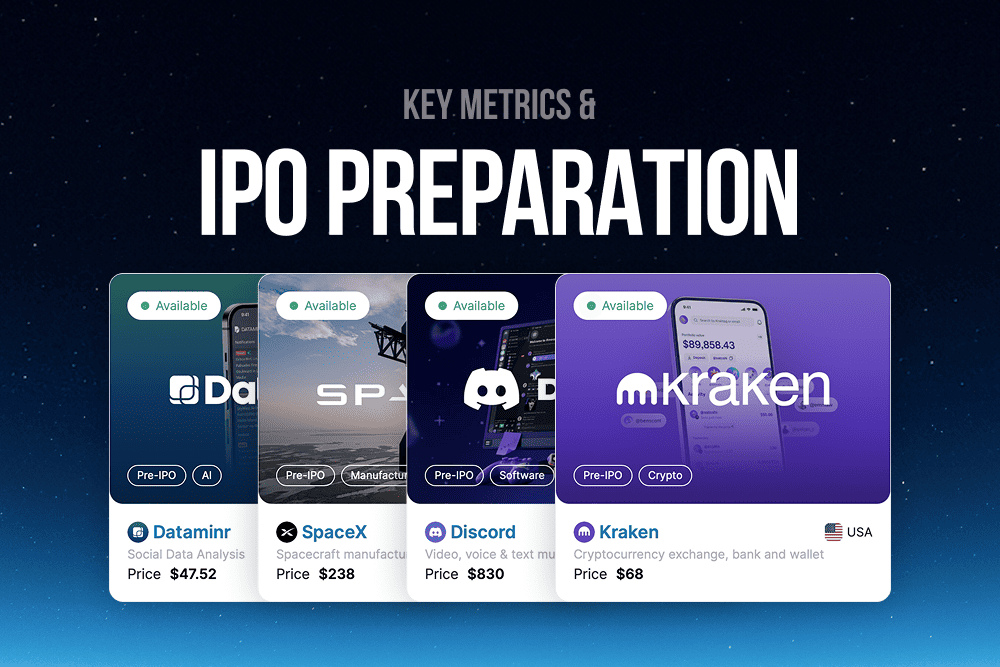

Overview of Dataminr, Discord, and SpaceX Performance in 2022–2025 Regolith participated in the early rounds of Dataminr Discord SpaceX

Despite operating in different segments, Dataminr, Discord, and SpaceX demonstrate similar long-term dynamics: scaling their products, expanding user and enterprise adoption, strengthening technological infrastructure, and taking preparatory steps that may precede a potential public listing or other structured decisions sometimes pursued by private companies.

These trends help form a clear picture of each company’s current position and the direction in which they are moving today.

Contents Dataminr: Business Model Expansion and Pre-IPO Stage Discord: User Growth and Movement Toward a Public Format SpaceX: Launch Scale-Up and Starlink Expansion Summary: Key Development Trends in 2022–2025 Media Mentions and Sources Dataminr: Business Model Expansion and Pre-IPO Stage Dataminr

Key development markers (2022–2025):

Annual Recurring Revenue (ARR) has approached ~$200M , reflecting strong demand for risk intelligence solutions. 800+ corporate and government clients , including roughly two-thirds of Fortune 50 companies and multiple U.S. and international government agencies.Over 1,500 media organizations worldwide use Dataminr’s tools for newsroom intelligence.In 2024–2025, the company introduced new generative-AI capabilities (ReGenAI, Context Agents), strengthening its technology stack and expanding use cases. In 2025, Dataminr raised an $85M convertible loan, seen by leadership as part of its pre-IPO preparation. A previously anticipated 2023 IPO was postponed due to market conditions. According to media reports, the company continues to evaluate a potential listing when conditions are favorable.

Discord: User Growth and Movement Toward a Public Format Discord

Key development facts:

Monthly active users have exceeded 200M , nearly double the 2020 levels. Public data suggests revenue grew from $135M in 2020 to roughly $575M in 2023, and may have surpassed $600M by the end of 2024 . Growth is driven by Nitro subscriptions and new premium features for servers. The platform now covers education, creative industries, and professional groups, well beyond gaming. In 2025, according to media reports, Discord confidentially filed for an IPO and began working with Goldman Sachs and JPMorgan as underwriters. Secondary market transactions in 2023–2024 valued the company in the $7–10B range – lower than 2021 peaks, but aligned with corrections across the tech sector. In early 2025, co-founder Jason Citron stepped down as CEO, transferring leadership to an external executive as part of IPO readiness . Analysts view Discord as one of the prominent candidates for a public debut once the IPO market regains momentum.

SpaceX: Launch Scale-Up and Starlink Expansion SpaceX continues rapid expansion across government missions, commercial orbital launches, and the high-growth Starlink satellite internet service.

Operational growth:

134 orbital launches in 2024, setting a new industry record.For 2025, SpaceX initially targeted ~170 launches; the actual count reached ~140 due to mission scheduling and resource allocation — still maintaining the world’s fastest cadence. SpaceX remains the leader in reusable launch vehicles (Falcon 9, Falcon Heavy), significantly reducing operational costs. SpaceX maintains its leadership in the reusable launch vehicle segment with Falcon 9 and Falcon Heavy, enabling a significant reduction in operational costs.

Financial performance:

Revenue grew annually, according to analyst estimates: ~$4–5B ~$8.7B ~$13–14B

Elon Musk’s forecast for 2025 is around $15.5B in total revenue.

Starlink as a core driver:

Subscriber base grew from ~1M in 2022 to ~4.6M in 2024 , and surpassed 5M by early 2025 . Media reports indicate Starlink reached operational breakeven in late 2023. Starlink now accounts for a significant share of SpaceX revenue and is central to the company’s long-term strategy. Valuation:

2023 valuation: ~$137B 2024 valuation: ~$350B through a major employee-share transaction (per Bloomberg and others) SpaceX remains one of the world’s largest private tech companies. While a full-company IPO is not publicly considered, a potential Starlink IPO is frequently discussed as the division approaches sustained profitability.

Summary: Key Trends Across 2022–2025 Across all three companies, several shared patterns emerge:

Scaling of business models Growth in customer and revenue metrics (based on available public data)Strengthening of technological capabilities , including AI toolsPreparatory corporate steps toward potential public-market scenarios – whether IPOs or structured private transactions Together, these dynamics illustrate how leading technology companies adapt to changing market conditions, refine operational models, and move toward more mature corporate structures.

Media Mentions and Sources This analytical overview is based on publicly available data from:

The material is informational and reflects publicly accessible indicators of company development. Metrics are approximate and may vary depending on market conditions.