Bitcoin Drops Below $65K Amid Global Correction: Market Analysis and Impact on Mining

February 2026 has become one of the most volatile periods for the crypto market in the past two years. Bitcoin fell below $65,000, briefly touching $60,000 before bouncing back. From its October 2024 highs of $108,500, the asset has lost roughly 40%.

Total crypto market capitalization dropped from a peak of $4.38 trillion to $2.1–2.3 trillion – a $2 trillion drawdown.

Several indicators reflect the scale of panic. The Fear & Greed Index plunged to 5–9 points – levels last seen during the FTX collapse in 2022. Over $2.7 billion in positions were liquidated within 24 hours, with $1.42 billion of that in Bitcoin alone. Open interest on futures markets fell to $103 billion.

The ETF market also saw record activity. BlackRock's IBIT posted $10 billion in daily trading volume – an all-time high – as its price dropped 13%. This marked the fund's second-worst day in terms of price action since launch. Fidelity's FBTC led outflows at $148.7 million in a single day. Total outflows from spot BTC ETFs exceeded $400 million in the first week of February.

The pressure didn't come from crypto alone. The tech sector is undergoing a reassessment: investors are questioning whether AI companies can deliver on the expectations priced into their stocks. AMD lost 17% in a single day after earnings, and Palantir along with other tech names are also under pressure.

Around 62% of BTC ETF holders are now underwater, with an average entry price near $85,000. Crypto is reacting to a broader risk-off move. It's painful, but not unique – corrections like this have occurred in every Bitcoin cycle.

Bitcoin Cycles: Why Lows Matter More Than Highs

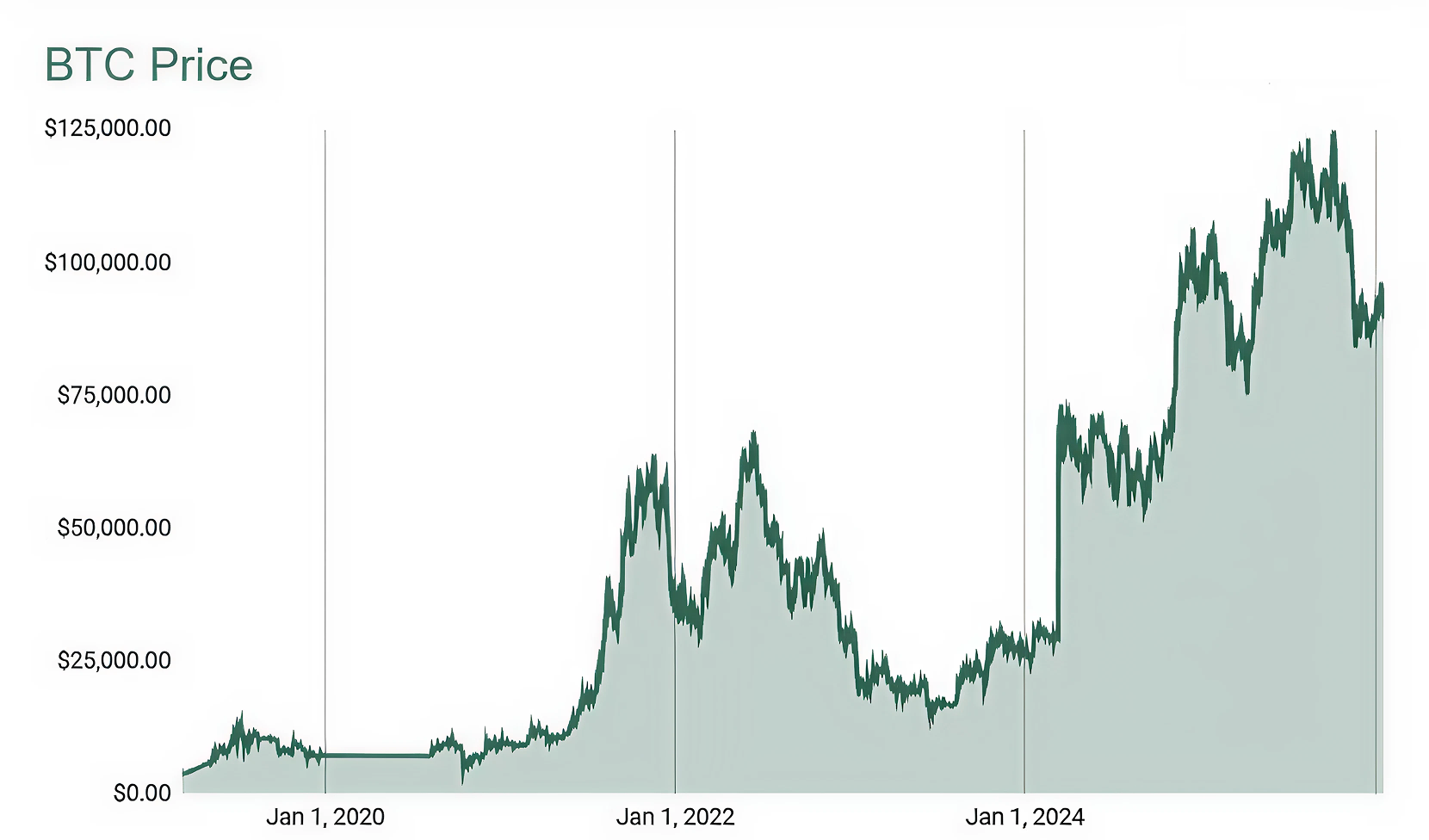

Short-term drawdowns can look alarming, but viewed across full market cycles, the picture changes. Historically, Bitcoin's cycle lasts around 4 years (~1,458 days) and is tied to halving events. Each cycle brings not only new highs, but progressively higher lows:

