Marketplace Regolith

Your investment opportunities

RELF

US Tax Liens Investment

Updated on 8 Dec 2025

Regolith

Company

Updated on 8 Dec 2025

About

RELF by Regolith

Regolith Real Estate Liquidation Fund (RELF) offers investors an opportunity to participate in real estate investments through Property Guaranteed Notes (PGNs) with a 18% coupon rate. RELF specializes in acquiring properties through tax liens, foreclosures, and distressed sales, aiming to capitalize on opportunities where properties are purchased at a significant discount to market value. The fund's strategy includes renovating and reselling properties for profit, backed by a secure investment structure that ensures investor capital is protected by property assets. RELF targets regions like South Florida, leveraging local expertise and market insights to maximize returns for investors seeking stable, income-generating opportunities in the real estate sector.

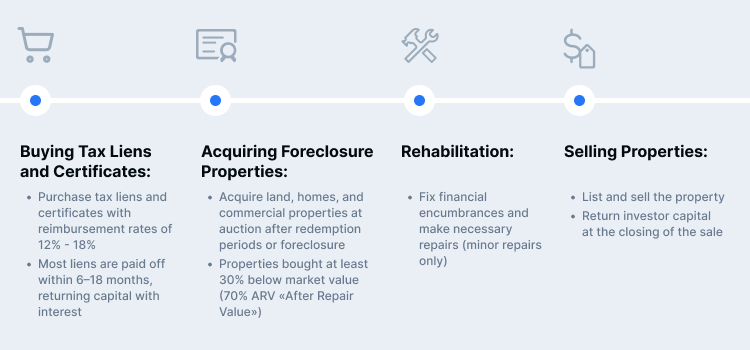

Business Model

Buying Tax Liens and Certificates:

- Purchase tax liens and certificates with reimbursement rates of 12% - 18%

- Most liens are paid off within 6–18 months, returning capital with interest

Acquiring Foreclosure Properties:

- Acquire land, homes, and commercial properties at auction after redemption periods or foreclosure

- Properties bought at least 30% below market value (70% ARV «After Repair Value»)

Rehabilitation:

- Fix financial encumbrances and make necessary repairs (minor repairs only)

Selling Properties:

- List and sell the property

- Return investor capital at the closing of the sale

How Liens and Foreclosures Happen

- Out of State Owner: A strong indication of an out-of-state owner is when the property’s physical address and mailing address do not match. In other words, the owner may not be aware of his or her delinquent taxes.

- Two Names on Title: This may indicate a married couple that may be in “marital realignment”. In most instances, neither of them may be willing to invest money in a property that they may not own after the divorce.

- Returned Mail in Property File: The homeowner is responsible for notifying the county of any address changes. Therefore, if the homeowner fails to notify the county at their own fault, they will not receive notices of any tax defaults.

- Vacant Property: Owner may have abandoned it

- Lack of Maintenance: A poorly maintained property shows that the owner has lost interest; however, the property may be of value to the Fund. We have profited off of these goldmines several times in the past.

How It Works

- Investor Deposits Funds:

— Funds deposited with Regolith Capital Trust Series 115 RELF

— Interest starts accruing from day one - Acquisition:

— Regolith buys properties and tax certificates at auction

— Tax certificates secured by property value - Management:

— Fund manager buys foreclosure properties, makes necessary repairs

— Hires agent to sell the property - Returns:

