Weekly IPO Digest: Bullish Results and Recent Deal Performance

Bullish Results and IPO Market Overview

In this week’s review, we break down the key IPO market developments: from locking in profits on Bullish to analyzing the performance of recent listings amid growing volatility. The material will be useful for investors tracking newly listed companies, the fintech segment, and the broader IPO market environment.

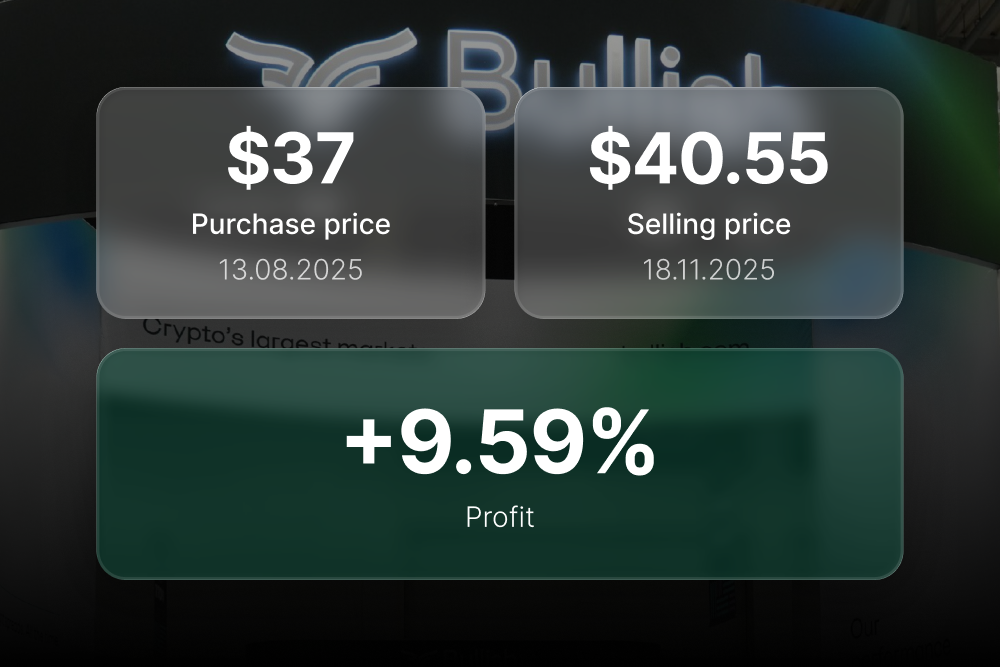

Bullish: +9.59% Profit Amid a Volatile Market

One of the week’s main highlights was securing a profit on Bullish. The position was closed on Friday at $40.55, delivering a +9.59% gain relative to the IPO price of $37 — despite elevated market turbulence.

This result is particularly notable given:

- the pullback in cryptocurrencies driven by ETF outflows and inflation expectations;

- weak performance across U.S. and Asian equity markets;

- pressure on the tech sector following an overheated rally in previous months.

Bullish once again demonstrated the resilience of its model and sustained investor interest even in challenging macro conditions.

Market Correction: What’s Shaping IPO Performance

Over recent weeks, the market has shown signs of caution. Key factors include:

- increased investor prudence ahead of new inflation data;

- a correction in the crypto sector;

- cooling interest in technology stocks;

- tighter expectations around monetary policy and interest rates.

Against this backdrop, newly listed IPOs are showing mixed and uneven performance.

Recent IPO Dynamics: From Strong Outperformers to Adjustment Phase

Despite the broader correction, several recent listings continue to deliver strong results.

