Annual Letter from Warren Buffett to Berkshire Hathaway Shareholders: Summary and Key Insights

Buffett’s Farewell Letter 2025: The Closing Chapter of a 60-Year Era

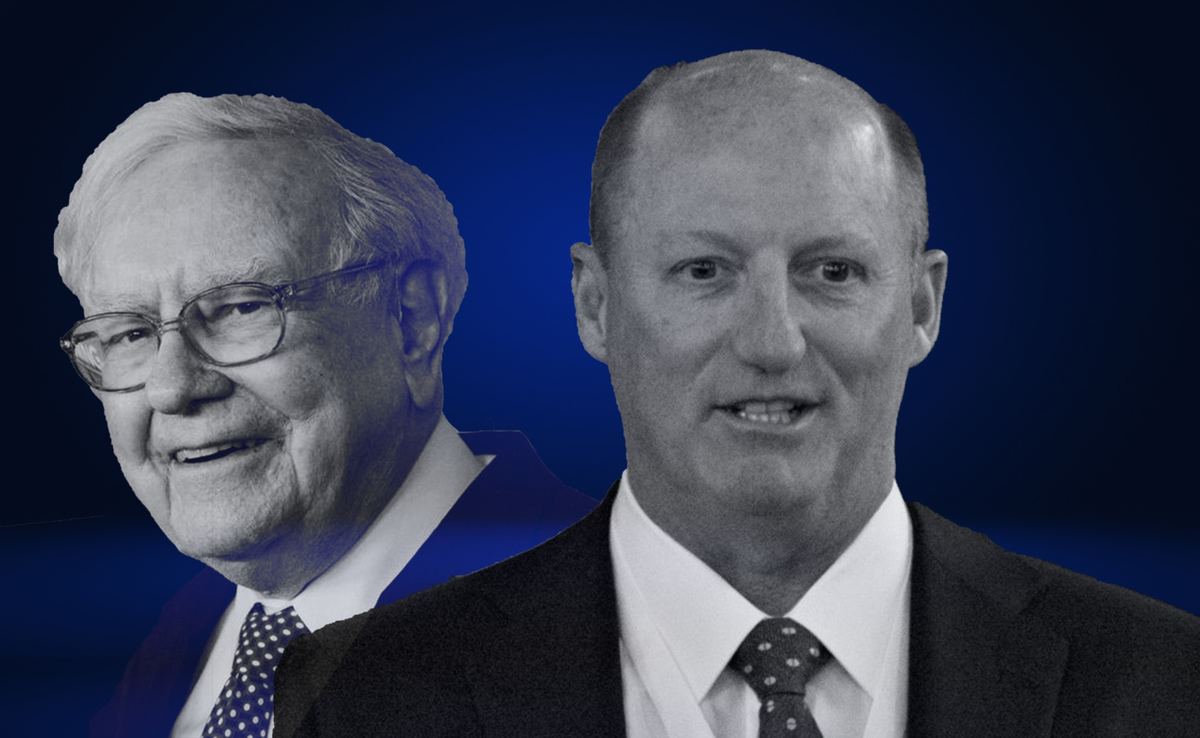

On November 10, 2025, Warren Buffett, at the age of 95, released a letter that instantly became a historical document. This was not merely another annual note to shareholders, but Buffett’s farewell as Chief Executive Officer of Berkshire Hathaway. With it, a 60-year chapter in corporate leadership came to an end – an era that saw the company transform from a struggling textile manufacturer into a corporation with a market capitalization exceeding $1 trillion.

In what reads like an investment testament, Buffett summed up the work of a lifetime, formally confirmed the transfer of power to Greg Abel, and offered his final guidance to investors in his trademark style of folksy wisdom.

Historical Context: From Textiles to a Trillion Dollars

Warren Buffett took control of Berkshire Hathaway in 1965, when the company’s shares traded at just $19. By the time of his final letter, Class A shares had surpassed $700,000, and Berkshire’s market capitalization had crossed the historic $1 trillion mark.

Buffett emphasized that this success was not the result of speculation, but of iron discipline and consistency.

The Market’s Greatest Teacher: The Warren Buffett Phenomenon

In today’s economic reality, Warren Buffett is not only the world’s most successful investor, but also a widely respected “voice of common sense.” Markets listen to him because his advice is rooted in practice. For six decades, Buffett has proven the resilience of his strategy through multiple crises, inflationary cycles, and technological revolutions.

Berkshire Hathaway has become a benchmark for stability. With an average annual return of 19.8%, the company has outperformed the broader market – nearly doubling the S&P 500's long-term returns – while maintaining an impeccable reputation. For the professional investment community, Buffett’s strategies and public letters have long served as a compass through market cycles and economic turbulence.