— Funds returned to operating company at closing

— Investors can withdraw initial deposit after 12 months

— Quarterly dividends can be reinvested

— 3-month withdrawal notification after initial 6-month hold period

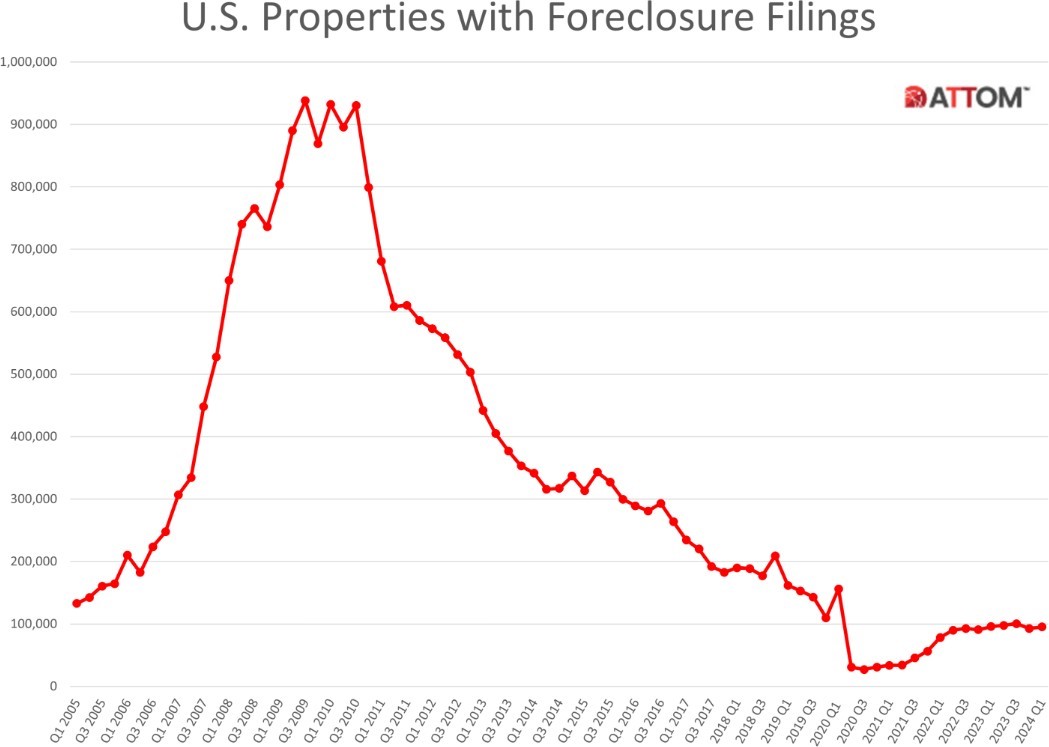

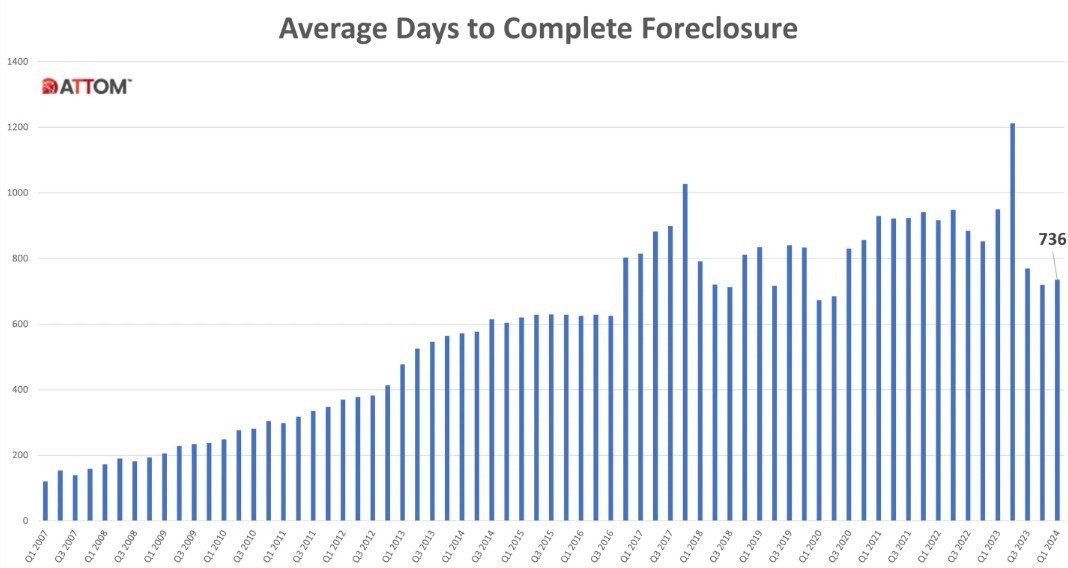

Trends in Foreclosures

The Market for Foreclosure has begun to increase from a bottom in 2021, and we forecast a significant increase in supply, which should provide more opportunities

