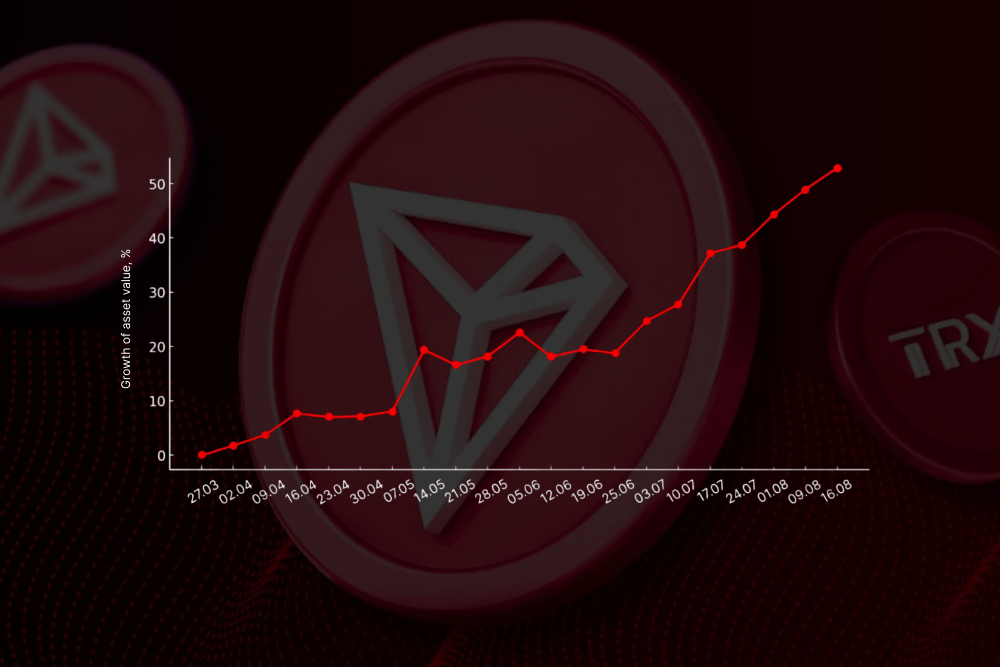

TRON Staking Fund After 4.5 Months: How TRX Price Growth Shapes Overall Yield

How Does TRX Price Growth Impact TRON Staking Fund Returns?

Since the fund’s dividends are paid in USDT, any appreciation in TRX price increases overall dollar-denominated yield. Here’s how it works 👇

Example:

Suppose you invested $10,000 at the start. With TRX priced at $0.230 at the end of March, you would have purchased 43,478.3 TRX.

Over 4.5 months, the fund paid out +7.08% in TRX dividends, which equals $708 if the price had stayed flat.

But when converted to USD at payout dates, the yield was actually +8.05% → $805 instead of $708.

👉 Annualized yield rose from ~19% to ~21.6% thanks to TRX price growth at the time of payouts.

And the higher the TRX price after purchase, the higher your returns in USD. At a base yield of 19% per year in TRX:

TRX +50% → 30% annual yield in USD

TRX +100% → 40% annual yield

TRX +150% → 50% annual yield

And so on — directly proportional to price growth.

📈 Don’t forget — not only do your dividends increase, but the asset itself appreciates. When sold, you can cash out TRX at a higher price than you bought it.

✅ For example, at the current TRX price of $0.3481:

• Your position of 43,478.3 TRX would have grown from $10,000 → $15,135.

That’s why we recommend viewing the TRON Staking Fund as a long-term instrument. Its full strength is revealed over an extended investment horizon.