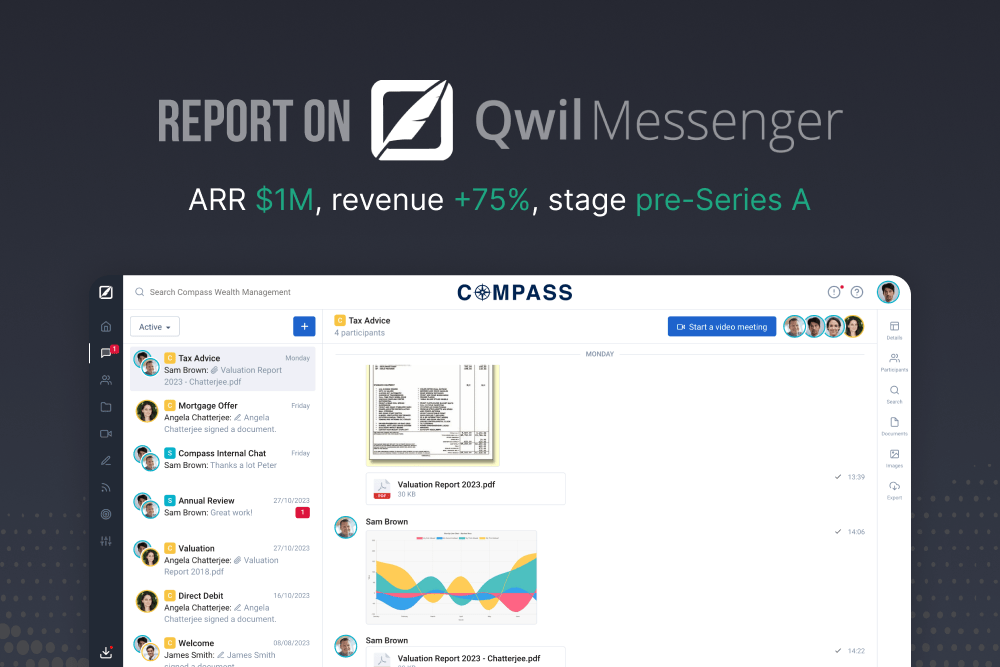

Qwil Messenger Report: ARR $1M, Revenue +75% — Focus on Banks and Financial Services

🪶 About Qwil Messenger

Qwil Messenger is a corporate platform designed for secure communication between companies and their clients. It combines chat, file sharing, video calls, and electronic signature features.

The platform focuses on financial and professional sectors, where security and regulatory compliance are essential. All messages in Qwil are encrypted, and the service is certified under international standards, meeting GDPR, MiFID II, HIPAA, and other requirements.

Users are divided into “staff” and “clients,” and communication occurs only between pre-approved contacts. Each organization receives its own controlled and auditable communication space.

✅ Key Updates (2023–2025)

• Funding. In 2023, Qwil raised around £0.8M, bringing total funding to approximately $4.5M. Investors include Schroders, Tenity, and Clearconsult Management. The company remains at the pre-Series A stage.

• Client Growth. The platform is used by more than 2,000 organizations worldwide, primarily banks, wealth managers, and financial service firms. Clients include Nedbank Private Wealth, St. James’ Place, Fidelity, and others. Roughly 12,000 employees and hundreds of thousands of clients use Qwil daily.

Revenue Growth:

• 2021 — $1.0M

• 2023 — $1.6M (+60%)

• 2024 — $2.8M (+75%)

The company reached $1M in annual recurring revenue (ARR) from long-term contracts.

• New Features. Added two-factor authentication, “staff-only” chats, user statuses, an enhanced file manager, moderated and recorded video conferences, and DocuSign integration for e-signatures.

• Partnerships. Qwil integrated with the Avaloq ecosystem, providing access to hundreds of banks. It previously joined the Schroders Cobalt Fintech In-Residence program and has integrations with Salesforce, Slack, and other systems.

• Competition. While many corporate communication tools exist (e.g., Slack, Element), few meet strict compliance requirements. Qwil positions itself as a niche solution for inter-organizational communication with full regulatory adherence and data control.

• Team. Co-founders: Nicolas George (CTO) and Peter Reading (CEO until 2024). Since 2025, the CEO has been Laurent Guyot. The company employs about 10 people.

• Media Presence. Qwil publishes thought leadership on secure communication in financial services. While major media coverage has been limited, the topic gained attention amid multi-million-dollar fines against banks for using non-compliant messengers like WhatsApp.

💲 Monetization & Exit Strategy

Qwil operates on a SaaS model, charging per-user subscription fees. The main revenue comes from long-term corporate contracts, with additional sales channels tested via marketplaces.

The most likely exit scenario is an acquisition by a strategic buyer (fintech, CRM provider, or major bank). An IPO remains unlikely at the current scale.

⚡️ Risks

• Regulatory. Changes in compliance rules may require product updates. However, tighter messaging regulations benefit Qwil’s positioning.

• Technological. Data breaches or outages could harm reputation; competition from large tech companies is another risk.

Qwil Messenger shows steady growth and solid monetization. Despite remaining an early-stage company with under $3M in revenue, its strong niche positioning and potential strategic exit make it an attractive case to watch.

Regolith App:

🔼 AppStore ▶ GooglePlay