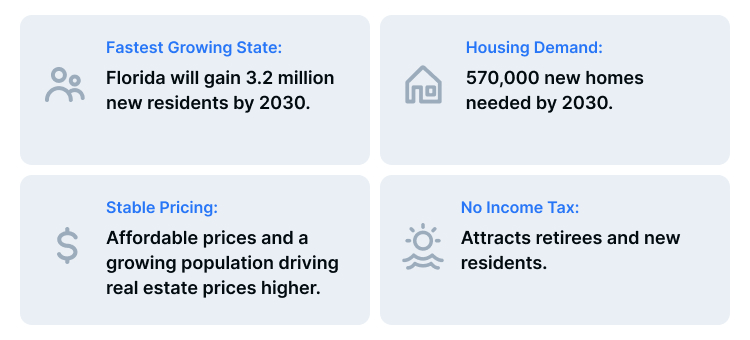

Best Location

South Florida (Miami to West Palm Beach) offers an affordable, stable pricing and growing population that will drive Real Estate prices high

Builders will not be able to keep up with demand

— As much as construction companies accelerate their projects, there is nothing to indicate that they will be able to cope with the growing demand. In the last decade, the state of Florida built only 950,000 new units, against 1.62 million in the 2000s and 1.26 million in the 90s. The 2020s would need to break all records.

Market slowed down momentarily – It’s time to enter

— It so happens that, recently, the American Central Bank (FED) was forced to increase interest rates, in order to control the inflationary escalation. Higher interest rates made mortgages more expensive, and demand for real estate experienced a slight slowdown.

NO Income Tax

— Florida has 0 (Zero) income tax, so as the population ages, they migrate to States where they keep more of their income. Many of the largest States continue to increase State taxes, and the residents are moving to Florida.

Weather, Climate and Beaches

— 825 Miles of Sandy Beaches. 90% of Residential houses are located within 30 miles of the famous Beaches

— Sun and warm weather all year round

— It’s where Americans retire and enjoy life

Advantages of Investing in Florida

• Fastest Growing State: Florida will gain 3.2 million new residents by 2030

• Housing Demand: 570,000 new homes needed by 2030

• Stable Pricing: Affordable prices and growing population driving real estate prices higher

• No Income Tax: Attracts retirees and new residents

• Climate and Lifestyle: 825 miles of beaches, warm weather year-round

Sample Property Listing ( фото)

• Market Value: $155,000

• Auction Price: $97,100 (63% ARV)

• Sale Price: $147,250prices higher

• Rent Estimate (Monthly): $1,650

• Time for Flip: 104 Days

Regolith’s Presence in Florida

• Office Location: Jupiter, Florida

• Management: Top management inspects every property

• Legal Expertise: 20 years in Florida real estate law

• Local Knowledge: Partners live and work in Palm Beach

• Proximity to Investments: All properties within 20 miles of the beach

Invest in RELF Today

• High Returns: Up to 18% annual returns

• Secure: Property-backed investments

• Quarterly Dividends: Regular income for investors

• Experienced Management: Decades of real estate experience

***Fund Operation Process

The fund engages in acquiring land, houses, and commercial real estate at post-confiscation auctions, where purchases are made at least 30% below market value, ensuring high potential for value growth through repairs and improvements. Typically, this process takes 6 to 9 months, allowing investors to see the expected profit in the short term.

***Management

The RELF fund management team from Regolith consists of experienced professionals in the U.S. real estate market. These experts not only possess deep market knowledge, but also strictly adhere to certain criteria when selecting investment properties. For instance, with properties in Florida, special attention is paid to those located within 20 miles of the coast. Such nuances ensure high liquidity and potential for value growth. This approach maximizes returns for investors, ensuring that the fund invests wisely and strategically approaches each transaction.

Regolith

Company

Details

Expected ROI per year

18%Terms

Deal fee

0%Exit fee

0%Carried interest

30%Management fee

0%Minimum investment period

1 yearDividends

Once per 6 monthsDocuments

RELF

US Tax Liens Investment

Updated on 8 Dec 2025

Regolith

Company

Русский

Русский