OpenSea Investment Analysis: Platform Growth, SEA Token, and IPO Outlook

🛳 Investment Analysis: OpenSea

OpenSea is the world’s largest NFT marketplace, launched in 2017. In January 2022, the company raised $300M at a $13.3B valuation. Total funding to date stands at approximately $427M. With the launch of OS2, the platform now supports 19 blockchains.

✅ Key Metrics for 2025

• Financials. OpenSea does not publish official financial statements. Estimated annual revenue is around $33M, with an average monthly trading volume of $190M. By August 2025, trading volume declined to $65M.

• Assets. In 2025, OpenSea established an NFT reserve worth over $1M for its flagship collection.

• OS2 Update. In February 2025, OpenSea launched OS2, featuring cross-chain trading and ERC-20 token support; by May, it was live on 19 blockchains.

• Costs and Valuation. Although expenses are undisclosed, the company is actively cutting costs. At a $13.3B valuation, the EV/Revenue multiple stands at roughly 400× (Dealroom).

• Partnerships. In September 2025, OpenSea joined the Coinbase One program, offering user rewards. It also integrated NFT galleries and gaming platforms such as GAM3S.GG.

📈 IPO Outlook

• Funding. The latest major round was Series C in January 2022. No new rounds have been announced since; total capital raised is approximately $427M.

.png)

• Valuation. Following the NFT market cooldown, OpenSea’s implied valuation may have declined to $10–12B, though no official figures have been published.

• IPO Timing. Talks about a public offering have been ongoing since 2021 but were delayed due to the crypto winter and regulatory uncertainty. An IPO appears unlikely before 2026, with a potential valuation of $10–15B.

🧭 Strategic Initiatives

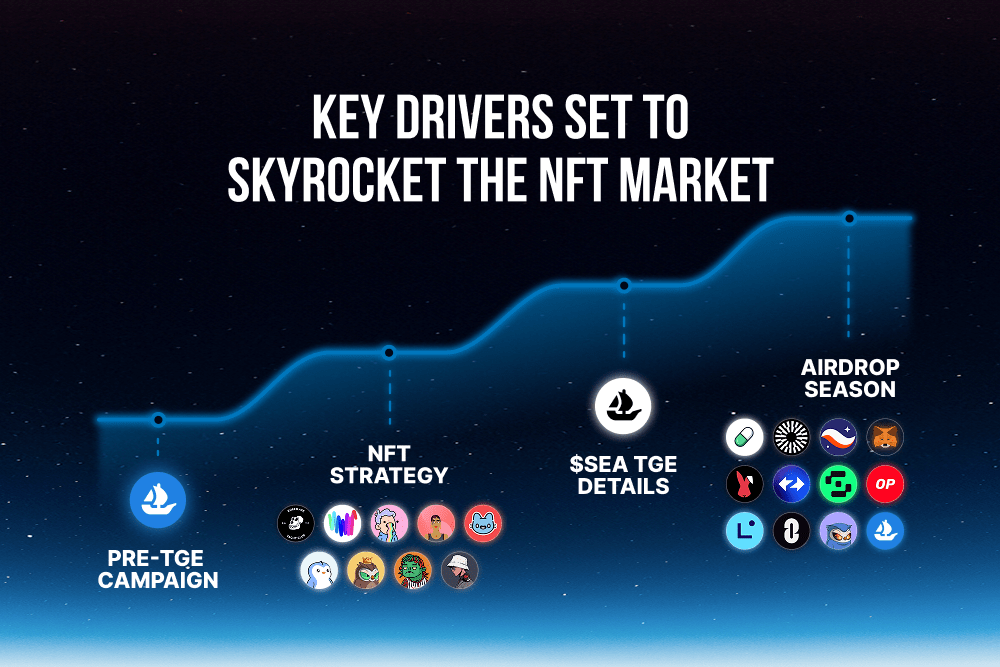

• SEA Token & Rewards Program. OpenSea announced the SEA token launch, scheduled for October 2025. The token is designed to incentivize long-term engagement among active users.

• NFT Campaigns. Key initiatives include the Flagship Collection ($1M in rare NFTs), the SEA airdrop (57 000 active addresses vs 730 on Blur), and community programs for artists and collectors.

• Infrastructure. In 2025, OpenSea acquired the Rally wallet (converted into a trading dashboard) and launched a mobile app with AI analytics — a step toward integrating NFT and crypto trading within one ecosystem.

• Partnerships. The company expanded collaborations with DeFi and Web3 projects — wallets, aggregators, and metaverses — and launched the OpenSea Foundation to distribute SEA tokens, donations, and grants.

🌐 Impact on the NFT Market

After the 2024 correction, the NFT sector is shifting from speculation toward utility-driven use cases. Key growth drivers include:

• Gaming and metaverse assets

• Tokenization of real-world objects and DeSci initiatives

• Technological innovations (iNFTs, Ordinals)

• Improved regulation and infrastructure

Market size is projected to grow from $40B (2024) to $200B by 2030. OpenSea maintains 70–72% of the Ethereum NFT market, with its main competitor Blur targeting professional traders.

.png)

OpenSea continues to host major collections such as CryptoPunks, BAYC, and Pudgy Penguins, while its XP rewards program stimulates “blue-chip” NFT trading.

📘 Conclusion

OpenSea remains the dominant player, controlling roughly 70% of the Ethereum NFT market. Revenue is in the tens of millions of dollars, but trading activity needs renewed momentum. Key growth factors include the OS2 upgrade, SEA token, and Web3/DeFi integrations, while risks stem from competition and market volatility.

An IPO is expected no earlier than 2026, likely at a valuation below the $13.3B peak of 2022. With a crypto market recovery, OpenSea could retain its leadership. The SEA token, OS2 ecosystem, and new partnerships should help sustain engagement and reinforce its market position.

While short-term results depend on crypto market dynamics, current initiatives form a foundation for steady long-term growth.