End of Lock-Up Periods for 7 IPOs: Netskope, Pattern Group, Klarna, Figure – Regolith IPO Digest

Lock-Up Expiration: Netskope (NTSK)

Result: $19.00 → $19.30 (+1.58%)

The lock-up expiration for Netskope passed without a spike in volatility. On December 11, the company released its Q3 FY2026 results, showing revenue and ARR (annual recurring revenue) growth of more than 30% year over year, reinforcing Netskope’s positioning as a resilient business within the cloud security and SASE segment.

As the market had largely priced in this performance in advance, the shares remained close to the IPO price at the time of lock-up expiration and showed only moderate movement. Additional stability came from the company’s clear subscription-based business model and the availability of fresh revenue and ARR data, which reduced uncertainty and limited price fluctuations in the first months after the IPO.

Lock-Up Expiration: Pattern Group (PTRN)

Result: $14.00 → $12.00 (−14.29%)

Pattern Group reached its lock-up expiration following a volatile period typical for many technology IPOs. In the autumn, the shares rallied on the back of strong quarterly results, record NRR (net revenue retention), and consistent business expansion through acquisitions that broadened the product portfolio and growth channels, including deals with ROI Hunter and NextWave. Closer to the lock-up date, however, the market became more cautious in assessing growth rates and valuation multiples, and the stock traded below its IPO price.

According to Simply Wall St, Pattern’s current share price is nearly twice below its estimated fair value. In practical terms, this suggests that part of the pressure on the stock may reflect cautious post-IPO market sentiment and valuation reset after the initial offering, rather than a deterioration in the company’s underlying fundamentals.

Lock-Up Expiration: Klarna (KLAR)

Result: $40.00 → $31.70 (−20.75%)

Klarna approached the lock-up expiration against a backdrop of solid operational growth. The company reported GMV and revenue growth of more than 20% year over year, with the Klarna Card emerging as one of the key drivers of ecosystem expansion. At the same time, the market focused on the quarterly loss and the trajectory toward profitability, which constrained demand for the shares. As a result, by the time the lock-up ended, the stock remained under pressure despite positive momentum in core business metrics.

Klarna approached the lock-up expiration against a backdrop of solid operational growth. The company reported GMV and revenue growth of more than 20% year over year, with the Klarna Card emerging as one of the key drivers of ecosystem expansion. At the same time, the market focused on the quarterly loss and the trajectory toward profitability, which constrained demand for the shares. As a result, by the time the lock-up ended, the stock remained under pressure despite positive momentum in core business metrics.

