Marketplace Regolith

Your investment opportunities

SPY ETF

500 Largest Public Companies Index

Updated on 2 Mar 2026

State Street Global Advisors

Sponsor of the Trust

“Access to the 500 largest publicly traded companies in the S&P 500 — a core building block for a diversified portfolio.”

Updated on 2 Mar 2026

About

SPY (SPDR S&P 500 ETF Trust) is an exchange-traded fund that provides access to the 500 largest publicly traded companies included in the S&P 500 Index through a single investment.

The fund’s objective is to track the performance of the S&P 500 Index, which is considered one of the key benchmarks of the U.S. equity market.

SPY was launched in 1993 and is one of the oldest and most liquid ETFs in the world.

Sponsor of the Trust: State Street Global Advisors – one of the world’s largest asset managers. The fund was created as a core instrument for investors who view the U.S. equity market as a standalone asset class and prefer to access it in an exchange-traded, transparent, and regulated format, without the need to independently build a portfolio of hundreds of individual stocks.

The fund is traded on NYSE Arca and is available to investors as a standard ETF instrument.

What are you actually investing in?

By investing in SPY, you invest in shares of the largest publicly traded companies included in the S&P 500 Index. The fund does not select individual stocks and is not actively managed – it replicates the structure of the index, following its composition and weightings.

SPY’s return is formed through:

- the increase or decrease in the market value of the index constituents’ shares;

- dividends paid by the companies (reinvested within the fund and reflected in the price).

The investment is directly linked to the business performance of the largest corporations, rather than to individual sectors or speculative ideas.

Index composition

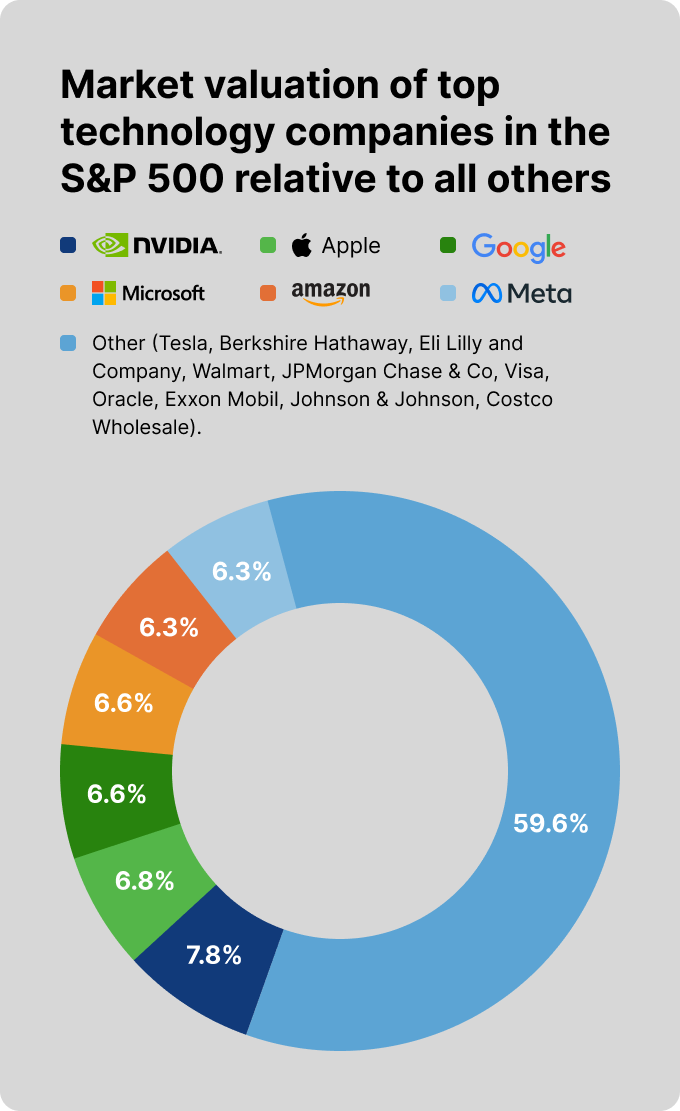

The S&P 500 Index covers a broad range of the economy and includes companies from key industries:

- Technology — Apple, Microsoft, Nvidia, Alphabet

- Financial sector — JPMorgan Chase, Bank of America, Goldman Sachs

- Consumer goods and services — Amazon, Walmart, The Coca-Cola Company

- Healthcare and industrials — Johnson & Johnson, Pfizer, Boeing

- Communications and energy — Meta (Facebook), Verizon, Exxon Mobil

.png)

Company weights in the index are determined by market capitalization, which results in a larger allocation to the biggest and most influential businesses. This approach provides broad diversification and reduces dependence on the performance of individual companies.

How the structure works

SPY uses a classic ETF structure:

- shares of the underlying companies are accounted for and held within the fund’s custodial infrastructure through licensed custodians;

- the fund’s structure is fully transparent and disclosed on a regular basis;

- the fund operates under the supervision of U.S. regulators and auditors.

SPY is one of the most liquid ETFs in the world, allowing investors to buy and sell the fund at prices close to market value, without significant losses due to bid-ask spreads.

