Regolith IPO Digest: BitGo’s NYSE Debut, Navan Ahead of Lock-Up Expiry, and Closed IPO Results

BitGo: A Profitable Business as the Key Driver of Investor Interest

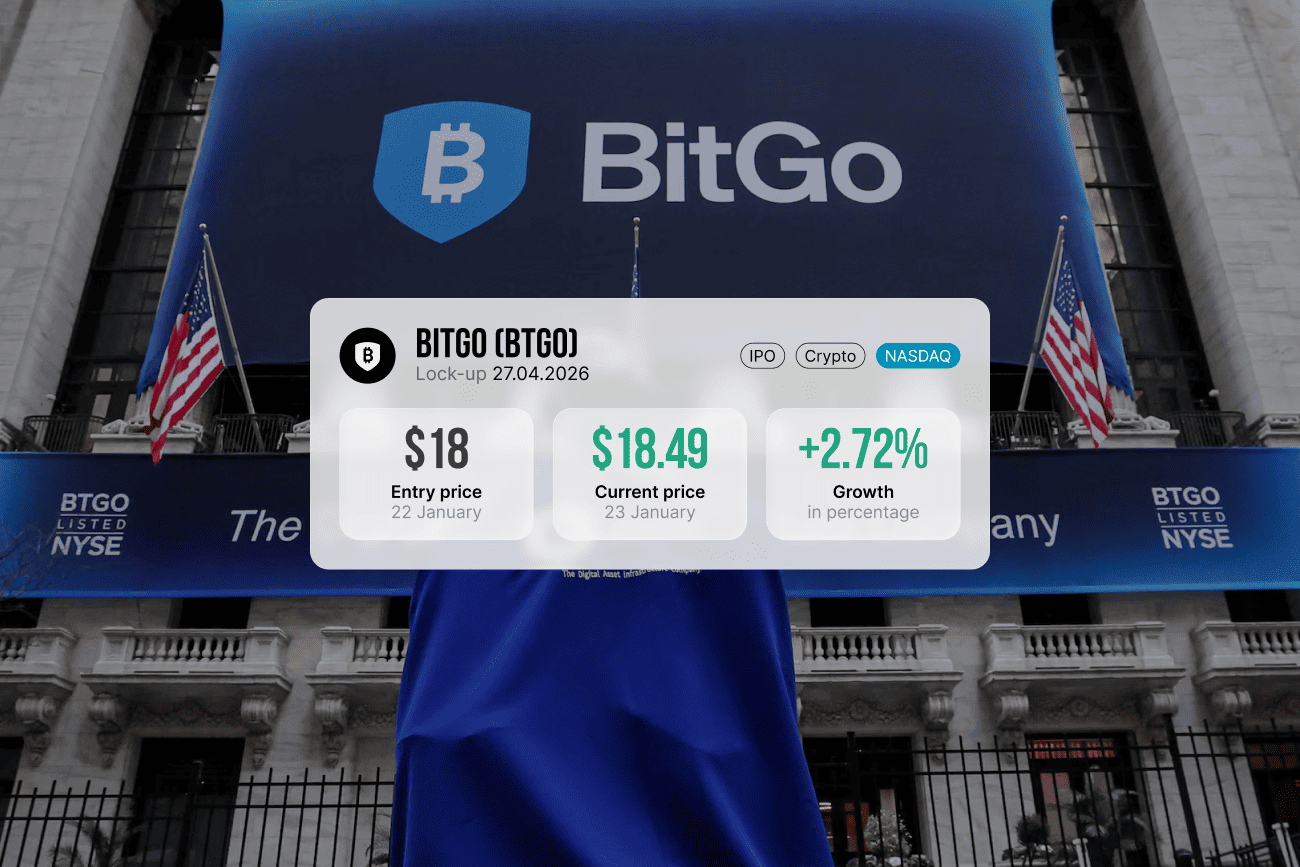

Yesterday, BitGo made its debut on the NYSE and quickly became one of the most notable IPOs of the year. The company priced its offering at $18 per share and gained approximately 20% on its first trading day, reflecting strong market demand. Shares are currently trading around $18.49 (+2.72%).

The IPO implied a valuation of over $2 billion, with peak intraday market capitalization reaching approximately $2.6 billion.

The key factor behind the positive market reaction was BitGo’s entry into the public markets as an already profitable company, supported by a resilient business model across digital asset custody, prime brokerage, and crypto infrastructure services.

Going forward, the stock’s performance will primarily depend on the company’s financial results and its ability to sustain growth and profitability.

Navan: A Recovery Story Amid Market Caution

Navan, by contrast, remains a recovery story. After its IPO at $25 per share, the stock declined to $15.09 (−39.64%).

Recently, the shares received some support from $9.4 million in purchases by Andreessen Horowitz, alongside 29% year-over-year revenue growth and an integration with Emirates, which strengthened the company’s product offering.

Despite these positives, the market remains cautious due to Navan’s valuation level and ongoing operational risks. A recovery toward IPO levels will require further improvement in financial performance. The upcoming lock-up expiration on February 2, 2026, remains a key event to monitor.

Regolith’s IPO Participation: Period Results

Between August 2025 and January 2026, Regolith participated in IPOs of 12 major companies, providing a diversified view of post-IPO performance.

Top-performing IPOs

In all three cases, gains were supported by strong operating performance, business scalability, and sustainable revenue growth.

Moderately positive performance

- Black Rock Coffee Bar (+17.25%)

- Bullish (+9.59%)

- Netskope (+1.58%)

Here, the market shifted from initial IPO momentum to a more balanced and fundamentals-driven valuation.

.png)

Negative performance

In these cases, expectations outpaced actual business performance. Price pressure was amplified by position unwinding and the absence of short-term growth catalysts.

Key Takeaways for Investors

The results of this period reinforce a core principle of the IPO market:

post-IPO returns are driven primarily by financial metrics and the quality of business growth, rather than by the IPO event itself.

At the same time, diversification across multiple offerings significantly reduces the impact of individual underperforming cases and helps build a more resilient investment outcome.

We wish you successful investments!