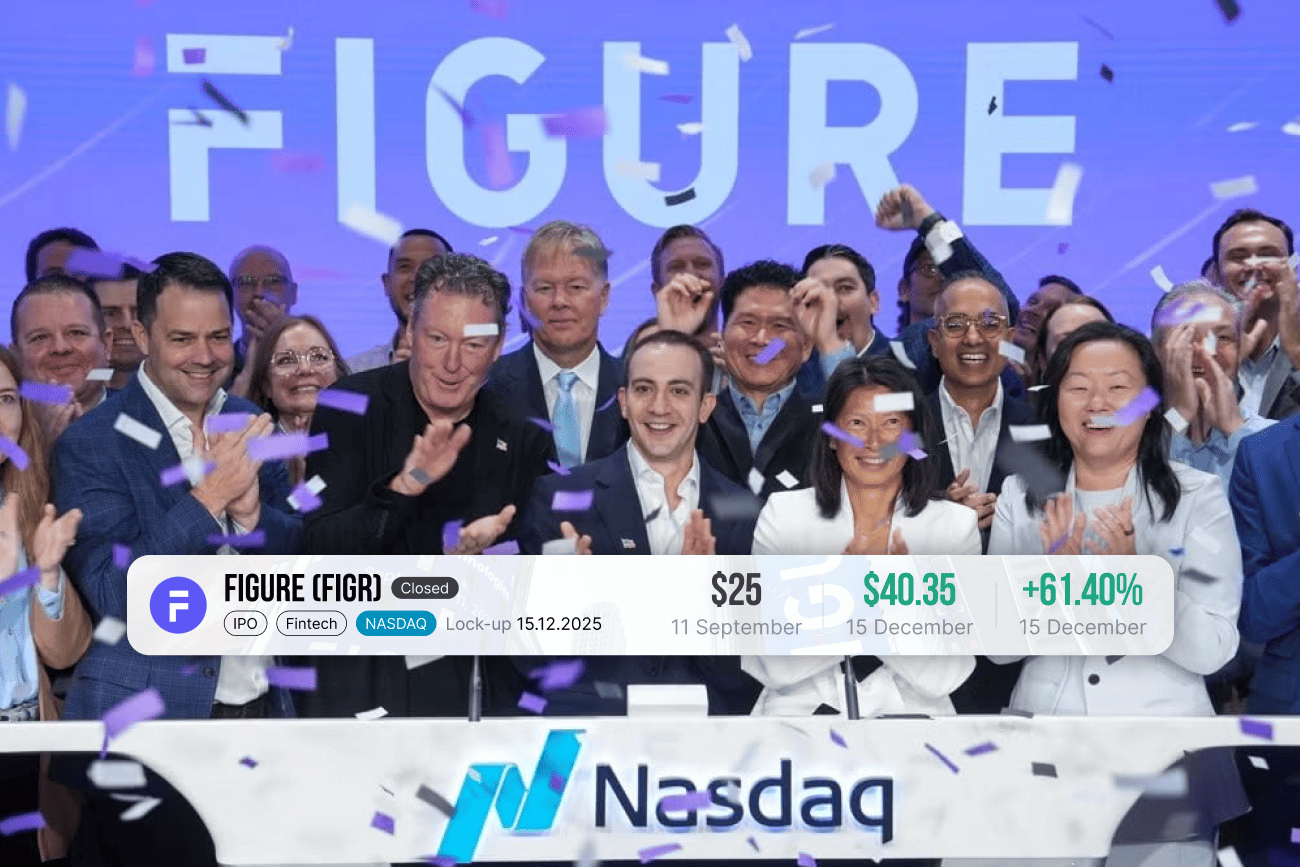

Lock-Up Expiration: Figure (FIGR)

Result: $25.00 → $40.35 (+61.40%)

Figure completed its lock-up period with one of the strongest financial reports among recent IPOs. Net income increased to $89.6 million from $27.3 million a year earlier, while revenue accelerated on the back of an expanding loan portfolio. Demonstrated profitability alongside business growth supported investor confidence. Against this backdrop, the shares delivered strong positive performance and maintained their upward momentum through the lock-up expiration.

Lock-Up Expiration: Gemini (GEMI)

Result: $28.00 → $11.82 (-57.79%)

Gemini reached its lock-up expiration amid elevated volatility. Despite 53% year-over-year revenue growth, the company remained unprofitable and traded at a high valuation premium. In the post-IPO phase, investors tend to be particularly sensitive to the balance between growth and profitability, and revenue momentum alone was not sufficient to offset valuation risks. This resulted in a pronounced decline in the share price by the time the lock-up ended.

The company priced its IPO at $28, above the initial range of $24–26, driven by strong demand. However, on the first day of trading the shares closed at around $32. Despite Nasdaq support and solid initial demand, investor sentiment toward crypto exchanges remains cautious.

Lock-Up Expiration: Legence (LGN)

Result: $28.00 → $42.04 (+50.14%)

Legence completed its lock-up period amid sustained market interest. The company continued to scale its business through an active M&A strategy, including the acquisition of the fast-growing contractor IMD, which strengthened Legence’s positioning in high-tech and infrastructure segments. The transaction expanded the project portfolio and improved revenue diversification, which was positively received by investors. Against this backdrop, the shares showed solid appreciation and maintained positive momentum through the lock-up expiration.

Legence completed its lock-up period amid sustained market interest. The company continued to scale its business through an active M&A strategy, including the acquisition of the fast-growing contractor IMD, which strengthened Legence’s positioning in high-tech and infrastructure segments. The transaction expanded the project portfolio and improved revenue diversification, which was positively received by investors. Against this backdrop, the shares showed solid appreciation and maintained positive momentum through the lock-up expiration.

Lock-Up Expiration: Black Rock Coffee Bar (BRCB)

Result: $20.00 → $23.45 (+17.25%)

Black Rock Coffee Bar approached the lock-up expiration with a more measured performance typical of consumer-focused companies. The business continued to expand its store footprint and deepen its presence in core markets, supporting operating metrics. Institutional investor interest remained stable. As a result, the shares posted steady gains without sharp volatility by the time the lock-up ended.

Upcoming Lock-Up Expirations: Navan, Phoenix Education Partners, Neptune Insurance

Over the next month, lock-up periods are expected to end for three additional companies, and we continue to monitor their share price dynamics and fundamental drivers.

Navan has been added to the Russell 2000 and Russell 3000 indices, increasing visibility among institutional investors and index funds. The company also confirmed strong operating momentum, with Q3 revenue up 29% year over year to $195 million. At the same time, the shares continue to trade below the IPO price, as the market remains cautious amid broader sector volatility.

.png)

Phoenix Education Partners reported results for the fourth quarter and the full 2025 fiscal year. Q4 revenue reached $257.4 million, up from $240.2 million a year earlier, while net income increased to $17.6 million. Full-year 2025 revenue exceeded $1 billion, pointing to stable operational growth following the IPO.

Neptune Insurance continues to demonstrate strong operating momentum. Q3 2025 revenue increased by 31.2% to $44.4 million, and gross written premiums reached $101.6 million. Net income declined only slightly due to IPO-related expenses, while margins remain high.

Key Takeaways for Investors

The results of recently completed lock-up expirations illustrate how the market transitions from initial expectations to a more balanced assessment of public companies. At this stage, investor focus shifts away from the IPO event itself toward the quality of growth, revenue structure, and the company’s ability to deliver on stated targets as a public entity.

Differences in share price performance reflect varying levels of market confidence in each company’s forward trajectory rather than randomness. Where financial reporting and the business model provide clear visibility for the coming quarters, share prices tend to behave more consistently.

In this sense, the post-IPO period acts as a critical filter. It separates short-term interest from long-term investment rationale and highlights which companies are ready for the public markets and which are still in an adaptation phase. For investors, this underscores the importance of a portfolio approach and disciplined execution: in IPO investing, outcomes are driven not by individual transactions, but by managing the full cycle and risk at the portfolio level.

.png)