Greg Abel: The New Engine of the Empire Built by Buffett

On January 1, 2026, one of the most significant leadership transitions in modern financial history took place: Greg Abel assumed the role of CEO of Berkshire Hathaway. This was not a symbolic reshuffle, but the beginning of a “New Era” for the global investment community.

While Buffett spent decades as the chief strategist and architect of a unique capital-allocation system, Abel is widely seen as the executive capable of turning that system into a unified platform for managing industrial giants.

Previously, Abel led Berkshire Hathaway Energy, transforming it into one of the most efficient and profitable energy businesses in the world. For investors entering 2026, his appointment signals a shift – from classic stock selection toward strategic stewardship of entire sectors of the economy.

Buffett will remain Chairman of the Board, but he will no longer write annual shareholder letters or appear at shareholder meetings. In his farewell message, he expressed complete confidence in his successor, stating:

“Greg Abel has more than lived up to the high expectations I placed on him. I cannot think of a CEO, management consultant, academic, statesman—anyone—whom I would prefer over Greg to manage your and my savings.”

To reassure shareholders, Buffett added that he would retain all of his shares – representing roughly 30% voting control – until investors grow as comfortable with Abel as they once did with him.

These remarks helped calm the market, which had briefly weighed on Berkshire's shares following the May announcement of the legendary “Oracle of Omaha’s” departure.

Record Taxes and Philanthropy: What These Numbers Signal to Investors Today

Berkshire Hathaway’s report is more than a list of expenses – it is a clear demonstration of business quality. At a time when many companies mask losses or operate under constant debt, Berkshire continues to choose transparency. In his final letter, Buffett remained true to that principle, highlighting several defining figures:

- A 60-year marathon: Berkshire Hathaway delivered an average annual growth rate close to 20%. This performance underscores the adaptability and durability of Buffett’s system across crises and inflationary shocks. It reinforces a timeless lesson: in investing, marathon runners consistently outperform sprinters.

- Personal wealth and conviction: At the time of his departure, Buffett’s net worth was estimated at roughly $150 billion. On the very day the letter was published, he donated approximately $1.35 billion to four family foundations – the gesture of someone who believes in what he built. For Buffett, corporate reputation has always mattered more than personal wealth.

- Record tax payments: In 2024, Berkshire Hathaway paid a record $26.8 billion in taxes – the largest amount ever paid by a U.S. company. This figure reflects real profitability and honest reporting, proof of a business that genuinely earns its profits.

Before turning to the lessons of the farewell letter, it is worth recalling the principles on which Buffett – or, as Wall Street calls him, the “Oracle of Omaha” – built his 60-year strategy.

Warren Buffett’s 10 Golden Rules of Investing

- Never lose money. Structure risk so that a total loss of capital is avoided. Survival is the foundation of long-term success.

- Never forget Rule No. 1. This principle alone filters out most questionable investments.

- Stay within your circle of competence. Invest only in businesses you understand. This protects you from hype-driven and overly risky sectors.

- Buy a business, not a stock. Treat every share purchase as ownership in a real company, not as a lottery ticket.

- Price is what you pay; value is what you get. Seek assets where intrinsic value exceeds market price.

- Be contrarian. Capital flows to those who can wait while the crowd makes its costliest mistakes.

- Look for an economic moat. Choose companies with durable competitive advantages.

- Harness the power of compounding. Reinvest profits and let time work in your favor. Time is an investor’s greatest ally.

- Invest in yourself. Knowledge and skills are the only assets that cannot be taken away.

- The favorite holding period is forever. If you are not willing to own a business for ten years, do not own it for ten minutes.

The Final Note: A Message to Investors

Buffett did not leave those seeking financial direction without guidance. In his final message, he reaffirmed his unwavering belief in capitalism and in the long-term strength of the American economy. He once again highlighted the “magic” of compound interest and the importance of owning high-quality companies for the long term – names such as Coca-Cola and American Express.

A special place in the letter was devoted to professional ethics. Buffett openly acknowledged his past business mistakes and urged today’s leaders to practice managerial humility.

In closing, he returned to a thought he had repeated for decades: an investor’s most valuable asset is time. “Time is undefeated,” he wrote. These words go beyond financial reporting. Buffett leaves behind a simple formula for future generations: discipline, integrity, and a long-term horizon deliver more than the pursuit of quick profits.

Buffett’s farewell letter stands as the final chord of a legendary career. Over 60 years, he did more than compound shareholder wealth – he left behind a set of principles of financial discipline more valuable than any dividend.

For those who wish to study Buffett’s arguments firsthand and form their own view on the outlook for the global economy, the original letter is available on Berkshire Hathaway’s official website.