New Tool on Regolith – ETF Market: ETFs on the S&P 500 and Precious Metals

New Direction on Regolith – ETF Market

We are launching a new investment direction – ETF Market. It provides full access to exchange-traded funds (ETFs), allowing investors to participate in global markets with a minimum investment of $50, without complex operational steps.

ETF Market is designed as a core investment tool for those who want to invest systematically, build long-term capital, and use proven market solutions in a transparent and convenient format.

What Is an ETF and Why Investors Use Them

ETF (Exchange Traded Fund) is a publicly traded investment fund that allows investors to gain exposure to multiple assets within a single transaction, without the need to select each asset individually.

An ETF is essentially a packaged portfolio: it tracks a market, an index, or a specific strategy and automatically reflects its performance.

ETFs are widely used:

- for long-term capital growth

- for inflation protection

- for savings and long-term financial goals

- as the core foundation of an investment portfolio

For these reasons, ETFs are considered one of the most basic and universal instruments in global investment practice.

Investing in the S&P 500 Index

S&P 500 includes 500 of the largest publicly traded U.S. companies, such as Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla, Berkshire Hathaway, JPMorgan Chase, Johnson & Johnson, and others.

.png)

S&P 500 is widely regarded as a key benchmark of the U.S. stock market. ETFs tracking this index, such as SPY, are often used as the core of long-term portfolios, eliminating the need to manually select from hundreds of individual stocks.

Investing in Precious Metals – GLTR ETF

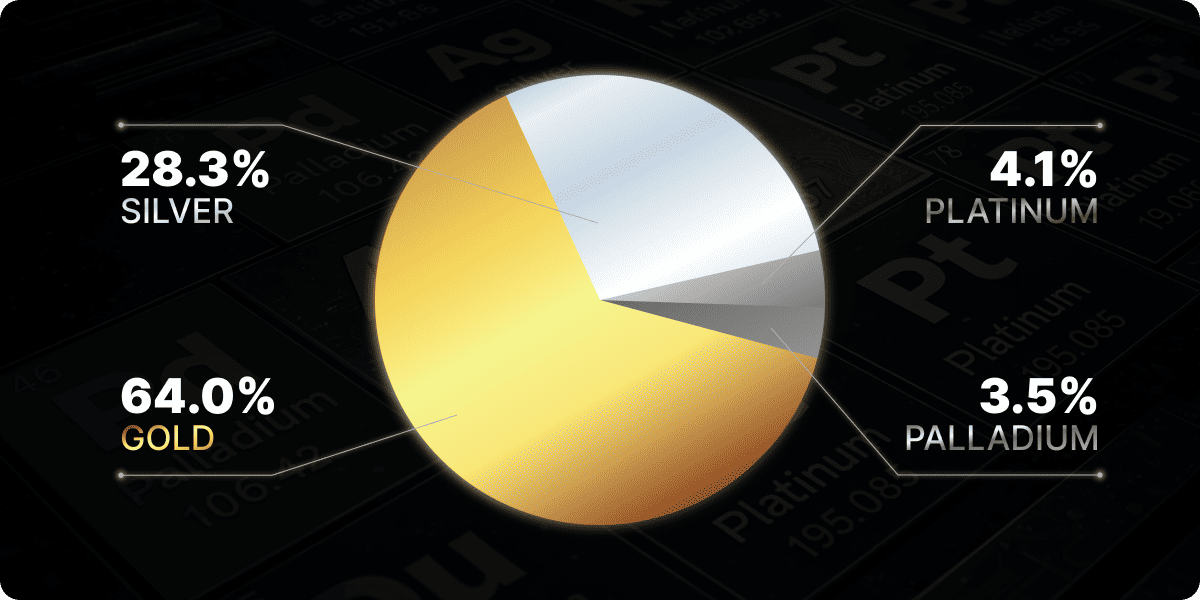

GLTR is an ETF backed by a basket of physical precious metals with the following allocation: Gold – 64.0%; Silver – 28.3%; Platinum – 4.1% and Palladium – 3.5%&

Precious metals are considered hard assets and often behave differently from equities and currencies. Their value is driven not only by financial markets, but also by real economic demand, making them an important diversification component in an investment portfolio.

Expansion of the ETF Lineup

ETF Market will continue to grow and expand with additional strategies. Planned additions include:

- ETFs focused on the U.S. technology sector – QQQ

- Dividend strategies based on the S&P 500 – JEPI

- Thematic ETFs focused on artificial intelligence, robotics, and automation – AIQ and BOTZ

This approach allows investors to build portfolios aligned with different objectives – from growth and capital protection to regular income.

ETF Market Investment Terms

We have made ETF investing максимально accessible:

- minimum investment — $50

- purchase fee — 2%

- profit-based fees — 0%

- minimum holding period — 1 week

ETF purchases take only a few clicks and require no additional setup or complex actions.

ETF Market as an Investment “Savings Tool”

ETF Market functions as an investment “savings tool”, where capital gradually works toward either the growth of the U.S. market or the performance of real assets. This format is suitable both for regular small contributions and for building a stable long-term investment strategy.