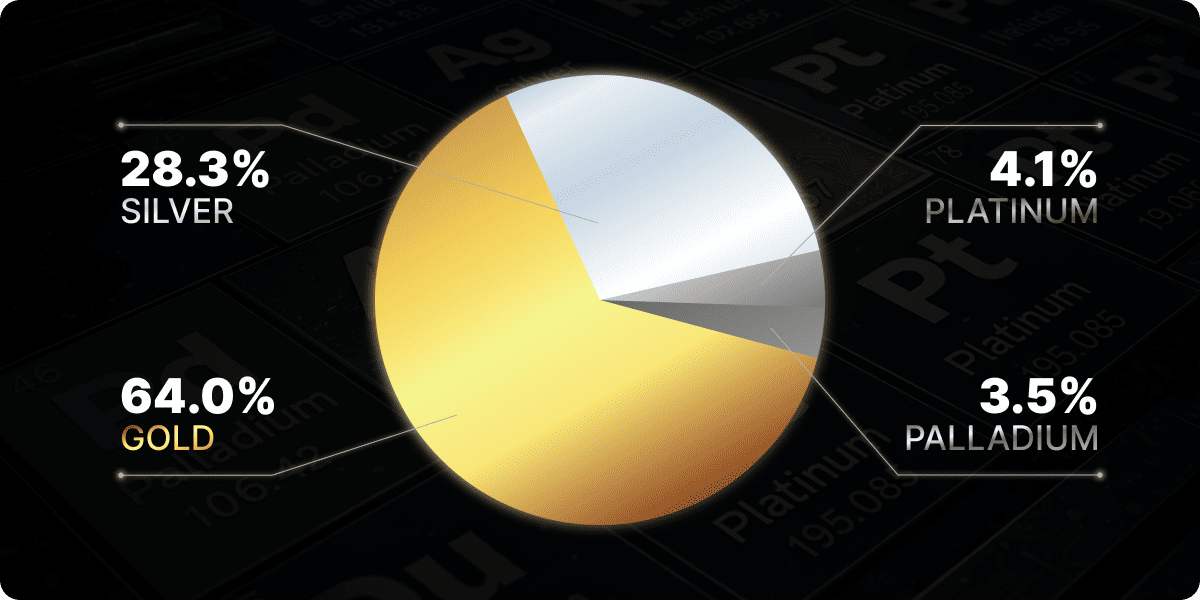

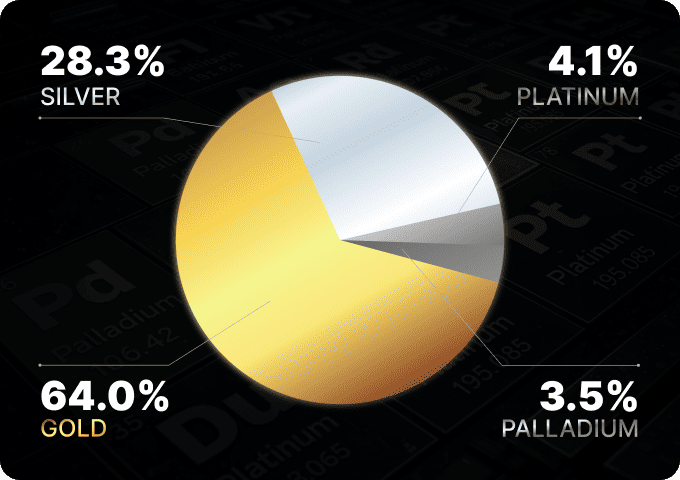

Basket composition

While the weights of individual metals may change over time, the core concept of GLTR remains unchanged: a four-metal precious metals basket. This structure allows investors to avoid concentration in a single metal and instead obtain more balanced exposure within the precious metals segment.

According to the fact sheet as of 30 September 2025, the weightings were as follows:

• Gold – 64.0%

• Silver – 28.3%

• Platinum – 4.1%

• Palladium – 3.5%

Gold traditionally represents the largest allocation due to its liquidity and role as a widely recognized store of value. Silver, platinum, and palladium add industrial and technological demand drivers, broadening the sources of demand within the basket.

Storage arrangements

The fund’s metals are stored in professional, high-security vaults used by institutional market participants. The primary storage location is London, one of the world’s key hubs for precious metals trading and custody.

For platinum and palladium, the trust documentation also allows for storage in London or Zurich through approved sub-custodians. This custody framework aligns with institutional market standards and is designed to ensure security, oversight, and transparency of ownership.

Fees and distributions

GLTR operates under a simple and transparent expense structure:

• Total Expense Ratio (TER): 0.60% per year, covering fund management, metal storage, and administration costs

• Dividends: generally not paid; investor returns are driven by price appreciation or depreciation of the underlying metals

When purchasing GLTR through the Regolith platform, an entry fee of 2% of the transaction amount applies.

Why GLTR is included in a portfolio

GLTR is typically used as a strategic asset allocation tool and may contribute to improving portfolio resilience during different market cycles.

