SpaceX set a $800 billion valuation and is considering a 2026 IPO at $1.5 trillion

Company Valuation, Key Growth Drivers and the Role of Elon Musk

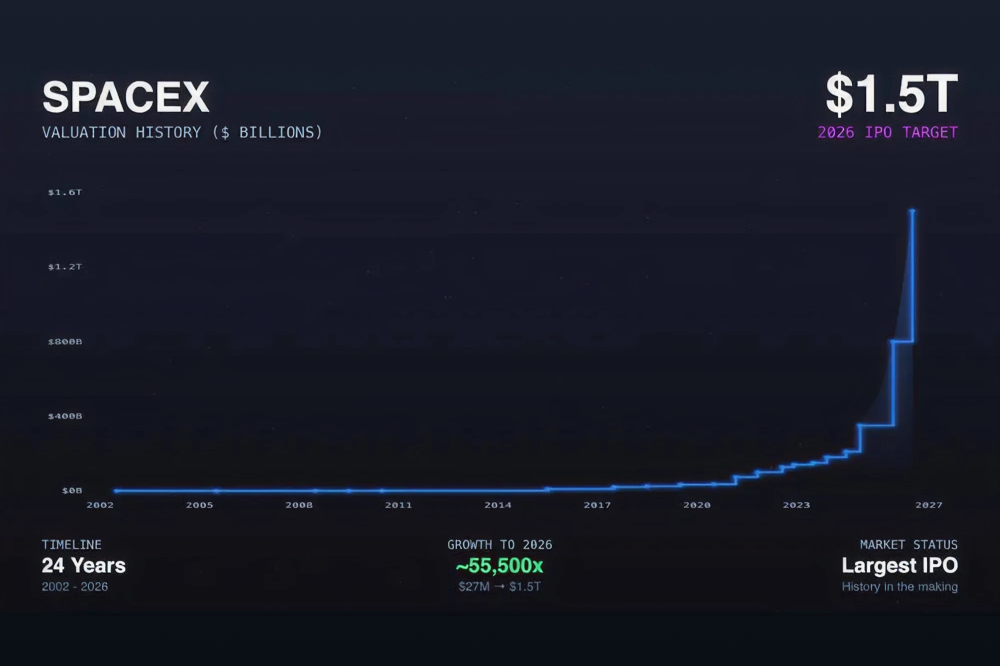

By the end of 2025, SpaceX had set a valuation of approximately $800 billion following secondary transactions between existing shareholders. This valuation established a new reference point for discussions around a potential SpaceX IPO and the company’s longer-term growth trajectory as a public market asset. For private companies of this scale, it is a relatively rare case where business value is defined by an actual transaction rather than projections, allowing investors and analysts to compare SpaceX with the world’s largest public companies and the biggest IPOs of recent years.

At the same time, Bloomberg, Reuters и The Wall Street Journal reported that SpaceX is preparing for a potential public offering in 2026.

In analytical scenarios, valuations of up to $1.5 trillion are increasingly being discussed. These figures reflect how investors assess the growth potential of SpaceX’s core businesses, particularly Starlink, as well as the company’s positioning as a long-term global infrastructure player.

SpaceX Valuation Around $800 Billion

SpaceX’s current valuation is based on a secondary share sale, involving transactions between existing shareholders and a limited group of investors.

.jpeg)

The $421 per-share price in the latest secondary round, outlined by SpaceX Chief Financial Officer Bret Johnsen in a memo to shareholders, is nearly double the $212 per-share price set in July, when the company was valued at approximately $400 billion.

Unlike valuations presented in investor materials or implied by market expectations, secondary transactions reflect actual demand for ownership stakes at a given point in time. While they do not create public liquidity, such deals serve as important benchmarks for institutional investors and the pre-IPO market.

Key metrics currently referenced by the market include:

- share price: $421;

- prior valuation (summer 2025): about $400 billion;

- current implied valuation: about $800 billion;

- transaction format: secondary sale.

Preparation for a Potential IPO in 2026

In a corporate communication reviewed by Bloomberg, SpaceX indicated that it is considering a public offering scenario in 2026.

A potential IPO is viewed as a source of funding for the company’s long-term, capital-intensive projects. Among the stated priorities are:

- further development of Starship and increased launch frequency;

- investments in space-based infrastructure for data processing and artificial intelligence;

- projects related to the lunar program and the broader space exploration strategy.