Fees and distributions

The fund operates under a simple expense model:

- Total Expense Ratio (TER): approximately 0.09% per year — one of the lowest among ETFs;

- Dividends: paid by the index constituents and reflected in the fund’s return.

When purchasing SPY through the Regolith platform:

- Entry fee: 2%

- Performance fee: 0%

The fund’s expenses are already embedded in the price of the instrument and do not require additional charges from the investor.

The role of SPY in an investment portfolio

SPY is typically considered a core element of a long-term investment portfolio.

The fund may be used in a portfolio for the following purposes:

- strategic capital growth – participation in the performance of the largest public companies;

- broad diversification – access to 500 companies within a single instrument;

- formation of the portfolio “core,” around which other asset classes may be added;

- reduction of single-company risk – results depend on the overall index dynamics rather than on one stock.

Risks

Investments in SPY are associated with market risks typical of equity markets:

- the fund is subject to market volatility — its value may decline during economic downturns;

- high correlation with the U.S. equity market — declines in the stock market are reflected in SPY’s price;

- returns are not guaranteed and depend on the financial performance of the index constituents.

- SPY is not a defensive asset and is not intended for hedging short-term market risks.

Instrument parameters

- Ticker: SPY

- Type: S&P 500 Index ETF

- Exchange: NYSE Arca

- Return type: price appreciation + dividends

Subscription and redemption terms

Purchasing SPY through the Regolith platform is carried out on an ongoing basis, without a fixed subscription date. Transactions are executed 1–3 times per week, depending on the operational schedule and market conditions.

- Minimum investment period: 1 week

- Minimum transaction amount on Regolith: $50

- Entry fee: 2%

- Performance fee: 0%

Withdrawals are processed according to the platform’s standard procedures after the minimum investment period has been completed.

Frequently Asked Questions about SPY ETF (FAQ)

1. What is SPY?

SPY is an exchange-traded fund (ETF) that allows investors to gain exposure to the 500 largest publicly traded companies included in the S&P 500 Index through a single purchase. The fund reflects the performance of the U.S. equity market through the combined results of these companies.

2. Who manages the fund?

The fund is issued and administered by State Street Global Advisors, one of the world’s largest asset management firms, specializing in institutional investment products.

3. What exactly am I investing in when I buy SPY?

By purchasing SPY, you invest in shares of the 500 largest companies included in the S&P 500 Index. This is not an investment in a single company or a specific sector, but participation in the aggregate performance of the largest businesses.

4. Is this active management?

No. SPY is a passive index fund. It does not attempt to outperform the market and does not select individual stocks; instead, it replicates the structure of the S&P 500 Index.

5. Which companies are included in the fund?

The fund includes companies from a wide range of economic sectors, including technology, financials, healthcare, industrials, and consumer sectors. These include Apple, Microsoft, Nvidia, Alphabet, and other major corporations.

6. Does the composition of the fund change?

Yes. The composition of the S&P 500 Index is reviewed on a regular basis. Companies may be added or removed based on their size, liquidity, and compliance with index criteria. SPY automatically reflects these changes.

7. Does SPY pay dividends?

Yes. Companies included in the index pay dividends. These dividends are accumulated by the fund and reflected in the instrument’s return (partly through distributions and partly through the price).

8. What fees apply to the fund?

When purchasing SPY through the Regolith platform:

- entry fee — 2%;

- performance fee — 0%.

9. What role does SPY play in an investment portfolio?

SPY is often used as a core component of an investment portfolio. The fund provides broad diversification and helps reduce dependence on the performance of individual companies.

10. Why is SPY considered a long-term investment?

Historically, the S&P 500 Index has grown over long periods despite crises and market downturns. SPY reflects this long-term growth by providing exposure to the largest and most resilient companies.

11. What risks are associated with investing in SPY?

The value of SPY depends on overall market conditions. During crises or economic downturns, the fund’s price may decline. In the short term, higher volatility is possible.

12. Are there any tax considerations?

Taxation depends on the investor’s country of tax residency. For investors outside the United States, local jurisdiction rules apply.

13. Where is SPY traded?

The fund is traded on the U.S. exchange NYSE Arca and is one of the most liquid ETFs in the world.

14. How does the SPY purchase process work through Regolith?

Purchasing SPY through the Regolith platform is carried out on an ongoing basis and is not tied to a fixed date. Transactions are executed 1–3 times per week, depending on market conditions and the platform’s operational schedule.

After an order is submitted, funds are reserved, and the purchase is executed during the next available trading window at the actual transaction price.

15. What is the minimum investment period?

The minimum investment period is 1 week. After this period, the investor may continue holding the position or exit the instrument without a platform exit fee.

16. What is the minimum entry amount?

The minimum transaction amount for purchasing SPY through Regolith is $50.

State Street Global Advisors

Sponsor of the Trust

“Access to the 500 largest publicly traded companies in the S&P 500 — a core building block for a diversified portfolio.”

Performance

Return for 2020

+18.37%Return for 2021

+28.75%Return for 2022

−18.17%Return for 2023

+26.19%Return in 2024

+24.89%Return in 2025

+17.72%Terms

Deal Fee

2%Carried Interest

0%Minimum investment period

1 weekRisk potential

Low

Русский

Русский