- 2013–2015: peak ~$1,100 (Nov 2013) → bottom ~$170 (Jan 2015), –85% correction

- 2017–2018: peak ~$20,000 (Dec 2017) → bottom ~$3,200 (Dec 2018), –84% correction

- 2021–2022: peak ~$69,000 (Nov 2021) → bottom ~$15,500 (Nov 2022), –77% correction

- 2024–2026: peak ~$108,500 (Oct 2024) → current low ~$60,000–67,000, –38–45% correction

On average, previous cycles took about a year to move from peak to bottom. Recovery to prior highs took 24–26 months from the low.

Many long-term market participants view rising lows as a more meaningful signal than peak values. They reflect the network's maturation and strengthening market structure: with each cycle, the baseline support level moves higher.

Miners who have been through multiple cycles understand: volatility isn't an anomaly – it's a defining feature of Bitcoin. Periods of extreme fear have historically coincided with the best long-term entry points. This isn't a prediction – it's history.

How This Affects the Mining Fund

Mining profitability depends directly on Bitcoin's price and network difficulty. In recent months, both factors have worked against miners.

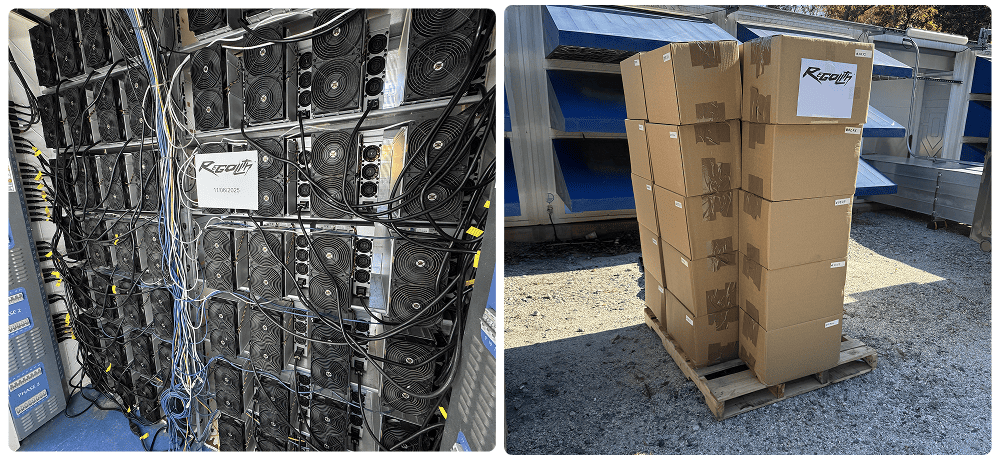

Network hashrate has climbed as new equipment comes online, including S21 models. Meanwhile, BTC price remains below expectations – putting pressure on returns.

The situation is similar for Dogecoin and Litecoin: when prices fall and difficulty rises, some equipment is temporarily taken offline when revenue no longer covers electricity costs.

Mining Fund dividends reflect this reality. In August–September 2025, weekly returns reached 0.55–0.83%; by February 2026, they had dropped to 0.12–0.21%. This isn't a malfunction – it's the reality of mining under current conditions.

Network Difficulty: A Built-In Balancing Mechanism

On February 7, 2026, Bitcoin's network difficulty adjusted downward by 11.16% – from 141.67T to 125.86T.

How it works: when prices fall and some miners shut down their equipment, the network automatically reduces difficulty. This makes mining more profitable for those who remain – they earn more rewards for the same costs.

Historically, periods of declining difficulty have helped offset price pressure and improved mining unit economics.

The fund's team is using this window for optimization: testing and deploying updated firmware and equipment configurations to improve energy efficiency.

Fund Position

Mining Fund continues to operate normally. All systems are running, equipment is online, and dividends are being distributed on schedule.

What's happening now reflects market conditions. Mining profitability has always been tied to Bitcoin's price and network difficulty. When both factors work against you, returns decline.

That said, the market remains cyclical. Bitcoin has been through periods like this before – and has emerged from each one at new all-time highs.

The difficulty reduction we're seeing now is already starting to offset the price drop. If BTC stabilizes or recovers, we expect fund performance to follow.

The team is focused on operational efficiency: optimizing equipment, managing costs, and adapting to the market. We'll keep operating and keep you posted.