SpaceX management has emphasized that the timing, structure and final valuation of any offering will depend on market conditions as well as the company’s readiness to operate as a public entity.

.jpeg)

The establishment of SpaceX’s valuation at around $800 billion through secondary transactions became a starting point for longer-term scenario analysis. In the context of preparations for a potential IPO, analysts and market participants began extrapolating the company’s current valuation based on expected growth across its key business segments. As a result, a $1.5 trillion valuation has appeared in a number of articles and analytical models as a possible reference point under favorable market conditions.

Starlink as a Key Driver of Value

Although SpaceX is widely known for its rocket technology, Starlink represents the primary contributor to the company’s potential capitalization. The global satellite network already serves millions of users and continues to expand rapidly.

Starlink is increasingly viewed as a standalone infrastructure and telecommunications business. Its investment appeal is driven by scalability, global reach and the potential for strong operating margins. In addition, the project holds strategic importance for government and corporate clients, broadening the range of revenue sources.

Starlink largely explains why investors are willing to consider elevated valuation benchmarks for SpaceX and why discussions around a future IPO often include the possibility of structurally separating this business.

SpaceX as a Diversified Ecosystem

SpaceX has long moved beyond a single-revenue business model. Today, it operates as a diversified ecosystem comprising several strategic segments:

- commercial and government launches using Falcon 9 and Falcon Heavy;

- development of Starship as a platform for future missions;

- satellite internet services through Starlink;

- long-term contracts with NASA and the U.S. Department of Defense;

- emerging areas related to orbital logistics and space infrastructure.

This business profile allows investors to view SpaceX not only as a technology company, but also as a global infrastructure player.

Elon Musk and the Growth of Personal Wealth

The increase in SpaceX’s valuation has had a direct impact on the personal wealth of its founder. According to Forbes, Elon Musk’s net worth has exceeded $600 billion, making him the wealthiest individual in history. A significant portion of this wealth is tied to his stake in SpaceX, estimated at approximately 42%.

It should be noted that this represents illiquid wealth, calculated based on valuations of holdings in both private and public companies. Nevertheless, the trajectory remains striking. In 2020, Musk’s net worth was estimated at around $25 billion, while the gap between him and the next-ranked individuals on the global rich list now exceeds $400 billion.

Regolith and SpaceX Pre-IPO

For Regolith, SpaceX represents more than a news headline. We participated in investments at the early pre-IPO stage, well before the market began discussing valuations at or above $800 billion.

Our approach is built around access to private companies ahead of public listings, in-depth analysis of business models and assessment of long-term growth drivers. In the near future, we plan to expand access to pre-IPO opportunities for Regolith investors, while maintaining a strong focus on transparency and risk management.

Conclusion

Over a relatively short period by large-business standards, SpaceX has completed a journey that typically takes decades. Rapid valuation growth, the transition from a narrowly focused technology company to a diversified ecosystem, and its emergence as a global infrastructure platform have made SpaceX one of the most significant private company stories in today’s market. The valuation of approximately $800 billion established through actual transactions already places SpaceX alongside the world’s largest public companies.

SpaceX’s capitalization significantly exceeds that of most companies that have gone public in recent years. Analysts compare a potential SpaceX IPO with the record-setting Saudi Aramco listing in 2019, which was completed at a valuation of about $1.7 trillion. As a result, the market increasingly views a SpaceX IPO as an event capable of setting a new benchmark for public markets.

.jpeg)

This dynamic is driven by a combination of factors. The company no longer relies on a single business line: commercial and government launches, Starlink, long-term contracts and space programs form a resilient and balanced business structure. Elon Musk’s long-term vision and focus on large-scale objectives, rather than short-term market expectations, have also played a critical role. Together, rapid growth, diversification and strategic leadership have propelled SpaceX to valuation levels that would have seemed unattainable just a few years ago.

For Regolith, this story underscores the value of early access. We invested in SpaceX at the pre-IPO stage, when the company was still shaping its current business model and capitalization was well below today’s levels. This approach allows investors to participate alongside founders and major institutional players long before a company becomes part of the global public market narrative. Access to pre-IPO SpaceX opportunities will be reopened soon. Stay tuned for updates.