The fund can serve several portfolio objectives:

• Diversification within real assets: exposure to four precious metals in a single instrument, reducing reliance on the performance of any single metal

• Inflation and currency risk hedging: precious metals have historically exhibited different behavior compared to equities and bonds, although such relationships are neither stable nor guaranteed

• Reduction of corporate risk: the fund structure is not dependent on management quality, balance sheets, or operational risks of mining companies; however, market and custody risks remain

• Portfolio balancing during periods of uncertainty: GLTR can complement traditional financial assets due to its distinct sensitivity profile

Risks

Investments in GLTR are subject to a number of market and regulatory risks that should be considered as part of portfolio construction:

• Price volatility: precious metals prices may fluctuate significantly due to macroeconomic conditions, shifts in supply and demand, and monetary policy expectations

• U.S. tax considerations: for U.S. investors, the fund is structured as a grantor trust, and gains on physically backed precious metals may be taxed under the collectibles regime — up to 28% on long-term capital gains for individuals

• Non-U.S. investors: taxation is governed by the rules and rates applicable in the investor’s jurisdiction

Key instrument details

• Ticker: GLTR

• Structure: Physically backed precious metals ETF / Trust

• Exchange: NYSE

• Expense ratio: 0.60% per annum

GLTR does not provide regular dividend distributions. Investor returns are generated through changes in the market value of the instrument, reflecting price movements of the metals held in the basket.

Subscription and Redemption Mechanics

Purchases of GLTR are processed on an ongoing basis, without a fixed subscription date. Transactions are typically executed 1–3 times per week, depending on operational schedules and market conditions.

• Minimum investment period: 1 week

• Minimum transaction size: $50

• Entry fee: 2%

• Performance fee: 0%

Redemptions are carried out in accordance with standard procedures after the minimum investment period has elapsed.

Frequently Asked Questions about GLTR ETF (FAQ)

1. What is GLTR?

GLTR is an exchange-traded fund (ETF) that allows investors to gain exposure to precious metals through a single purchase. The fund reflects the price movements of gold, silver, platinum, and palladium by combining them into one instrument.

2. Who manages the fund?

The fund is issued under the abrdn brand, a large international investment company that manages investment products globally.

3. What exactly am I investing in when I buy GLTR?

By purchasing GLTR, you are investing not in companies or derivatives, but in physical precious metals. The fund’s price moves in line with the global market prices of these metals.

4. Are the metals actually physical?

Yes. The fund owns physical bullion of precious metals. These bars are stored in professional vaults, their bar lists are published regularly, and the storage facilities are subject to independent inspections.

5. Which metals are included in the fund?

The fund includes four metals: gold, silver, platinum, and palladium. Their weights may change slightly over time, but the composition always remains limited to these four metals.

6. What was the fund composition in the latest reporting period?

According to the report dated September 30, 2025, the metal weights were as follows:

Gold — 64.0%

Silver — 28.3%

Platinum — 4.1%

Palladium — 3.5%

7. Where are the fund’s metals stored?

Most of the metals are stored in secure vaults in London. For platinum and palladium, storage in London or Switzerland is also предусмотрено through specialized custodians.

8. Does the fund pay dividends?

No. GLTR does not pay dividends. Investor returns are generated through changes in the fund’s price, which reflects movements in precious metal prices.

9. What fees apply to the fund?

When purchasing GLTR through the Regolith platform, a 2% entry fee is charged on the investment amount. There is no profit-based fee, which is 0%.

10. Why do investors add GLTR to their portfolios?

GLTR is commonly used to diversify portfolios and reduce dependence on equities, bonds, and currencies. Precious metals often behave differently from traditional financial markets.

11. Why are precious metals becoming relevant again?

Investors are increasingly seeking “hard” assets that are less dependent on money printing and political decisions. In addition, silver, platinum, and palladium are widely used in industry and technology, which supports long-term demand.

12. What risks are associated with investing in GLTR?

Precious metal prices can be volatile. The value of the fund may rise or fall, particularly over shorter time horizons.

13. Are there any tax considerations?

Some countries apply specific tax rules to funds that invest in physical metals. Tax treatment depends on the investor’s country of tax residence.

14. Where is GLTR traded?

GLTR is traded on the NYSE.

15. How does the GLTR purchase process work?

Purchases of GLTR through the Regolith platform are carried out on an ongoing basis and are not tied to a fixed date. Trades are executed 1–3 times per week, depending on market conditions and the platform’s operational schedule.

After submitting a request, funds are reserved and the purchase is completed during the next available trading window. Investors gain exposure at the actual execution price.

16. What is the minimum investment period?

The minimum investment period is one week. After this period, the investor may continue holding the position or exit the instrument without additional platform fees.

17. What is the minimum investment amount?

The minimum transaction amount when purchasing GLTR through Regolith is $50.

Aberdeen Standard Investments

Sponsor of the Trust

“You invest in physical gold, silver, platinum, and palladium. These assets are often used as a hedge against inflation and the devaluation of fiat currencies: metals cannot be ‘printed,’ and their supply is limited.”

Performance

Return for 2020

+29.52%Return for 2021

−9.60%Return for 2022

−0.25%Return for 2023

+2.01%Return for 2024

+20.63%Return for 2025

+87.25%Terms

Deal Fee

2%Carried Interest

0%Minimum investment period

1 weekRisk potential

Low

GLTR ETF

Physical Precious Metals Basket

Updated on 19 Feb 2026

Aberdeen Standard Investments

Sponsor of the Trust

“You invest in physical gold, silver, platinum, and palladium. These assets are often used as a hedge against inflation and the devaluation of fiat currencies: metals cannot be ‘printed,’ and their supply is limited.”

Русский

Русский