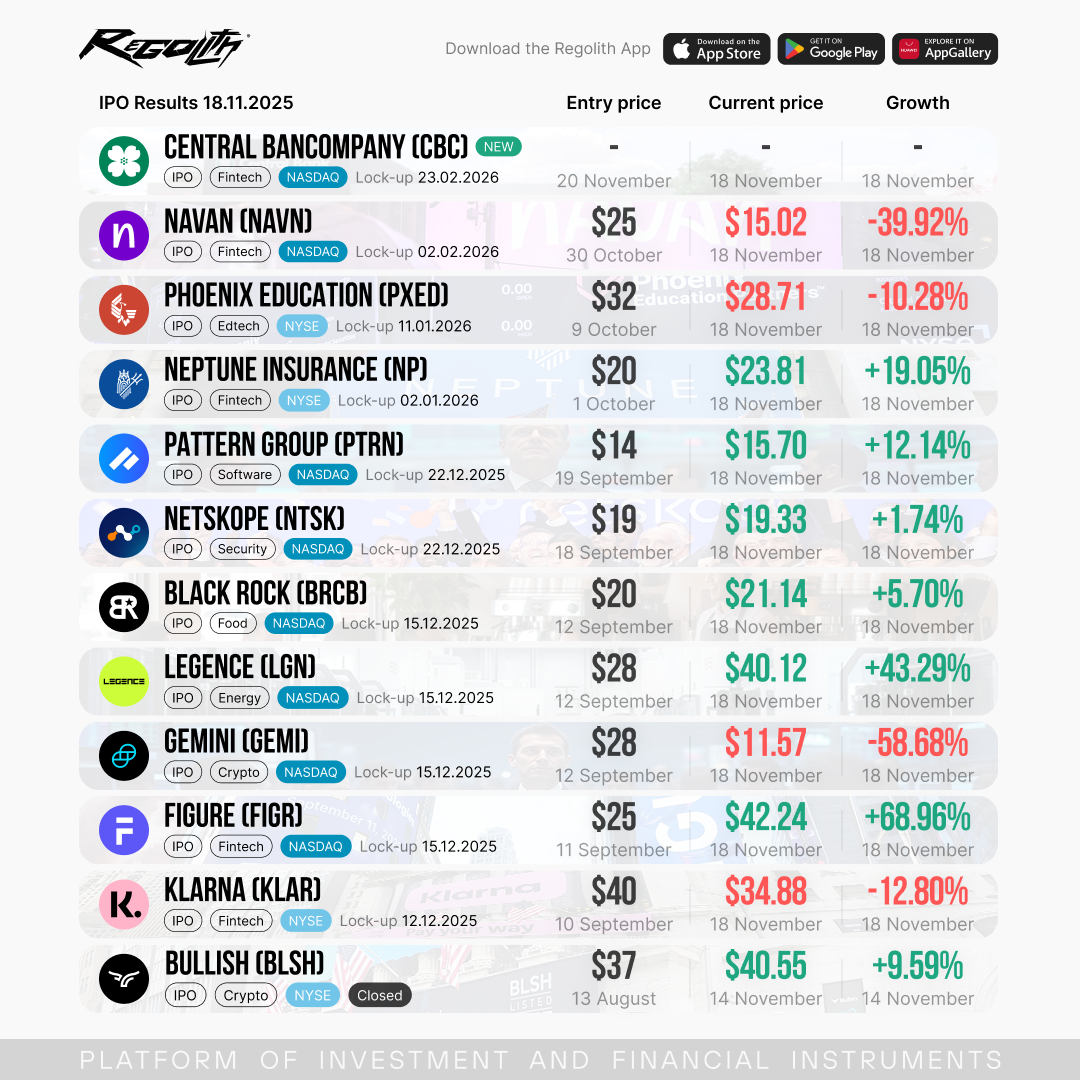

Top Performers

- Figure — +68.96%

Remains one of the key beneficiaries of growing interest in fintech and blockchain infrastructure. - Legence — +43.29%

Supported by stable operating metrics and rising demand for energy-efficiency solutions. - Neptune Insurance — +19.05%

- Pattern Group — +12.14%

Both companies demonstrate business resilience and continue to attract institutional demand despite market risks.

Moderate Gains

- Black Rock Coffee Bar — +5.70%

- Netskope — +1.74%

While the growth is modest, maintaining positive dynamics during a correction is a healthy signal for the IPO market.

Correction Among Select IPOs

- Phoenix Education Partners — –10.28%

Investors are awaiting clearer guidance on revenue and margins. - Klarna — –12.80% (down from $40 to $34.88)

The BNPL sector remains highly sensitive to rate expectations and consumer activity.

Largest Declines

- Navan — –39.92%

- Gemini — –58.68%

Both companies remain under pressure amid concerns around financial transparency and elevated perceived risk.

Weekly Summary: A Mixed IPO Landscape

The IPO market continues to show divergence: some issuers maintain strong momentum even in a correction, while others undergo an adjustment period after going public.

The profitable +9.59% exit from Bullish was one of the standout events of the week, demonstrating that opportunities remain even in choppy market conditions.

With new earnings reports and lock-up expirations approaching in mid-December, IPO activity may intensify again. We’ll continue keeping you updated on the key developments so you never miss the shifts that matter.